Download TOC as PDF

Contents

1 The Report Key Assumptions…………………………………. 25

2 Executive Summary………………………………………………. 26

2.1 Key Findings…………………………………………………… 26

2.2 Key Conclusions………………………………………………. 39

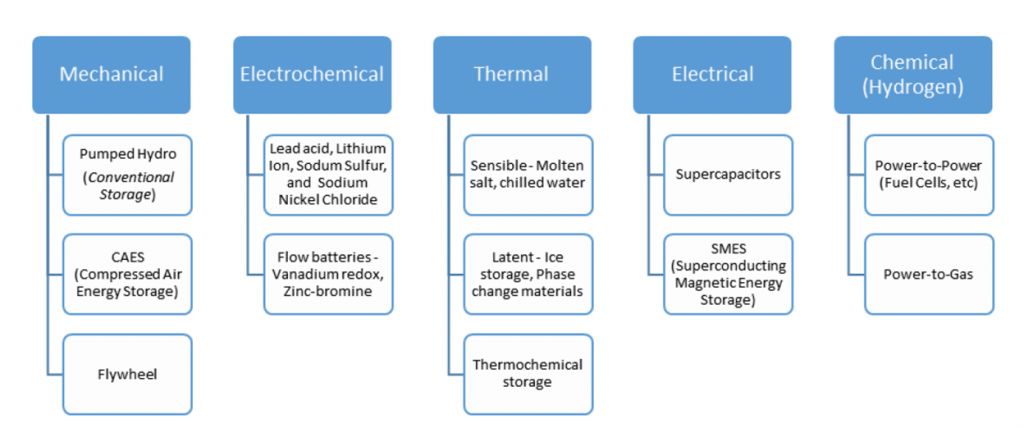

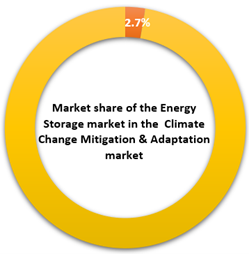

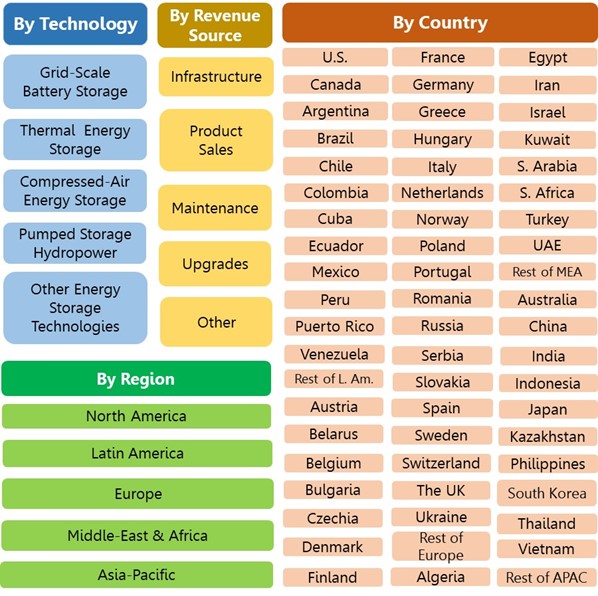

2.3 Global Energy Storage Market Segmentation Vectors. 49

2.4 Global Energy Storage Market – 2022-2030…………… 50

2.4.1 Global Market by Technology – 2022-2030………. 50

2.4.2 Global Market by Revenue Source – 2022-2030… 53

2.4.3 Global Market by Region – 2022-2030…………….. 53

2.4.3 Global Market by Country – 2022-2030……………. 55

3 COP26 & COVID-19 Implications……………………………… 56

3.1 COP26 Takeaway……………………………………………. 56

3.2 COVID-19 Implications………………………………………. 57

4 The Industry Value Chain……………………………………….. 59

5 Business Opportunities…………………………………………. 60

6 Market Drivers………………………………………………………. 71

7 Market Inhibitors…………………………………………………… 72

8 SWOT Analysis…………………………………………………….. 73

8.1 Strengths……………………………………………………….. 73

8.2 Weaknesses…………………………………………………… 74

8.3 Opportunities…………………………………………………… 75

8.4 Threats………………………………………………………….. 76

TECHNOLOGY, PRODUCT & SERVICE MARKETS…………….. 78

9 Global Energy Storage Technologies, Products & Services Markets – 2020-2030…………………………………. 78

9.1 Technology, Products & Services Markets Size………. 78

9.2 Technology Products & Services Markets Dynamics… 79

9.3 Technology Products & Services Markets Share……… 81

10 Compressed-Air Storage Market – 2022-2030……………. 83

10.1 CEO Takeaway……………………………………………….. 83

10.1.1 Summary………………………………………………….. 83

10.1.2 Adiabatic Compressed-Air Energy Storage………. 85

10.1.3 Diabatic Compressed-Air Energy Storage………… 85

10.2 Key Vendors…………………………………………………… 86

10.3 Global Compressed-Air Storage Market – 2020-2030. 86

10.3.1 Compressed-Air Storage Market Size……………… 86

10.3.2 Compressed-Air Storage Market Dynamics………. 87

10.3.3 Compressed-Air Storage Market Share……………. 87

11 Grid-Scale Battery Storage Market – 2022-2030…………. 88

11.1 CEO Takeaway……………………………………………….. 88

11.1.1 Summary………………………………………………….. 88

11.1.2 The U.S. Energy Storage Market…………………… 91

11.1.3 Grid-Scale Battery Storage Benefits……………….. 91

11.1.4 EVs and Energy Storage………………………………. 93

11.2 Key Vendors…………………………………………………… 94

11.3 Global Grid-Scale Battery Storage Market – 2020-2030 95

11.3.1 Grid-Scale Battery Storage Market Size…………… 95

11.3.2 Grid-Scale Battery Storage Market Dynamics……. 95

11.3.3 Grid-Scale Battery Storage Market Share…………. 95

12 Hydroelectric Energy Storage Market – 2022-2030……… 96

12.1 CEO Takeaway……………………………………………….. 96

12.1.1 Summary………………………………………………….. 96

12.1.2 Facts & Figures………………………………………….. 99

12.1.3 Pumped Hydroelectric Storage Technologies……. 99

12.1.4 Variable-Speed Pump-Storage Technology…….. 100

12.1.5 Key Vendors……………………………………………. 100

12.2 Global Hydroelectric Energy Storage Market – 2020-2030……………………………………………………………. 101

12.2.1 Hydroelectric Energy Storage Market Size……… 101

12.2.2 Hydroelectric Energy Storage Market Dynamics. 102

12.2.3 Hydroelectric Energy Storage Market Share……. 102

