| 1 |

Summary |

| 2 |

Extended Summary |

| 2.1 |

Major Findings |

| 2.2 |

Major Conclusions |

| 2.3 |

Global ETD Market – 2015-2020 |

| 2.3.1 |

The 2015-2020 Global ETD Market Outlook |

| 2.3.2 |

Global ETD Market: Systems Sales & Aftersales Revenues – 2015-2020 |

| 2.3.3 |

Global Vertical ETD Submarkets -2011-2020 |

| 3 |

ETD Market: Drivers |

| 4 |

ETD Market: Inhibitors |

| 5 |

SWOT Analysis |

| 5.1 |

Strengths |

| 5.2 |

Weaknesses |

| 5.3 |

Opportunities |

| 5.4 |

Threats |

| 6 |

Competitive Analysis |

| 7 |

Explosives and Narcotics Detection Technologies |

| 7.1 |

Explosive Materials Classification |

| 7.2 |

Canine Explosives and NarcoticsScreening |

| 7.3 |

Explosives and Narcotics Detection Technologies |

| 7.3.1 |

Explosives and Narcotics Trace Detection (ETD) |

| 7.3.2 |

Bulk Explosives and Narcotics Detection |

| 7.3.3 |

Current Explosives & Narcotics Detection Technologies Map |

| 7.3.4 |

ETD vs. Bulk Explosives & Narcotics Detection: Pros & Cons |

| 7.4 |

ETD and Other Explosive Detection Systems: Prices |

| 7.5 |

Emerging People Screening Technologies |

| 8 |

Current Explosives and Narcotics Trace Detection (ETD) Technologies |

| 8.1 |

ETD Principles of Operation |

| 8.2 |

ETD Core Technologies |

| 8.2.1 |

Overview |

| 8.2.2 |

Ion Mobility Spectroscopy (IMS) |

| 8.2.3 |

ChemiLuminescence (Thermal Energy Analyzers) |

| 8.2.4 |

Electron Capture Detectors (ECD) |

| 8.2.5 |

Surface Acoustic Wave (SAW) |

| 8.2.6 |

Nanotechnology-enabled Technologies for Explosives and Narcotics Detection |

| 9 |

Technology Outlook – 2015-2020 |

| 9.1 |

Introduction |

| 9.2 |

Techno-Tactical Needs |

| 9.3 |

ETD of the Future: Techno-Tactical Drivers |

| 9.4 |

ETD of the Future: Performance & Operational Goals |

| 9.5 |

Advanced Sample Collection |

| 9.6 |

Dual Sensor ETD Technology |

| 9.7 |

Integrated Explosives, Chemical Warfare and Narcotics Trace Detectors |

| 10 |

Pipeline ETD Technologies |

| 10.1 |

Nanotechnology Explosives and Narcotics Trace Detection: Challenges |

| 10.2 |

Receptor-based ETD |

| 10.3 |

Molecularly Imprinted Polymers Based ETD |

| 10.4 |

Nano-mechanical Sensor Based ETD |

| 10.5 |

Electronic Nose Based ETD |

| 10.6 |

Silica Micro-cantilever Based ETD |

| 10.7 |

Surface Enhanced Raman Scattering Based ETD |

| 10.8 |

Hybrid Nano-sensor Based ETD |

| 10.9 |

Protein Coated Carbon Nanotubes, Nano Based ETD |

| 10.1 |

Piezo-resistive Polymer Cantilever Nano Based ETD |

| 10.11 |

Inkjet Based Wireless Sensor ETD Technology |

| 10.12 |

Amino-silane Coated Nanowires Arrays Based ETD |

| 10.13 |

Free-surface Microfluidic Control of Surface-Enhanced Raman Spectroscopy Based ETD |

