| 1 |

Summary |

| 2 |

Extended Summary |

| 2.1 |

Major Findings |

| 2.2 |

Major Conclusions |

| 2.3 |

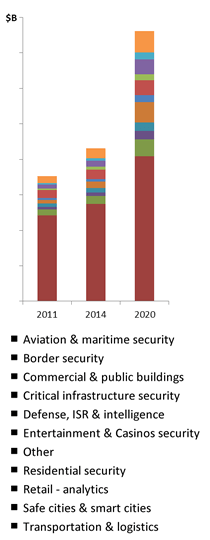

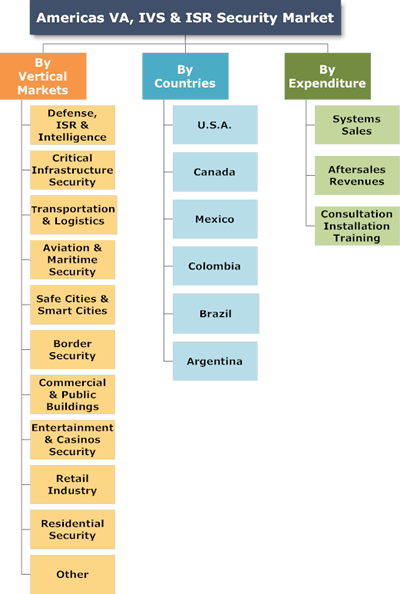

Americas Intelligent Video Surveillance, ISR & Video Analytics Market – 2015-2020 |

| 3 |

Global Geopolitical Outlook |

| |

MARKET ANALYSIS |

| 4 |

VA, IVS & ISR: Market Drivers |

| 5 |

VA, IVS & ISR: Market Inhibitors |

| 6 |

IVS, ISR & Video Analytics Industry: SWOT Analysis |

| 6.1 |

Strengths |

| 6.2 |

Weaknesses |

| 6.3 |

Opportunities |

| 6.4 |

Threats |

| 7 |

Intelligent Video Surveillance: Competitive Analysis |

| 8 |

Business Challenges and Opportunities |

| 8.1 |

Business Challenges |

| 8.2 |

Business Opportunities |

| |

TECHNOLOGIES |

| 9 |

Present and Pipeline Intelligent Video Surveillance Technologies |

| 9.1 |

Intelligent CCTV Surveillance Technologies Challenges |

| 9.1.1 |

Technologies Challenges |

| 9.2 |

Remote Biometric Detection Challenges |

| 9.2.1 |

Remote Threat Identification |

| 9.2.2 |

Intelligent Video Surveillance System Performance |

| 9.2.3 |

Distributed Sensors Remote Systems Challenges |

| 9.3 |

IVS Remote Detection |

| 9.4 |

Intelligent Video Surveillance Based Biometric Identification |

| 9.4.1 |

Intelligent Video Surveillance and Biometrics |

| 9.4.2 |

IVS Based Biometric Face Recognition Identification vs. Verification |

| 9.4.3 |

Performance of CCTV-Based Biometric Recognition Technologies |

| 9.4.4 |

Remote Biometric Identification Technologies |

| 9.4.5 |

Criminal & Terrorist Watch Lists |

| 9.4.6 |

Fused Intelligent Video Surveillance and Biometric Technology |

| 9.4.7 |

Fused Multi-modal IVS Biometric Remote People Screening |

| 9.5 |

Intelligent Video Surveillance: Tracking |

| 9.5.1 |

Overview |

| 9.5.2 |

IVS & VA based Behavioral Profiling |

| 9.5.3 |

Tag and Track – IVS |

| 9.5.4 |

Intelligent Video Surveillance: Behavior Profiling – Drivers |

| 9.5.5 |

Intelligent Video Surveillance: Behavior Profiling – Inhibitors |

| 9.6 |

Video Analytics-based Intelligent Transportation Systems |

| 9.7 |

Tele-Retail, Amazon Fire Phone FireFly Video Analytics Firmware |

| 10 |

Present and Pipeline Video Analytics (VA) & Video Content Analytics (VCA) Technologies |