13 Thermal Energy Storage Market – 2022-2030…………… 103

13.1 CEO Takeaway……………………………………………… 103

13.1.1 Summary………………………………………………… 103

13.1.2 Thermal Energy Storage Advantages……………. 106

13.1.3 Molten Salt Storage Technology…………………… 107

13.1.4 Key Vendors……………………………………………. 107

13.2 Global Thermal Energy Storage Market – 2020-2030 108

13.2.1 Thermal Energy Storage Market Size…………….. 108

13.2.2 Thermal Energy Storage Market Dynamics…….. 108

13.2.3 Thermal Energy Storage Market Share………….. 109

14 Other Energy Storage Modalities Market – 2022-2030.. 110

14.1 Global Other Energy Storage Modalities Market – 2020-2030……………………………………………………………. 110

14.1.1 Other Energy Storage Modalities Market Size….. 110

14.1.2 Other Energy Storage Modalities Market Dynamics……………………………………………………………… 110

14.1.3 Other Energy Storage Modalities Market Share.. 111

REVENUE SOURCE MARKETS…………………………………….. 112

15 Energy Storage Market by Revenue Source – 2020-2030 112

15.1 Global Market – 2020-2030………………………………. 112

15.2 Energy Storage Market Dynamics – 2020-2030…….. 113

15.3 Energy Storage Market Share – 2020-2030………….. 114

REGIONAL MARKETS…………………………………………………. 115

16 Regional Energy Storage Markets – 2020-2030…………. 115

16.1 Regional Markets – 2020-2030………………………….. 115

17 North America Energy Storage Market……………………. 116

17.1 North America Market CEO Takeaway………………… 116

17.2 North America Market – 2020-2030…………………….. 118

17.2.1 Market by Sector………………………………………. 118

17.2.2 Market by Revenue Source…………………………. 120

17.3 North America Energy Storage Market Dynamics – 2020-2030…………………………………………………….. 121

17.4 North America Market Share – 2020-2030……………. 121

18 Latin America Energy Storage Market…………………….. 122

18.1 Latin America Market CEO Takeaway…………………. 122

18.2 Latin America Market – 2020-2030…………………….. 124

18.2.1 Market by Sector………………………………………. 124

18.2.2 Market by Revenue Source…………………………. 126

18.3 Latin America Energy Storage Market Dynamics – 2020-2030……………………………………………………………. 127

18.4 Latin America Market Share – 2020-2030…………….. 127

19 Europe Energy Storage Market……………………………… 128

19.1 Europe Market CEO Takeaway………………………….. 128

19.2 Europe Market – 2020-2030……………………………… 130

19.2.1 Market by Sector………………………………………. 130

19.2.2 Market by Revenue Source…………………………. 132

19.3 Europe Energy Storage Market Dynamics – 2020-2030 133

19.4 Europe Market Share – 2020-2030…………………….. 133

20 Middle East & Africa Energy Storage Market…………… 134

20.1 Africa Market CEO Takeaway……………………………. 134

20.2 The Middle East Market CEO Takeaway……………… 135

20.3 Middle East & Africa Market – 2020-2030…………….. 136

20.3.1 Market by Sector………………………………………. 136

20.3.2 Market by Revenue Source…………………………. 138

20.4 Middle East & Africa Energy Storage Market Dynamics – 2020-2030…………………………………………………….. 139

20.5 Middle East & Africa Market Share – 2020-2030……. 139

21 Asia Pacific Energy Storage Market……………………….. 140

21.1 Asia Pacific Market CEO Takeaway……………………. 140

21.2 Asia Pacific Market – 2020-2030………………………… 143

21.2.1 Market by Sector………………………………………. 143

21.2.2 Market by Revenue Source…………………………. 145