| 10.13.1 |

Introduction |

| 10.13.2 |

Trace Chemical Vapor Detection Cartridge |

| 10.13.3 |

Free Surface MicroFluidic Chip |

| 10.13.4 |

Continuous Preconcentrator |

| 10.13.5 |

Raman Chemical Specific Signatures |

| 10.14 |

Molecularly Imprinted Polymers Explosives and Narcotics Detection Kit |

| 10.15 |

Quantum Sniffer Portable ETD |

| 10.16 |

Cantilever Nano Mechanical Sensors |

| 10.17 |

Sensor Array and Neural Network Based ETD |

| 10.18 |

Temperature-Stepped Desorption Based ETD |

| 10.19 |

Trace Detection of Nitrogen-Based Explosives with UV-PLF |

| 10.2 |

Non-Contact Explosives and Narcotics Harvesting ETD |

| 10.20.1 |

Non-Contact Harvesting |

| 10.20.2 |

ETD Transport |

| 10.20.3 |

ETD Analysis |

| 10.20.4 |

ETD Reporting |

| 10.21 |

Check Point Explosives and Narcotics Detection System |

| 10.22 |

Trace Detection of Small Molecules by Pulsed-Ultraviolet Laser Raman Spectroscopy |

| 10.23 |

Sensing Trace Amounts of Nitro-Aromatic Explosives and Narcotics Using Nanowire-Nanocluster Hybrids |

| 10.24 |

Detection of Explosives and Narcotics at Trace Levels by Laser-Induced Breakdown Spectroscopy (LIBS) |

| 10.25 |

Universal Explosive Detection System |

| 10.26 |

MEMS-Based Explosive Particle Detection and Remote Particle Stimulation |

| 10.27 |

Laser Vaporization of Trace Explosives and Narcotics for Enhanced Non-Contact Detection |

| 10.28 |

Advanced Materials and Sensor Platforms |

| 10.29 |

Basic Research |

| 11 |

Pipeline ETD Systems by Configuration and Application |

| 11.1 |

ETD Based Document Scanner |

| 11.2 |

Boarding Gate Explosives Scanners |

| 11.3 |

Vehical Screening ETD Systems |

| 12 |

Aviation Security Screening |

| 12.1 |

Market Background |

| 12.2 |

Legislation and Regulations Schedule |

| 12.3 |

People Screening Portals |

| 12.4 |

Checked Luggage Screening |

| 12.4.1 |

Screening Process |

| 12.4.2 |

Screening Process |

| 12.4.3 |

ETD Based Screening |

| 12.5 |

Air Cargo Screening |

| 12.5.1 |

Air Cargo Explosives Screening: Background |

| 12.5.2 |

Global Air Travel 1980-2012 Growth |

| 13 |

Global ETD Market – 2011-2014 Data & 2015-2020 Forecast |

| 13.1 |

ETD Global Market |

| 13.1.1 |

Global Systems Sales vs. Service, Consumables & Upgrade Revenues – 2011 – 2020 |

| 13.1.2 |

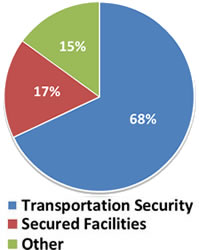

Global Vertical ETD Submarkets |

| 13.2 |

Global ETD Systems Sales |

| 13.2.1 |

Sales by Vertical Submarket – 2011- 2020 |

| 13.2.2 |

Sales by Configuration: Hand-Held, Table-Top & Other Configurations – 2011- 2020 |

| 13.3 |

Global ETD Aftersale Market |

| 13.3.1 |

ETD Aftersales Market Trends |

| 13.3.2 |

Contracted ETD Service Business |

| 13.3.3 |

Time and Materials Revenues |

| 13.3.4 |

ETD Spare Parts Revenues |

| 13.3.5 |

ETD Consumables Revenues |

| 13.3.6 |

Typical ETD Lifecycle |

| 13.4 |

Global Vertical ETD Submarkets |

| 13.4.1 |

Global Transportation Security ETD Market – 2011-2014 Data & 2015-2020 Forecast |