| 10.1 |

Video Analytics |

| 10.1.1 |

Introduction |

| 10.1.2 |

Wireless Video Analytics |

| 10.1.3 |

Cloud-based Video Analytics |

| 10.1.4 |

Cloud Platforms |

| 10.1.5 |

Online Video Analytics |

| 10.1.6 |

Behavioral Analysis |

| 10.1.7 |

Video Analytic Applications |

| 10.1.8 |

Video Analytics Architecture |

| 10.1.9 |

Real Time Automatic Alerts Software |

| 10.1.10 |

Image Segmentation Software |

| 10.1.11 |

Item Tracking Intelligent CCTV Surveillance Software |

| 10.1.12 |

Object Sorting and ID |

| 10.1.13 |

Item Identification and Recognition |

| 10.1.14 |

IVS Based Face Recognition |

| 10.1.15 |

License Plate Recognition (LPR) |

| 10.1.16 |

Sorting Actions and Behaviors |

| 10.1.17 |

Crowd Surveillance |

| 10.1.18 |

Multi-Camera Intelligent CCTV Surveillance Systems |

| 10.2 |

Video Content Analysis (VCA) |

| 10.2.1 |

Introduction |

| 10.2.2 |

VCA Systems |

| 10.2.3 |

Pipeline VCA Research |

| 10.2.4 |

Video Content Analysis Software |

| 10.2.5 |

Present Limitations of Video Analytics Software |

| 10.2.6 |

Automated Analysis Of Video Surveillance Data |

| 10.2.7 |

Item Detection |

| 10.2.8 |

Background Subtraction: Gaussian Mixture Based Software |

| 10.2.9 |

Background Subtraction |

| 10.2.10 |

Item Detection Based on a Single-Image Algorithm |

| 10.2.11 |

Item Tracking Software |

| 10.2.12 |

Kalman Filtering Techniques, Region Segmentation |

| 10.2.13 |

Kalman Filters Application To Track Moving Items |

| 10.2.14 |

Partially Observable Markov Decision Process, IVS Systems |

| 10.2.15 |

“Splitting” Items Algorithms |

| 10.2.16 |

Dimension Based Items Classifiers |

| 10.2.17 |

Shape Based Item Classifiers |

| 10.2.18 |

Event Detection Methods |

| 10.2.19 |

Vision-Based Human Action Recognition |

| 10.2.20 |

3D Derived Egomotion |

| 10.2.21 |

Path Reconstruction Software |

| 10.2.22 |

Video Cameras Gap Mitigation Software |

| 10.2.23 |

Networked Cameras Tag and Track Software |

| 10.3 |

Visual Intelligence Technologies |

| 10.3.1 |

The Visual Intelligence Process |

| 10.3.2 |

Fusion Engine |

| 10.3.3 |

Event Description |

| 10.3.4 |

Reasoning |

| 10.3.5 |

Reporting |

| 10.4 |

Smart Cameras |

| 10.5 |

Pulse Video Analytics |

| 10.6 |

Underwater ISR |

| 10.7 |

ROSS Covert Multi-modal Ground ISR System |

| 10.8 |

Mini ISR Aerostats |

| 10.9 |

Pirsiavash and Ramanan’s, Activity-Recognition IVS Algorithm |

| 10.10 |

Camera & Video Analytics-based Advanced Driver Assistance Systems (ADAS) Technology and Market |

| 10.10.1 |

Camera & VA-based Advanced Driver Assistance Systems Market |

| 10.10.2 |

Camera & VA -based Advanced Driver Assistance Systems Technology |

| 11 |

IVS Products and Services |

| 11.1 |

IVS Present and Pipeline Products |

| 11.1.1 |

Commercial Applications: Present and Pipeline Products |

| 11.1.2 |

Pipeline Software And Hardware Under Development |

| 11.2 |

IVS Based Intelligence, Surveillance and Reconnaissance (ISR) Systems |

| 11.2.1 |

Overview |

| 11.2.2 |

Portable ISR Video Surveillance Kits |

| 11.3 |

Video Information Management (PSIM) Systems |

| 11.4 |

Video Surveillance as a Service (VSaaS) |

| 11.4.1 |

The VSaaS Technology |

| 11.4.2 |

The VSaaS Market |

| 11.4.3 |

Video Surveillance as Service : 26 Key Vendors |

| |

PROGRAMS |

| 12 |

U.S. Conveyance Protection Program |

| 13 |

U.S. Intelligent Video Surveillance Based Threat Detection R&D Programs |

| 13.1 |

Check Point Program |

| 13.2 |

Social Behavioral Threat Analysis Project |

| 13.3 |

DARPA IVS Based “Future Behavior” Project |

| 13.4 |

Biometric Detector Project |

| |

THE MARKET |

| 14 |

Americas Intelligent Video Surveillance, ISR & Video Analytics Market – 2015-2020 |