21.3 Asia Pacific Energy Storage Market Dynamics – 2020-2030……………………………………………………………. 146

21.4 Asia Pacific Market Share – 2020-2030……………….. 146

NATIONAL MARKETS…………………………………………………. 147

22 Energy Storage Market by Country – 2020-2030………. 147

22.1 Energy Consumption Indicatiors………………………… 147

22.2 National Markets Size – 2020-2030…………………….. 151

22.3 National Markets Dynamics – 2020-2030…………….. 152

22.4 National Markets Shares – 2020-2030………………… 154

22.5 National Markets by Revenue Source – 2020-2030… 157

22.5.1 Infrastructure Markets………………………………… 157

22.5.2 Product Sales…………………………………………… 159

22.5.3 Maintenance Markets…………………………………. 160

22.5.4 Upgrades Markets…………………………………….. 162

22.5.5 Other* Revenue Sources……………………………. 164

North America……………………………………………………………. 166

23 U.S. Energy Storage Market – 2020-2030…………………. 166

23.1 U.S. Market CEO Takeaway……………………………… 166

23.1.1 Key Facts………………………………………………… 166

23.1.2 National Policy………………………………………….. 167

23.1.3 Energy Supply………………………………………….. 167

23.1.4 Energy Consumption…………………………………. 167

23.1.5 Electricity………………………………………………… 168

23.2 U.S. Energy Storage Market – 2020-2030……………. 168

23.3 U.S. Market Dynamics – 2020-2030……………………. 169

23.4 U.S. Market Share – 2020-2030…………………………. 169

24 Canada Energy Storage Market – 2020-2030……………. 170

24.1 Canada Market CEO Takeaway…………………………. 170

24.1.1 Key Facts………………………………………………… 170

24.1.2 National Policy………………………………………….. 170

24.1.3 Energy Supply………………………………………….. 171

24.1.4 Energy Consumption…………………………………. 171

24.1.5 Electricity………………………………………………… 172

24.2 Canada Energy Storage Market – 2020-2030……….. 172

24.3 Canada Market Dynamics – 2020-2030……………….. 172

24.4 Canada Market Share – 2020-2030……………………. 172

Latin America…………………………………………………………….. 174

25 Argentina Energy Storage Market – 2020-2030………… 174

25.1 Argentina Market CEO Takeaway………………………. 174

25.1.1 Key Facts………………………………………………… 174

25.1.2 National Policy………………………………………….. 174

25.1.3 Energy Consumption…………………………………. 175

25.1.4 Electricity………………………………………………… 176

25.2 Argentina Energy Storage Market – 2020-2030…….. 176

25.3 Argentina Market Dynamics – 2020-2030…………….. 177

25.4 Argentina Market Share – 2020-2030………………….. 177

26 Brazil Energy Storage Market – 2020-2030………………. 177

26.1 Brazil Market CEO Takeaway……………………………. 177

26.1.1 Key Facts………………………………………………… 177

26.1.2 National Policy………………………………………….. 177

26.1.3 Energy Supply………………………………………….. 179

26.1.4 Energy Consumption…………………………………. 179

26.1.5 Electricity………………………………………………… 179

26.2 Brazil Energy Storage Market – 2020-2030………….. 181

26.3 Brazil Market Dynamics – 2020-2030………………….. 181

26.4 Brazil Market Share – 2020-2030……………………….. 181

27 Chile Energy Storage Market – 2020-2030……………….. 182

27.1 Chile Market CEO Takeaway…………………………….. 182

27.1.1 Key Facts………………………………………………… 182

27.1.2 National Policy………………………………………….. 182

27.1.3 Energy Supply………………………………………….. 183

27.2 Chile Energy Storage Market – 2020-2030…………… 183

27.3 Chile Market Dynamics – 2020-2030…………………… 183

27.4 Chile Market Share – 2020-2030……………………….. 183

28 Colombia Energy Storage Market – 2020-2030…………. 185