| 13.4.2 |

Global Secured Facilities ETD Market – 2011-2014 Data & 2015-2020 Forecast |

| 13.4.3 |

Global “Other Applications” ETD Market – 2011-2014 Data & 2015-2020 Forecast |

| 14 |

European ETD Market – 2015-2020 |

| 14.1 |

European ETD Market Background |

| 14.1.1 |

Overview |

| 14.1.2 |

EU ETD Related Regulation |

| 14.1.3 |

Screening of Air Cargo Routed to the U.S. |

| 14.2 |

European Aviation Passenger Security Market by Countries |

| 14.2.1 |

United Kingdom Aviation Security Background |

| 14.2.1.1 |

UK Aviation Passenger Security Screening Statistics |

| 14.2.2 |

Sweden Aviation Passenger Security Screening Statistics |

| 14.2.3 |

Denmark Aviation Passenger Security Screening Statistics |

| 14.2.4 |

Netherlands Aviation Passenger Security Screening Statistics |

| 14.2.5 |

Belgium Aviation Passenger Security Screening Statistics |

| 14.2.6 |

Germany Aviation Security Background |

| 14.2.6.1 |

Germany Aviation Passenger Security Screening Statistics |

| 14.2.7 |

France Aviation Security Background |

| 14.2.7.1 |

France Aviation Passenger Security Screening Statistics |

| 14.2.8 |

Spain Aviation Passenger Security Screening Statistics |

| 14.2.9 |

Italy Aviation Security Background |

| 14.2.9.1 |

Italy Aviation Passenger Security Screening Statistics |

| 14.2.10 |

Austria Aviation Passenger Security Screening Statistics |

| 14.2.11 |

Czech Republic Aviation Passenger Security Screening Statistics |

| 14.2.12 |

Poland Aviation Passenger Security Screening Statistics |

| 14.2.13 |

Russia Aviation Security Background |

| 14.2.13.1 |

Russia Aviation Passenger Security Screening Statistics |

| 14.3 |

Europe Market Analysis, 2011-2012 Market Data & 2013-2020 Market Forecast |

| 14.4 |

Systems Sales |

| 14.5 |

ETD Aftersales Market |

| 14.6 |

EuropeTotal Market |

| 14.6.1 |

Vertical European Submarkets – 2011-2014 Data & 2015-2020 Forecast |

| 14.6.2 |

Systems Sales, Service, Consumables & Upgrade Revenues – 2011-2014 Data & 2015-2020 Forecast |

| 14.7 |

Vertical Submarkets |

| 14.7.1 |

Transportation Security ETD Market – 2011-2014 Data & 2015-2020 Forecast |

| 14.7.2 |

Secured Facilities ETD Market – 2011-2014 Data & 2015-2020 Forecast |

| 14.7.3 |

Other Applications ETD Market – 2011-2014 Data & 2015-2020 Forecast |

| 15 |

ETD Systems from 2012 TSA Air Cargo Screening Technology List |

| 15.1 |

ETD Devices Qualified for Screening Operations |

| 15.2 |

ETD Devices Conditionally Approved for Screening Operations |

| 16 |

ETD Business Opportunities |

| 16.1 |

Improved Detection Quality |

| 16.2 |

Enable Multiple-threat Detection |

| 16.3 |

ReduceTransaction Cost |

| 16.4 |

Increase Automation |

| 16.5 |

Reduce Throughput Delays |

| 16.6 |

Ease of Integration |

| 16.7 |

Medium Capacity, Multi-Threat Screening Systems |

| 16.8 |

Upgraded Bio-Chem, Narcotics & Explosives Multi-Threat Trace Detection Screening |

| 16.9 |

“Power” Multi-Threat ETD Vapor-trace Collector |

| 16.1 |

Fused Technology Screening Systems with RFID and Risk Assessment Infrastructure |