| 14.1 |

Market Size |

| 14.2 |

Americas Intelligent Video Surveillance, ISR & Video Analytics Market Analysis |

| 14.3 |

Americas IVS, ISR & VA Market by Country – 2015-2020 |

| 14.3.1 |

Country Comparison by Market Size |

| 14.3.2 |

The Leading IVS, ISR & VA National Markets by Market Size |

| 14.3.3 |

Country Comparison by Market Growth Rates |

| 14.3.4 |

The Leading IVS, ISR & VA National Markets by Market Growth Rate |

| 15 |

Defense, ISR & IVS & VA Market – 2015-2020 |

| 15.1 |

Market Background |

| 15.1.1 |

Defense IVS Visual Intelligence |

| 15.1.2 |

Visual Intelligence Performance Tasks |

| 15.1.3 |

Unmanned Aerial ISR, Target Recognition and Surveillance Systems |

| 15.1.4 |

Surveillance and Strike (UCLASS), MQ-8 Fire Scout, Broad Area Maritime Surveillance (BAMS) UAV; and Marine Corps Small Tactical Unmanned Aerial System |

| 15.1.5 |

Unmanned Aerial ISR, Target Recognition and Surveillance Market – 2015-2020 |

| 15.1.6 |

UAV IVS Market |

| 15.1.7 |

VideoScout Program |

| 15.1.8 |

Enhanced Medium Altitude Reconnaissance and Surveillance System (EMARSS) Program |