28.1 Colombia Market CEO Takeaway………………………. 185

28.1.1 Key Facts………………………………………………… 185

28.1.2 National Policy………………………………………….. 185

28.1.3 Energy Consumption…………………………………. 185

28.1.4 Electricity………………………………………………… 186

28.2 Colombia Energy Storage Market – 2020-2030……… 186

28.3 Colombia Market Dynamics – 2020-2030…………….. 186

28.4 Colombia Market Share – 2020-2030………………….. 187

29 Cuba Energy Storage Market – 2020-2030……………….. 188

29.1 Cuba Market CEO Takeaway……………………………. 188

29.2 Cuba Energy Storage Market – 2020-2030…………… 189

29.3 Cuba Market Dynamics – 2020-2030………………….. 189

29.4 Cuba Market Share – 2020-2030……………………….. 189

30 Ecuador Energy Storage Market – 2020-2030…………… 190

30.1 Ecuador Market CEO Takeaway………………………… 190

30.2 Ecuador Energy Storage Market – 2020-2030………. 190

30.3 Ecuador Market Dynamics – 2020-2030………………. 190

30.4 Ecuador Market Share – 2020-2030……………………. 191

31 Mexico Energy Storage Market – 2020-2030…………….. 192

31.1 Mexico Market CEO Takeaway………………………….. 192

31.1.1 Key Facts………………………………………………… 192

31.1.2 National Policy………………………………………….. 192

31.1.3 Electricity………………………………………………… 194

31.2 Mexico Energy Storage Market – 2020-2030………… 194

31.3 Mexico Market Dynamics – 2020-2030………………… 194

31.4 Mexico Market Share – 2020-2030…………………….. 194

32 Peru Energy Storage Market – 2020-2030………………… 196

32.1 Peru Market CEO Takeaway…………………………….. 196

32.2 Peru Energy Storage Market – 2020-2030……………. 197

32.3 Peru Market Dynamics – 2020-2030…………………… 197

32.4 Peru Market Share – 2020-2030………………………… 197

33 Puerto Rico Energy Storage Market – 2020-2030……… 198

33.1 Puerto Rico Market CEO Takeaway……………………. 198

33.2 Puerto Rico Energy Storage Market – 2020-2030….. 199

33.3 Puerto Rico Market Dynamics – 2020-2030………….. 199

33.4 Puerto Rico Market Share – 2020-2030……………….. 199

34 Venezuela Energy Storage Market – 2020-2030………… 200

34.1 Venezuela Market CEO Takeaway……………………… 200

34.2 Venezuela Energy Storage Market – 2020-2030……. 201

34.3 Venezuela Market Dynamics – 2020-2030……………. 201

34.4 Venezuela Market Share – 2020-2030………………… 201

35 Rest of Latin America Energy Storage Market – 2020-2030 202

35.1 Rest of Latin America Energy Storage Market – 2020-2030……………………………………………………………. 202

35.2 Rest of Latin America Market Dynamics – 2020-2030 202

35.3 Rest of Latin America Market Share – 2020-2030….. 202

Europe……………………………………………………………………… 203

36 Austria Energy Storage Market – 2020-2030…………….. 203

36.1 Austria Market CEO Takeaway………………………….. 203

36.2 Austria Energy Storage Market – 2020-2030………… 204

36.3 Austria Market Dynamics – 2020-2030………………… 204

36.4 Austria Market Share – 2020-2030……………………… 204

37 Belarus Energy Storage Market – 2020-2030……………. 205

37.1 Belarus Market CEO Takeaway…………………………. 205

37.2 Belarus Energy Storage Market – 2020-2030……….. 206

37.3 Belarus Market Dynamics – 2020-2030……………….. 206

37.4 Belarus Market Share – 2020-2030…………………….. 206

38 Belgium Energy Storage Market – 2020-2030…………… 207

38.1 Belgium Market CEO Takeaway………………………… 207

38.2 Belgium Energy Storage Market – 2020-2030……….. 208