| 16.11 |

Third Party Service |

| 17 |

Leading Vendors |

| 17.1 |

American Innovations, Inc. |

| 17.2 |

Auto Clear US (Formerly Control Screening LLC) |

| 17.2.1 |

Company Profile & Contact Information |

| 17.2.2 |

ETD Screening Products |

| 17.3 |

Biosensor Applications AB |

| 17.3.1 |

Company Profile & & Contact Information |

| 17.3.2 |

ETD Screening Products |

| 17.4 |

Bruker Corporation |

| 17.5 |

DetectaChem, LLC |

| 17.5.1 |

Company Profile & Contact Information |

| 17.5.2 |

ETD Screening Products |

| 17.6 |

Electronic Sensor Technology |

| 17.6.1 |

Company Profile & Contact Information |

| 17.6.2 |

ETD Screening Products |

| 17.7 |

FLIR Systems, Inc. |

| 17.7.1 |

Company Profile & Contact Information |

| 17.7.2 |

ETD Screening Products |

| 17.8 |

Hitachi, Ltd |

| 17.8.1 |

Company Profile & Contact Information |

| 17.8.2 |

ETD Screening Products |

| 17.9 |

ICx Technologies |

| 17.9.1 |

Company Profile & Contact Information |

| 17.9.2 |

ETD Screening Products |

| 17.1 |

Implant Sciences |

| 17.10.1 |

Company Profile & Contact Information |

| 17.10.2 |

ETD Screening Products |

| 17.11 |

Ion Applications, Inc. |

| 17.11.1 |

Company Profile & Contact Information |

| 17.11.2 |

ETD Screening Products |

| 17.12 |

Ketech Defence |

| 17.12.1 |

Company Profile & Contact Information |

| 17.12.2 |

ETD Screening Products |

| 17.13 |

Mistral Security, Inc |

| 17.13.1 |

Company Profile & Contact Information |

| 17.13.2 |

ETD Screening Products |

| 17.14 |

Morpho Detection Inc. |

| 17.14.1 |

Company Profile & Contact Information |

| 17.14.2 |

ETD Screening Products |

| 17.15 |

NUCTECH Co. Ltd |

| 17.15.1 |

Company Profile & Contact Information |

| 17.15.2 |

ETD Screening Products |

| 17.16 |

Red X Defense |

| 17.16.1 |

Company Profile & Contact Information |

| 17.16.2 |

ETD Screening Products |

| 17.17 |

SCANNA MSC Ltd. |

| 17.17.1 |

Company Profile & Contact Information |

| 17.17.2 |

ETD Screening Products |

| 17.18 |

Scent Detection Technologies |

| 17.18.1 |

Company Profile & Contact Information |

| 17.18.2 |

ETD Screening Products |

| 17.19 |

Scintrex Trace |

| 17.19.1 |

Company Profile & Contact Information |

| 17.19.2 |

ETD Screening Products |

| 17.2 |

Sibel Ltd |

| 17.20.1 |

Company Profile & Contact Information |

| 17.20.2 |

ETD Screening Products |

| 17.21 |

Smiths Detection |

| 17.21.1 |

Company Profile & Contact Information |

| 17.21.2 |

ETD Screening Products |

| 17.22 |

Syagen Technology |

| 17.22.1 |

Company Profile & Contact Information |

| 17.22.2 |

ETD Screening Products |

| 17.23 |

Thermo Fisher Scientific Inc. |

| 17.23.1 |

Company Profile & Contact Information |

| 17.23.2 |

ETD Screening Products |

| 17.24 |

Westminster International Ltd. |

| 17.24.1 |

Company Profile & Contact Information |

| 17.24.2 |

ETD Screening Products |

| 18 |

Appendix A: ETD Product Comparison |

| 18.1 |

Desktop ETD Products: Vendors, Prices, Technologies, Detection & Capabilities Comparison |

| 18.2 |

Colorimetric ETD Products by Vendors, Prices, Technologies & Detection |

| 18.3 |

Hand-Held ETD by: Products, Vendors, Prices, Technologies, Detection & Capabilities Comparison |