| 15.2 |

U.S. DOD ISR Video Surveillance Programs |

| 15.2.1 |

U.S. DOD Full Motion Video ISR Programs |

| 15.2.2 |

Angel Fire |

| 15.2.3 |

Constant Hawk |

| 15.2.4 |

Airborne Reconnaissance Multi-sensor System (ARMS) Horned Owl |

| 15.2.5 |

Redridge II |

| 15.2.6 |

Scathe View |

| 15.2.7 |

Near Real-Time Full Motion Video ISR Analytics Market |

| 15.2.8 |

The Lockheed Martin, Harris Broadcast Communications, and NetApp Program |

| 15.2.9 |

Full Motion Video ISR: Market Analysis |

| 15.3 |

Americas Defense: ISR, IVS & VA Market – 2015-2020 |

| 15.3.1 |

Market Size |

| 15.3.2 |

Market Analysis |

| 16 |

Critical Infrastructure IVS Based Security Market – 2015-2020 |

| 16.1 |

Scope |

| 16.2 |

Market Background |

| 16.2.1 |

Overview |

| 16.2.2 |

Critical Infrastructure IVS Based Security: Business Opportunities |

| 16.3 |

Critical Infrastructure IVS Based Security: Market Drivers |

| 16.4 |

Critical Infrastructure IVS Based Security: Market Inhibitors |

| 16.5 |

Americas Critical Infrastructure IVS Based Security Market – 2015-2020 |

| 16.5.1 |

Market Size |

| 16.5.2 |

Market Analysis |

| 17 |

Transportation & Logistics IVS Market – 2015-2020 |

| 17.1 |

Market Background |

| 17.1.1 |

Overview |

| 17.1.2 |

Rail Industry IVS Market |

| 17.1.3 |

IVS Based Vehicle Tracking |

| 17.1.4 |

Key Transportation & Logistics IVS Companies |

| 17.1.5 |

Automatic Number Plate Recognition (ANPR) Market |

| 17.2 |

Americas Transportation & Logistics IVS & VA Market – 2015-2020 |

| 17.2.1 |

Market Size |

| 17.2.2 |

Market Analysis |

| 18 |

Aviation & Maritime IVS Based Security Market – 2015-2020 |

| 18.1 |

Aviation IVS Based Security Market Background |

| 18.1.1 |

Overview |

| 18.1.2 |

The U.S. DHS TSA IVS Program |

| 18.1.3 |

IVS Based Aviation Security Background Data and Market Dynamics |

| 18.1.4 |

Aviation IVS Based Security Business Opportunities |

| 18.2 |

Aviation Security IVS Based Systems: Market Drivers |

| 18.3 |

Aviation IVS Based Security: Market Inhibitors |

| 18.4 |

Maritime IVS Based Security: Market Background |

| 18.4.1 |

Scope |

| 18.4.2 |

Overview |

| 18.4.3 |

IVS Based Maritime Security Market: Business Opportunities |

| 18.5 |

IVS Based Maritime Security: Market Drivers |

| 18.6 |

IVS Based Maritime Security: Market Inhibitors |

| 18.7 |

Americas Aviation & Maritime IVS Based Security Market – 2015-2020 |

| 18.7.1 |

Market Size |

| 18.7.2 |

Market Analysis |

| 19 |

Safe Cities & Smart Cities IVS & VA Market – 2015-2020 |

| 19.1 |

Safe City vs. Smart City |

| 19.1.1 |

Smart Cities |

| 19.1.2 |

Safe Cities |

| 19.1.3 |

Safe City Surveillance Systems market |

| 19.2 |

Market Background |

| 19.2.1 |

Safe City Market Definition |

| 19.2.2 |

Safe City Public Safety Surveillance |

| 19.2.3 |

The U.S. Safe Cities |

| 19.3 |

Americas Safe Cities & Smart Cities IVS, ISR & VA Market – 2015-2020 |

| 19.3.1 |

Market Size |

| 19.3.2 |

Market Analysis |

| 20 |

Border IVS Based Security Market – 2015-2020 |

| 20.1 |

Border IVS, VA,& ISR Based Security Market Background |

| 20.1.1 |

Scope |

| 20.1.2 |

Overview |

| 20.1.3 |

IVS Based Biometric Border Checkpoints |

| 20.1.4 |

Border Security – Strategic Context |

| 20.1.5 |

IVS Based Border Security Market Challenges |

| 20.2 |

IVS Based Border Security Market Drivers |

| 20.3 |

IVS Based Border Security Market Inhibitors |

| 20.4 |

IVS Based Border Security Sub-Market Growth Sectors |

| 20.5 |

Americas Border IVS Based Security Market – 2015-2020 |

| 20.5.1 |

Market Size |

| 20.5.2 |

Market Analysis |

| 21 |

Commercial & Public Buildings IVS & VA Market – 2015-2020 |

| 21.1 |

Commercial & Public Buildings IVS & VA Market Background |

| 21.2 |

Americas Commercial & Public Buildings IVS & VA Market – 2015-2020 |

| 21.2.1 |

Market Size |

| 21.2.2 |

Market Analysis |

| 22 |

Entertainment & Casinos IVS Based Security Market – 2015-2020 |

| 22.1 |

Entertainment & Casinos IVS Based Security Global Market Background |

| 22.2 |

Americas Entertainment & Casinos IVS Based Security Market – 2015-2020 |

| 22.2.1 |

Americas Entertainment & Casinos IVS Based Security Market Size -2015-2020 |

| 22.2.2 |