38.3 Belgium Market Dynamics – 2020-2030………………. 208

38.4 Belgium Market Share – 2020-2030……………………. 208

39 Bulgaria Energy Storage Market – 2020-2030…………… 209

39.1 Bulgaria Market CEO Takeaway………………………… 209

39.2 Bulgaria Energy Storage Market – 2020-2030………. 210

39.3 Bulgaria Market Dynamics – 2020-2030………………. 212

39.4 Bulgaria Market Share – 2020-2030……………………. 212

40 Czech Republic Energy Storage Market – 2020-2030… 213

40.1 Czech Republic Market CEO Takeaway………………. 213

40.2 Czech Republic Energy Storage Market – 2020-2030 214

40.3 Czech Republic Market Dynamics – 2020-2030…….. 214

40.4 Czech Republic Market Share – 2020-2030………….. 215

41 Denmark Energy Storage Market – 2020-2030………….. 215

41.1 Denmark Market CEO Takeaway……………………….. 215

41.2 Denmark Energy Storage Market – 2020-2030……… 217

41.3 Denmark Market Dynamics – 2020-2030……………… 218

41.4 Denmark Market Share – 2020-2030………………….. 218

42 Finland Energy Storage Market – 2020-2030……………. 219

42.1 Finland Market CEO Takeaway…………………………. 219

42.2 Finland Energy Storage Market – 2020-2030………… 220

42.3 Finland Market Dynamics – 2020-2030……………….. 220

42.4 Finland Market Share – 2020-2030…………………….. 221

43 France Energy Storage Market – 2020-2030…………….. 221

43.1 France Market CEO Takeaway………………………….. 221

43.2 France Energy Storage Market – 2020-2030………… 222

43.3 France Market Dynamics – 2020-2030………………… 223

43.4 France Market Share – 2020-2030……………………… 223

44 Germany Energy Storage Market – 2020-2030………….. 224

44.1 Germany Energy Storage Market – 2020-2030……… 228

44.2 Germany Market Dynamics – 2020-2030……………… 228

44.3 Germany Market Share – 2020-2030………………….. 228

45 Greece Energy Storage Market – 2020-2030…………….. 230

45.1 Greece Market CEO Takeaway…………………………. 230

45.2 Greece Energy Storage Market – 2020-2030………… 231

45.3 Greece Market Dynamics – 2020-2030……………….. 231

45.4 Greece Market Share – 2020-2030…………………….. 231

46 Hungary Energy Storage Market – 2020-2030…………… 232

46.1 Hungary Market CEO Takeaway………………………… 232

46.2 Hungary Energy Storage Market – 2020-2030………. 233

46.3 Hungary Market Dynamics – 2020-2030………………. 233

46.4 Hungary Market Share – 2020-2030…………………… 234

47 Italy Energy Storage Market – 2020-2030………………… 234

47.1 Italy Market CEO Takeaway……………………………… 234

47.2 Italy Energy Storage Market – 2020-2030…………….. 237

47.3 Italy Market Dynamics – 2020-2030……………………. 237

47.4 Italy Market Share – 2020-2030…………………………. 237

48 Netherlands Energy Storage Market – 2020-2030……… 238

48.1 Netherlands Market CEO Takeaway…………………… 238

48.2 Netherlands Energy Storage Market – 2020-2030….. 239

48.3 Netherlands Market Dynamics – 2020-2030…………. 239

48.4 Netherlands Market Share – 2020-2030………………. 240

49 Norway Energy Storage Market – 2020-2030……………. 241

49.1 Norway Market CEO Takeaway…………………………. 241

49.2 Norway Energy Storage Market – 2020-2030……….. 242

49.3 Norway Market Dynamics – 2020-2030……………….. 242

49.4 Norway Market Share – 2020-2030…………………….. 242

50 Poland Energy Storage Market – 2020-2030…………….. 243

50.1 Poland Market CEO Takeaway………………………….. 243

50.2 Poland Energy Storage Market – 2020-2030………… 244