| 18.4 |

ETD Document Scanners: Products, Prices, Technologies & Explosives |

| 18.5 |

People Screening ETD Portals: Products, Vendors Price Comparison |

| 19 |

Appendix B: ETD Products – Prices and Procurement Contracts |

| 19.1 |

American Innovations, Inc. |

| 19.1.1 |

Contractor Information |

| 19.1.2 |

ETD Screening Products |

| 19.2 |

Anchortex Corporation |

| 19.2.1 |

Contractor Information |

| 19.2.2 |

ETD Screening Products |

| 19.3 |

Control Screening LLC |

| 19.3.1 |

Contractor Information |

| 19.3.2 |

ETD Screening Products |

| 19.3.3 |

Control Screening LLC – U.S. Government Contract |

| 19.4 |

Federal Resources Supply Co. |

| 19.4.1 |

Contractor Information |

| 19.4.2 |

ETD Screening Products |

| 19.4.3 |

Federal Resources Supply Co. – U.S. Government Contract |

| 19.5 |

ICx Technologies, Inc. |

| 19.5.1 |

Contractor Information |

| 19.5.2 |

ETD Screening Products |

| 19.5.3 |

ICx Technologies – U.S. Government Contract |

| 19.6 |

Implant Sciences Corp |

| 19.6.1 |

Contractor Information |

| 19.6.2 |

ETD Screening Products |

| 19.6.3 |

Implant Sciences – U.S. Government Contract |

| 19.7 |

Laurus Systems Inc. |

| 19.7.1 |

Contractor Information |

| 19.7.2 |

ETD Screening Products |

| 19.7.3 |

Laurus Systems Inc – U.S. Government Contract |

| 19.8 |

Morpho Detection |

| 19.8.1 |

Contractor Information |

| 19.8.2 |

ETD Screening Products |

| 19.8.3 |

Morpho Detection – U.S. Government Contract |

| 19.9 |

Security 20/20 Inc. |

| 19.9.1 |

Contractor Information |

| 19.9.2 |

Security 20/20 Inc ETD Screening Products |

| 19.9.3 |

Contract |

| 19.1 |

Security Detection |

| 19.11 |

Smiths Detection |

| 19.11.1 |

Contractor Information |

| 19.11.2 |

ETD Screening Products |

| 19.11.3 |

Smiths Detection – U.S. Government Contract |

| 19.12 |

Treasure Electronics, Inc. |

| 19.12.1 |

Contractor Information |

| 19.12.2 |

ETD Screening Products |

| 19.12.3 |

Treasure Electronics – U.S. Government Contract |

| 19.13 |

Veteran Corps Of America |

| 19.13.1 |

Contractor Information |

| 19.13.2 |

ETD Screening Products |

| 19.13.3 |

Veteran Corps of America Contract |

| 19.14 |

Winvale Group |

| 19.14.1 |

Contractor Information |

| 19.14.2 |

ETD Screening Products |

| 19.14.3 |

Winvale Group – U.S. Government Contract |

| 20 |

Appendix C: TSA Checked Luggage EDS & ETD Screening Configurations |

| 21 |

Appendix D: TSA Air Cargo Facility Regulations |

| 22 |

Appendix E: TSA Checked Luggage Systems |

| 23 |

Appendix F: The DOJ ETD Evaluation Protocol for 1st Responders |

| 23.1 |

Introduction |

| 23.2 |

The Basics of Instrument Operation |

| 23.3 |

Protocol for Characterizing a Trace Explosives Detector |

| 23.3.1 |

Probability of Detection – P(d) |

| 23.3.2 |

Detection Limit (DL) |

| 23.3.3 |

False-Negative Rate |

| 23.3.4 |

False-Positive Test |

| 23.3.5 |

Nuisance-Alarm Rate |

| 23.3.6 |

Interference Tests |

| 23.3.7 |

Throughput Rate |

| 23.3.8 |

Sampling Time |

| 23.3.9 |

Analysis Time |

| 23.3.10 |

Total Processing Time |

| 24 |

Appendix G: TSA Air Cargo Screening Technology List (ACSTL) |

| 24.1 |

Document Purpose |

| 24.2 |

Document Format |

| 24.3 |

Certified Air Cargo Screening Product Manufacturers Contact Information |

| 24.4 |

Certified 2D X-ray Devices |

| 24.5 |

Certified ETD Devices |

| 24.6 |

Certified Tomographic Explosive Detection Systems (EDS) |

| 24.7 |

Certified Carbon Dioxide (CO2) Monitors |

| 24.8 |

Certified Non-EDS 2D X-ray Devices |

| 24.9 |

Certified Electronic Metal Detection (EMD) Devices |

| 25 |

Appendix H: List of Authorized Air-Cargo on Passenger Plans Screening Facilities |

| 26 |

Appendix I: Narcotics Trafficking |

| 26.1 |

Illegal Narcotics Trade |

| 26.2 |

Narcotics Trafficking via West Africa |

| 26.3 |

Narcotics Trafficking Route in Asia |

| 26.4 |

Narcotics Trafficking in the United States |

| 26.5 |

Narcotics Trafficking in Mexico |

| 26.6 |

Narcotics Industry in Colombia |

| 27 |

Appendix J: Glossary |

| 28 |

Scope and Methodology |

| 28.1 |

Scope |

| 28.2 |

Report Structure |

| 28.3 |

Who Is This Report For? |

| 28.4 |

Research Methods |

| 28.5 |

Assumptions |

| 28.6 |

Possible Scenario Analysis |

| 29 |

Disclaimer |