Americas Entertainment & Casinos IVS Based Security Market Analysis |

| 23 |

Retail Industry IVS & VA Market – 2015-2020 |

| 23.1 |

Retail Industry IVS & VA Market Background |

| 23.1.1 |

Retail Industry IVS & VA Overview |

| 23.1.2 |

Intelligent Retail Surveillance |

| 23.1.3 |

Retail Industry Intelligent Video Surveillance, ISR & Video Analytics Market |

| 23.1.4 |

Loss Prevention IVS |

| 23.1.5 |

Cash Register Intelligent Video Surveillance Security System |

| 23.1.6 |

IVS Fused With Point-Of-Sale Transaction Data Systems |

| 23.1.7 |

IVS Based Retail Object Tracking |

| 23.1.8 |

Customer Demographics IVS Software |

| 23.1.9 |

Maximizing Retail Sales, Profit and Productivity |

| 23.1.10 |

The Retail Industry IVS Commercial Applications |

| 23.1.11 |

Amazon Fire Phone FireFly Video Analytics Impact on the Tele-Retail Services |

| 23.2 |

Americas Retail Industry IVS & VA Market – 2015-2020 |

| 23.2.1 |

Market Size |

| 23.2.2 |

Market Analysis |

| 24 |

Residential IVS Based Security Market – 2015-2020 |

| 24.1 |

Residential IVS Based Security Market Background |

| 24.1.1 |

Residential IVS Based Security Overview |

| 24.1.2 |

Residential Intruder Detection IVS Functionality |

| 24.2 |

Americas Residential IVS Based Security Market – 2015-2020 |

| 24.2.1 |

Americas Residential IVS Based Security Market Size 2011- 2020 |

| 24.2.2 |

Americas Residential IVS Based Security Market Analysis |

| 25 |

Other IVS & VA Applications Market – 2015-2020 |

| 25.1 |

Other IVS & VA Applications Market Background |

| 25.2 |

Americas Other Applications IVS & VA Market – 2015-2020 |

| 25.2.1 |

Americas Other Applications IVS & VA Market Size |

| 25.2.2 |

Americas Other Applications IVS & VA Market Analysis |

| |

VENDORS |

| 26 |

VA, ISR & ISR 111 Vendors |

| 26.1 |

3i-MIND |

| 26.1.1 |

Company Profile |

| 26.1.2 |

Video Surveillance Products |

| 26.1.3 |

Contact Information |

| 26.2 |

3VR |

| 26.2.1 |

Company Profile |

| 26.2.2 |

Video Surveillance Products |

| 26.2.3 |

Contact Information |

| 26.3 |

3xLOGIC |

| 26.3.1 |

Company Profile |

| 26.3.2 |

Video Surveillance Products |

| 26.3.3 |

Contact Information |

| 26.4 |

AAI Corporation |

| 26.4.1 |

Company Profile |

| 26.4.2 |

Video Surveillance Products |

| 26.4.3 |

Contact Information |

| 26.5 |

AAM Systems |

| 26.5.1 |

Company Profile |

| 26.5.2 |

Video Surveillance Products |

| 26.5.3 |

Contact Information |

| 26.6 |

ACTi Corporation |

| 26.6.1 |

Company Profile |

| 26.6.2 |

Video Surveillance Products |

| 26.6.3 |

Contact Information |

| 26.7 |

ADT Security Services |

| 26.7.1 |

Company Profile |

| 26.7.2 |

Video Surveillance Products |

| 26.7.3 |

Contact Information |

| 26.8 |

Adaptive Imaging Technologies |

| 26.8.1 |

Company Profile |

| 26.8.2 |

Video Surveillance Products |

| 26.8.3 |

Contact Information |

| 26.9 |

Agent Video Intelligence |

| 26.9.1 |

Company Profile |

| 26.9.2 |

Video Surveillance Products |

| 26.9.3 |

Contact Information |

| 26.10 |

AGT International |

| 26.10.1 |

Company Profile |

| 26.10.2 |

Video Surveillance Products |

| 26.10.3 |

Contact Information |

| 26.11 |

Aimetis |

| 26.11.1 |

Company Profile |

| 26.11.2 |

Video Surveillance Products |

| 26.11.3 |

Contact Information |

| 26.12 |

ALPHAOPEN |

| 26.12.1 |

Company Profile |

| 26.12.2 |

Video Surveillance Products |

| 26.12.3 |

Contact Information |

| 26.13 |

American Dynamics |

| 26.13.1 |

Company Profile |

| 26.13.2 |

Video Surveillance Products |

| 26.13.3 |

Contact Information |

| 26.14 |

Ampex Data Systems Corporation |

| 26.14.1 |

Company Profile |

| 26.14.2 |

Video Surveillance Products |

| 26.14.3 |

Contact Information |

| 26.15 |

Aralia System |

| 26.15.1 |

Company Profile |

| 26.15.2 |

Video Surveillance Products |

| 26.15.3 |

Contact Information |

| 26.16 |

AVCON Information Technology Co. Ltd |

| 26.16.1 |

Company Profile |

| 26.16.2 |

Video Surveillance Products |

| 26.16.3 |

Contact Information |

| 26.17 |

Avigilon Corporation |

| 26.17.1 |

Company Profile |

| 26.17.2 |

Video Surveillance Products |

| 26.17.3 |

Contact Information |

| 26.18 |

Axis |

| 26.18.1 |

Company Profile |

| 26.18.2 |

Video Surveillance Products |