50.3 Poland Market Dynamics – 2020-2030………………… 244

50.4 Poland Market Share – 2020-2030……………………… 245

51 Portugal Energy Storage Market – 2020-2030…………… 246

51.1 Portugal Market CEO Takeaway………………………… 246

51.2 Portugal Energy Storage Market – 2020-2030………. 247

51.3 Portugal Market Dynamics – 2020-2030………………. 247

51.4 Portugal Market Share – 2020-2030……………………. 247

52 Romania Energy Storage Market – 2020-2030………….. 249

52.1 Romania Market CEO Takeaway……………………….. 249

52.2 Romania Energy Storage Market – 2020-2030……… 250

52.3 Romania Market Dynamics – 2020-2030……………… 250

52.4 Romania Market Share – 2020-2030…………………… 250

53 Russia Energy Storage Market – 2020-2030…………….. 252

53.1 Russia Market CEO Takeaway………………………….. 252

53.2 Russia Energy Storage Market – 2020-2030…………. 254

53.3 Russia Market Dynamics – 2020-2030………………… 254

53.4 Russia Market Share – 2020-2030……………………… 254

54 Serbia Energy Storage Market – 2020-2030……………… 255

54.1 Serbia Market CEO Takeaway…………………………… 255

54.2 Serbia Energy Storage Market – 2020-2030…………. 256

54.3 Serbia Market Dynamics – 2020-2030…………………. 256

54.4 Serbia Market Share – 2020-2030……………………… 256

55 Slovakia Energy Storage Market – 2020-2030………….. 257

55.1 Slovakia Market CEO Takeaway………………………… 257

55.2 Slovakia Energy Storage Market – 2020-2030………. 258

55.3 Slovakia Market Dynamics – 2020-2030………………. 258

55.4 Slovakia Market Share – 2020-2030…………………… 258

56 Spain Energy Storage Market – 2020-2030………………. 259

56.1 Spain Market CEO Takeaway……………………………. 259

56.2 Spain Energy Storage Market – 2020-2030………….. 260

56.3 Spain Market Dynamics – 2020-2030………………….. 260

56.4 Spain Market Share – 2020-2030………………………. 261

57 Sweden Energy Storage Market – 2020-2030…………… 262

57.1 Sweden Market CEO Takeaway………………………… 262

57.2 Sweden Energy Storage Market – 2020-2030……….. 264

57.3 Sweden Market Dynamics – 2020-2030………………. 264

57.4 Sweden Market Share – 2020-2030……………………. 264

58 Switzerland Energy Storage Market – 2020-2030……… 265

58.1 Switzerland Market CEO Takeaway……………………. 265

58.2 Switzerland Energy Storage Market – 2020-2030….. 266

58.3 Switzerland Market Dynamics – 2020-2030………….. 266

58.4 Switzerland Market Share – 2020-2030……………….. 266

59 UK Energy Storage Market – 2020-2030………………….. 267

59.1 UK Market CEO Takeaway……………………………….. 267

59.2 UK Energy Storage Market – 2020-2030……………… 269

59.3 UK Market Dynamics – 2020-2030……………………… 269

59.4 UK Market Share – 2020-2030………………………….. 270

60 Ukraine Energy Storage Market – 2020-2030……………. 271

60.1 Ukraine Market CEO Takeaway…………………………. 271

60.2 Ukraine Energy Storage Market – 2020-2030……….. 272

60.3 Ukraine Market Dynamics – 2020-2030……………….. 272

60.4 Ukraine Market Share – 2020-2030…………………….. 272

61 Rest of Europe Energy Storage Market – 2020-2030…. 274

61.1 Rest of Europe Energy Storage Market – 2020-2030 274

61.2 Rest of Europe Market Dynamics – 2020-2030……… 274

61.3 Rest of Europe Market Share – 2020-2030…………… 274

Middle East & Africa……………………………………………………. 275

62 Algeria Energy Storage Market – 2020-2030…………….. 275

62.1 Algeria Market CEO Takeaway………………………….. 275