| 26.18.3 |

Contact Information |

| 26.19 |

Axxon |

| 26.19.1 |

Company Profile |

| 26.19.2 |

Video Surveillance Products |

| 26.19.3 |

Contact Information |

| 26.20 |

BAE Systems Plc |

| 26.20.1 |

Company Profile |

| 26.20.2 |

Video Surveillance Products |

| 26.20.3 |

Contact Information |

| 26.21 |

Basler |

| 26.21.1 |

Company Profile |

| 26.21.2 |

Video Surveillance Products |

| 26.21.3 |

Contact Information |

| 26.22 |

BiKal |

| 26.22.1 |

Company Profile |

| 26.22.2 |

Video Surveillance Products |

| 26.22.3 |

Contact Information |

| 26.23 |

Boeing Defense, Space & Security |

| 26.23.1 |

Company Profile |

| 26.23.2 |

Video Surveillance Products |

| 26.23.3 |

Contact Information |

| 26.24 |

Bosch Security Systems |

| 26.24.1 |

Company Profile |

| 26.24.2 |

Video Surveillance Products |

| 26.24.3 |

Contact Information |

| 26.25 |

Briefcam |

| 26.25.1 |

Company Profile |

| 26.25.2 |

Video Surveillance Products |

| 26.25.3 |

Contact Information |

| 26.26 |

Camero |

| 26.26.1 |

Company Profile |

| 26.26.2 |

Video Surveillance Products |

| 26.26.3 |

Contact Information |

| 26.27 |

Cernium |

| 26.27.1 |

Company Profile |

| 26.27.2 |

Video Surveillance Products |

| 26.27.3 |

Contact Information |

| 26.28 |

Churchill Navigation |

| 26.28.1 |

Company Profile |

| 26.28.2 |

Video Surveillance Products |

| 26.28.3 |

Contact Information |

| 26.29 |

CIEFFE |

| 26.29.1 |

Company Profile |

| 26.29.2 |

Video Surveillance Products |

| 26.29.3 |

Contact Information |

| 26.30 |

Cisco |

| 26.30.1 |

Company Profile |

| 26.30.2 |

Video Surveillance Products |

| 26.30.3 |

Contact Information |

| 26.31 |

Citilog |

| 26.31.1 |

Company Profile |

| 26.31.2 |

Video Surveillance Products |

| 26.31.3 |

Contact Information |

| 26.32 |

ClickIt |

| 26.32.1 |

Company Profile |

| 26.32.2 |

Video Surveillance Products |

| 26.32.3 |

Contact Information |

| 26.33 |

Cognimatics |

| 26.33.1 |

Company Profile |

| 26.33.2 |

Video Surveillance Products |

| 26.33.3 |

Contact Information |

| 26.34 |

Digital Results Group |

| 26.34.1 |

Company Profile |

| 26.34.2 |

Video Surveillance Products |

| 26.34.3 |

Contact Information |

| 26.35 |

Emza Visual Sense |

| 26.35.1 |

Company Profile |

| 26.35.2 |

Video Surveillance Products |

| 26.35.3 |

Contact Information |

| 26.36 |

Eptascape |

| 26.36.1 |

Company Profile |

| 26.36.2 |

Video Surveillance Products |

| 26.36.3 |

Contact Information |

| 26.37 |

DVTel |

| 26.37.1 |

Company Profile |

| 26.37.2 |

Video Surveillance Products |

| 26.37.3 |

Contact Information |

| 26.38 |

Exacq |

| 26.38.1 |

Company Profile |

| 26.38.2 |

Video Surveillance Products |

| 26.38.3 |

Contact Information |

| 26.39 |

GE Security |

| 26.39.1 |

Company Profile |

| 26.39.2 |

Video Surveillance Products |

| 26.39.3 |

Contact Information |

| 26.40 |

Genetec |

| 26.40.1 |

Company Profile |

| 26.40.2 |

Video Surveillance Products |

| 26.40.3 |

Contact Information |

| 26.41 |

Geovision |

| 26.41.1 |

Company Profile |

| 26.41.2 |

Video Surveillance Products |

| 26.41.3 |

Contact Information |

| 26.42 |

HASAM |

| 26.42.1 |

Company Profile |

| 26.42.2 |

Video Surveillance Products |

| 26.42.3 |

Contact Information |

| 26.43 |

Honeywell |

| 26.43.1 |

Company Profile |

| 26.43.2 |

Video Surveillance Products |

| 26.43.3 |

Contact Information |

| 26.44 |

IMINT Image Intelligence AB |

| 26.44.1 |

Company Profile |

| 26.44.2 |

Video Surveillance Products |

| 26.44.3 |

Contact Information |

| 26.45 |

IndigoVision |

| 26.45.1 |

Company Profile |

| 26.45.2 |

Video Surveillance Products |

| 26.45.3 |

Contact Information |

| 26.46 |

Intellivid |

| 26.46.1 |

Company Profile |

| 26.46.2 |

Video Surveillance Products |

| 26.46.3 |

Contact Information |

| 26.47 |

Intergraph Corporation |

| 26.47.1 |

Company Profile |

| 26.47.2 |

Video Surveillance Products |

| 26.47.3 |

Contact Information |

| 26.48 |

IntuVision Inc |

| 26.48.1 |

Company Profile |

| 26.48.2 |

Video Surveillance Products |

| 26.48.3 |

Contact Information |

| 26.49 |

Ioimage |

| 26.49.1 |

Company Profile |

| 26.49.2 |

Video Surveillance Products |

| 26.49.3 |

Contact Information |

| 26.50 |

IPConfigure |

| 26.50.1 |

Company Profile |

| 26.50.2 |

Video Surveillance Products |

| 26.50.3 |

Contact Information |

| 26.51 |

IPS Intelligent Video Analytics |

| 26.51.1 |

Company Profile |

| 26.51.2 |

Video Surveillance Products |

| 26.51.3 |

Contact Information |

| 26.52 |

Ipsotek |

| 26.52.1 |

Company Profile |

| 26.52.2 |

Video Surveillance Products |

| 26.52.3 |

Contact Information |

| 26.53 |

IQinVision |

| 26.53.1 |

Company Profile |

| 26.53.2 |

Video Surveillance Products |

| 26.53.3 |

Contact Information |

| 26.54 |

ISS |

| 26.54.1 |

Company Profile |

| 26.54.2 |

Video Surveillance Products |

| 26.54.3 |

Contact Information |

| 26.55 |

ITT EchoStorm |

| 26.55.1 |

Company Profile |

| 26.55.2 |

Video Surveillance Products |

| 26.55.3 |

Contact Information |

| 26.56 |

L-3 Communications Holdings Inc |

| 26.56.1 |

Company Profile |

| 26.56.2 |

Video Surveillance Products |

| 26.56.3 |

Contact Information |

| 26.57 |

Lockheed Martin Corporation |

| 26.57.1 |

Company Profile |

| 26.57.2 |

Video Surveillance Products |

| 26.57.3 |

Contact Information |

| 26.58 |

LuxRiot |

| 26.58.1 |

Company Profile |

| 26.58.2 |

Video Surveillance Products |

| 26.58.3 |

Contact Information |

| 26.59 |

MACROSCOP |

| 26.59.1 |

Company Profile |

| 26.59.2 |

Video Surveillance Products |

| 26.59.3 |

Contact Information |

| 26.60 |

March Networks |

| 26.60.1 |

Company Profile |

| 26.60.2 |

Video Surveillance Products |

| 26.60.3 |

Contact Information |

| 26.61 |

Mate Intelligent Video Ltd |

| 26.61.1 |

Company Profile |

| 26.61.2 |

Video Surveillance Products |

| 26.61.3 |

Contact Information |

| 26.62 |

Matrix Vision |

| 26.62.1 |

Company Profile |

| 26.62.2 |

Video Surveillance Products |

| 26.62.3 |

Contact Information |

| 26.63 |

MDS |

| 26.63.1 |

Company Profile |

| 26.63.2 |

Video Surveillance Products |

| 26.63.3 |

Contact Information |

| 26.64 |

Milestone Systems A/S |

| 26.64.1 |

Company Profile |

| 26.64.2 |

Video Surveillance Products |

| 26.64.3 |

Contact Information |

| 26.65 |

Mirasys |

| 26.65.1 |

Company Profile |

| 26.65.2 |

Video Surveillance Products |

| 26.65.3 |

Contact Information |

| 26.66 |

Mobotix |

| 26.66.1 |

Company Profile |

| 26.66.2 |

Video Surveillance Products |

| 26.66.3 |

Contact Information |

| 26.67 |

MTS |

| 26.67.1 |

Company Profile |

| 26.67.2 |

Video Surveillance Products |

| 26.67.3 |

Contact Information |

| 26.68 |

National Instruments |

| 26.68.1 |

Company Profile |

| 26.68.2 |

Video Surveillance Products |

| 26.68.3 |

Contact Information |

| 26.69 |

NetPosa Technologies, Ltd |

| 26.69.1 |

Company Profile |

| 26.69.2 |

Video Surveillance Products |

| 26.69.3 |

Contact Information |

| 26.70 |

NICE Systems |

| 26.70.1 |

Company Profile |

| 26.70.2 |

Video Surveillance Products |

| 26.70.3 |

Contact Information |

| 26.71 |

Northrop Grumman Corporation |

| 26.71.1 |

Company Profile |

| 26.71.2 |

Video Surveillance Products |

| 26.71.3 |

Contact Information |

| 26.72 |

Nuuo |

| 26.72.1 |

Company Profile |

| 26.72.2 |

Video Surveillance Products |

| 26.72.3 |

Contact Information |

| 26.73 |

ObjectVideo |

| 26.73.1 |

Company Profile |

| 26.73.2 |

Video Surveillance Products |

| 26.73.3 |

Contact Information |

| 26.74 |

On-Net Surveillance Systems |

| 26.74.1 |

Company Profile |

| 26.74.2 |

Video Surveillance Products |

| 26.74.3 |

Contact Information |

| 26.75 |

PCI-Suntek Technology Co., Ltd |

| 26.75.1 |

Company Profile |

| 26.75.2 |

Video Surveillance Products |

| 26.75.3 |

Contact Information |

| 26.76 |

Pelco |

| 26.76.1 |

Company Profile |

| 26.76.2 |

Video Surveillance Products |

| 26.76.3 |

Contact Information |

| 26.77 |

Pivot3 |

| 26.77.1 |

Company Profile |

| 26.77.2 |

Video Surveillance Products |

| 26.77.3 |

Contact Information |

| 26.78 |

Pixim |

| 26.78.1 |

Company Profile |

| 26.78.2 |

Video Surveillance Products |

| 26.78.3 |

Contact Information |

| 26.79 |

Proximex |

| 26.79.1 |

Company Profile |

| 26.79.2 |

Video Surveillance Products |

| 26.79.3 |

Contact Information |

| 26.80 |

PV Labs |

| 26.80.1 |