62.2 Algeria Energy Storage Market – 2020-2030………… 275

62.3 Algeria Market Dynamics – 2020-2030………………… 276

62.4 Algeria Market Share – 2020-2030……………………… 276

63 Egypt Energy Storage Market – 2020-2030………………. 277

63.1 Egypt Market CEO Takeaway……………………………. 277

63.2 Egypt Energy Storage Market – 2020-2030………….. 278

63.3 Egypt Market Dynamics – 2020-2030………………….. 278

63.4 Egypt Market Share – 2020-2030………………………. 278

64 Iran Energy Storage Market – 2020-2030…………………. 280

64.1 Iran Market CEO Takeaway………………………………. 280

64.2 Iran Energy Storage Market – 2020-2030…………….. 281

64.3 Iran Market Dynamics – 2020-2030…………………….. 281

64.4 Iran Market Share – 2020-2030…………………………. 281

65 Israel Energy Storage Market – 2020-2030………………. 282

65.1 Israel Market CEO Takeaway……………………………. 282

65.2 Israel Energy Storage Market – 2020-2030…………… 284

65.3 Israel Market Dynamics – 2020-2030………………….. 284

65.4 Israel Market Share – 2020-2030……………………….. 284

66 Kuwait Energy Storage Market – 2020-2030…………….. 285

66.1 Kuwait Market CEO Takeaway………………………….. 285

66.2 Kuwait Energy Storage Market – 2020-2030…………. 286

66.3 Kuwait Market Dynamics – 2020-2030………………… 286

66.4 Kuwait Market Share – 2020-2030……………………… 286

67 Saudi Arabia Energy Storage Market – 2020-2030…….. 287

67.1 Saudi Arabia Energy Storage Market – 2020-2030…. 288

67.2 Saudi Arabia Market Dynamics – 2020-2030………… 288

67.3 Saudi Arabia Market Share – 2020-2030……………… 288

68 South Africa Energy Storage Market – 2020-2030…….. 289

68.1 South Africa Market CEO Takeaway…………………… 289

68.2 South Africa Energy Storage Market – 2020-2030….. 290

68.3 South Africa Market Dynamics – 2020-2030…………. 290

68.4 South Africa Market Share – 2020-2030………………. 290

69 Turkey Energy Storage Market – 2020-2030…………….. 291

69.1 Turkey Market CEO Takeaway………………………….. 291

69.2 Turkey Energy Storage Market – 2020-2030…………. 293

69.3 Turkey Market Dynamics – 2020-2030………………… 293

69.4 Turkey Market Share – 2020-2030……………………… 293

70 UAE Energy Storage Market – 2020-2030………………… 294

70.1 UAE Market CEO Takeaway…………………………….. 294

70.2 UAE Energy Storage Market – 2020-2030……………. 295

70.3 UAE Market Dynamics – 2020-2030…………………… 295

70.4 UAE Market Share – 2020-2030………………………… 295

71 Rest of MEA Energy Storage Market – 2020-2030…….. 296

71.1 Rest of MEA Energy Storage Market – 2020-2030…. 296

71.2 Rest of MEA Market Dynamics – 2020-2030…………. 296

71.3 Rest of MEA Market Share – 2020-2030……………… 296

72 Australia Energy Storage Market – 2020-2030………….. 298

72.1 Australia Market CEO Takeaway……………………….. 298

72.2 Australia Energy Storage Market – 2020-2030………. 299

72.3 Australia Market Dynamics – 2020-2030……………… 299

72.4 Australia Market Share – 2020-2030…………………… 299

73 China Energy Storage Market – 2020-2030………………. 300

73.1 China Market CEO Takeaway……………………………. 300

73.2 China Energy Storage Market – 2020-2030………….. 301

73.3 China Market Dynamics – 2020-2030………………….. 301

73.4 China Market Share – 2020-2030………………………. 301

74 India Energy Storage Market – 2020-2030……………….. 302

74.1 India Market CEO Takeaway…………………………….. 302

74.2 India Energy Storage Market – 2020-2030…………… 303