Company Profile |

| 26.80.2 |

Video Surveillance Products |

| 26.80.3 |

Contact Information |

| 26.81 |

Raytheon Company |

| 26.81.1 |

Company Profile |

| 26.81.2 |

Video Surveillance Products |

| 26.81.3 |

Contact Information |

| 26.82 |

Salient Stills |

| 26.82.1 |

Company Profile |

| 26.82.2 |

Video Surveillance Products |

| 26.82.3 |

Contact Information |

| 26.83 |

Samsung Techwin |

| 26.83.1 |

Company Profile |

| 26.83.2 |

Video Surveillance Products |

| 26.83.3 |

Contact Information |

| 26.84 |

Sarnoff Corporation |

| 26.84.1 |

Company Profile |

| 26.84.2 |

Video Surveillance Products |

| 26.84.3 |

Contact Information |

| 26.85 |

SeeTec |

| 26.85.1 |

Company Profile |

| 26.85.2 |

Video Surveillance Products |

| 26.85.3 |

Contact Information |

| 26.86 |

Sentient |

| 26.86.1 |

Company Profile |

| 26.86.2 |

Video Surveillance Products |

| 26.86.3 |

Contact Information |

| 26.87 |

Siemens |

| 26.87.1 |

Company Profile |

| 26.87.2 |

Video Surveillance Products |

| 26.87.3 |

Contact Information |

| 26.88 |

SightLogix |

| 26.88.1 |

Company Profile |

| 26.88.2 |

Video Surveillance Products |

| 26.88.3 |

Contact Information |

| 26.89 |

Smartvue |

| 26.89.1 |

Company Profile |

| 26.89.2 |

Video Surveillance Products |

| 26.89.3 |

Contact Information |

| 26.90 |

Sony |

| 26.90.1 |

Company Profile |

| 26.90.2 |

Video Surveillance Products |

| 26.90.3 |

Contact Information |

| 26.91 |

Synectics |

| 26.91.1 |

Company Profile |

| 26.91.2 |

Video Surveillance Products |

| 26.91.3 |

Contact Information |

| 26.92 |

Synesis |

| 26.92.1 |

Company Profile |

| 26.92.2 |

Video Surveillance Products |

| 26.92.3 |

Contact Information |

| 26.93 |

Texas Instruments |

| 26.93.1 |

Company Profile |

| 26.93.2 |

Video Surveillance Products |

| 26.93.3 |

Contact Information |

| 26.94 |

Thales Group |

| 26.94.1 |

Company Profile |

| 26.94.2 |

Video Surveillance Products |

| 26.94.3 |

Contact Information |

| 26.95 |

V.A.S. GmbH |

| 26.95.1 |

Company Profile |

| 26.95.2 |

Video Surveillance Products |

| 26.95.3 |

Contact Information |

| 26.96 |

VDG Security BV |

| 26.96.1 |

Company Profile |

| 26.96.2 |

Video Surveillance Products |

| 26.96.3 |

Contact Information |

| 26.97 |

Verint |

| 26.97.1 |

Company Profile |

| 26.97.2 |

Video Surveillance Products |

| 26.97.3 |

Contact Information |

| 26.98 |

Viasys Intelligent Video Analytics |

| 26.98.1 |

Company Profile |

| 26.98.2 |

Video Surveillance Products |

| 26.98.3 |

Contact Information |

| 26.99 |

Vicon |

| 26.99.1 |

Company Profile |

| 26.99.2 |

Video Surveillance Products |

| 26.99.3 |

Contact Information |

| 26.100 |

Videalert Ltd |

| 26.100.1 |

Company Profile |

| 26.100.2 |

Video Surveillance Products |

| 26.100.3 |

Contact Information |

| 26.101 |

VideoBank |

| 26.101.1 |

Company Profile |

| 26.101.2 |

Video Surveillance Products |

| 26.101.3 |

Contact Information |

| 26.102 |

VideoIQ |

| 26.102.1 |

Company Profile |

| 26.102.2 |

Video Surveillance Products |

| 26.102.3 |

Contact Information |

| 26.103 |

VideoMining |

| 26.103.1 |

Company Profile |

| 26.103.2 |

Video Surveillance Products |

| 26.103.3 |

Contact Information |

| 26.104 |

VideoNext |

| 26.104.1 |

Company Profile |

| 26.104.2 |

Video Surveillance Products |

| 26.104.3 |

Contact Information |

| 26.105 |

Vidient |

| 26.105.1 |

Company Profile |

| 26.105.2 |

Video Surveillance Products |

| 26.105.3 |

Contact Information |

| 26.106 |

Vigilant Systems |

| 26.106.1 |

Company Profile |

| 26.106.2 |

Video Surveillance Products |

| 26.106.3 |

Contact Information |

| 26.107 |

Vi-system |

| 26.107.1 |

Company Profile |

| 26.107.2 |

Video Surveillance Products |

| 26.107.3 |

Contact Information |

| 26.108 |

WeCU Technologies Ltd |

| 26.108.1 |

Company Profile |

| 26.108.2 |

Video Surveillance Products |

| 26.108.3 |

Contact Information |

| 26.109 |

Westec |

| 26.109.1 |

Company Profile |

| 26.109.2 |

Video Surveillance Products |

| 26.109.3 |

Contact Information |

| 26.110 |

Zhejiang Dahua Technology |

| 26.110.1 |

Company Profile |

| 26.110.2 |

Video Surveillance Products |

| 26.110.3 |

Contact Information |