74.3 India Market Dynamics – 2020-2030…………………… 303

74.4 India Market Share – 2020-2030………………………… 303

75 Indonesia Energy Storage Market – 2020-2030………… 304

75.1 Indonesia Market CEO Takeaway………………………. 304

75.2 Indonesia Energy Storage Market – 2020-2030…….. 305

75.3 Indonesia Market Dynamics – 2020-2030…………….. 305

75.4 Indonesia Market Share – 2020-2030………………….. 305

76 Japan Energy Storage Market – 2020-2030……………… 306

76.1 Japan Market CEO Takeaway…………………………… 306

76.2 Japan Energy Storage Market – 2020-2030………….. 307

76.3 Japan Market Dynamics – 2020-2030…………………. 307

76.4 Japan Market Share – 2020-2030………………………. 307

77 Kazakhstan Energy Storage Market – 2020-2030……… 308

77.1 Kazakhstan Market CEO Takeaway……………………. 308

77.2 Kazakhstan Energy Storage Market – 2020-2030….. 309

77.3 Kazakhstan Market Dynamics – 2020-2030………….. 309

77.4 Kazakhstan Market Share – 2020-2030……………….. 309

78 Philippines Energy Storage Market – 2020-2030………. 310

78.1 Philippines Market CEO Takeaway…………………….. 310

78.2 Philippines Energy Storage Market – 2020-2030……. 311

78.3 Philippines Market Dynamics – 2020-2030…………… 311

78.4 Philippines Market Share – 2020-2030………………… 311

79 South Korea Energy Storage Market – 2020-2030…….. 312

79.1 South Korea Market CEO Takeaway…………………… 312

79.2 South Korea Energy Storage Market – 2020-2030…. 313

79.3 South Korea Market Dynamics – 2020-2030…………. 313

79.4 South Korea Market Share – 2020-2030……………… 313

80 Thailand Energy Storage Market – 2020-2030………….. 314

80.1 Thailand Market CEO Takeaway……………………….. 314

80.2 Thailand Energy Storage Market – 2020-2030………. 315

80.3 Thailand Market Dynamics – 2020-2030……………… 315

80.4 Thailand Market Share – 2020-2030…………………… 315

81 Vietnam Energy Storage Market – 2020-2030…………… 316

81.1 Vietnam Market CEO Takeaway………………………… 316

81.2 Vietnam Energy Storage Market – 2020-2030………. 317

81.3 Vietnam Market Dynamics – 2020-2030………………. 317

81.4 Vietnam Market Share – 2020-2030……………………. 317

82 Rest of Asia-Pacific Energy Storage Market – 2020-2030 318

82.1 Rest of Asia-Pacific Energy Storage Market – 2020-2030 318

82.2 Rest of Asia-Pacific Market Dynamics – 2020-2030.. 318

82.3 Rest of Asia-Pacific Market Share – 2020-2030…….. 318

VENDORS…………………………………………………………………. 319

83 Company 1…………………………………………………………. 319

84 Company 2…………………………………………………………. 319

85 Company 3…………………………………………………………. 320

86 Company 4…………………………………………………………. 320

87 Company 5…………………………………………………………. 321

88 Company 6…………………………………………………………. 321

89 Company 7…………………………………………………………. 322

90 Company 8…………………………………………………………. 322

91 Company 9…………………………………………………………. 323

92 Company 10……………………………………………………….. 323

93 Company 11……………………………………………………….. 324

94 Company 12……………………………………………………….. 324

APPENDICES…………………………………………………………….. 325

95 Appendix A: Glossary………………………………………….. 325

96 Appendix B: Abbreviations…………………………………… 343

97 Research Methodology………………………………………… 348

97.1 Report Structure…………………………………………….. 348

97.2 Methodology………………………………………………….. 348

97.3 For Whom is this Report?…………………………………. 349

98 Disclaimer and Copyright……………………………………… 350