Description

|

|

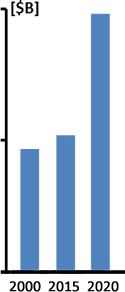

Belgium Homeland Security & Public Safety Market 2010, 2015 & 2020

|

Checkout our updated Global Homeland Security & Public Safety 2019-2024 report.

In light of the March 2016 terror carnage in Brussels airport and subway station, it proved that the past security measures are simply not working; a major overhaul of Belgium’s internal security infrastructure and funding is already in progress. This report forecasts a 2015-2020 market CAGR of 13.4%, four times the country 2000-2015 CAGR.

The two-volume (+ one*) report: “Belgium Homeland Security & Public Safety Market – 2017-2022” is the most comprehensive review of the Belgian Homeland Security & Public Safety market available today. It provides a detailed and reasoned roadmap of this growing market.

The report covers both the Belgian Homeland Security & Public Safety markets since in most cases, products and services have dual or triple use applications and present the same business opportunities (e.g., police equipment is used for three sectors: counter terror, counter crime and illegal immigration).

This report is published as one of our “Europe’s Terror & Migration Crisis Series” reports (concurrently with 9 other published and a dozen pipeline reports to be published soon).

Belgium Counter Terror & Public Safety Market is boosted by the following drivers:

- The complexity, planning and carnage of the Brussels terror attacks shook the Belgian government and public. The March 2016 Brussels bombings and the November 2015 Paris carnage have made it plain that the scale of the threat posed by the Islamic State to Belgium is far larger than most Belgians had previously thought. That threat is no longer limited to the radicalization of the approximately 450 Belgian citizens who left Belgium to fight alongside the Islamic State in Syria and Iraq.

- Belgian authorities assert that as of early 2015, about 380 Belgians have tried to leave in order to fight in Syria and Iraq and that 330 have succeeded in doing so; official sources also estimate that 180 individuals from Belgium are in the region or en route.

- ISIS terror threats coupled with the surge in entry of migrants are alarming and show no signs of declining. Present measures are simply not working; a complete Belgium-wide overhaul of the internal security strategy is essential.

- 2016 will probably be remembered as a watershed year for Belgium’s internal security market, with a number of different developments converging to mark a major turning point.

- The Belgian police forces are ill-equipped to encounter 21st century terrorists who use cutting-edge communication means, conduct exceptional pre-attack intelligence, and have been trained by ISIS on how to plan and conduct modern day guerrilla warfare using modern weapons.

- The Belgian market for security and safety products are served by EU defense and security companies. Even with a preference for EU manufactured products, foreign products can usually strongly compete on the basis of price and performance. They do not encounter any direct trade barriers or quotas. Non-tariff, indirect trade barriers may be the approval process of dual-use goods, which include many security market products.

|

Belgium Homeland Security & Public Safety Market Report Core Submarkets |

This report is a resource for executives with interests in the industry. It has been explicitly customized for the security industry and government decision-makers in order to enable them to identify business opportunities, developing technologies, market trends and risks, as well as to benchmark business plans.

Questions answered in this 467-page two-volume + one* report includes:

- What will the market size and trends be during 2016-2022?

- Which submarkets provide attractive business opportunities?

- Who are the decision-makers?

- What drives the customers to purchase solutions and services?

- What are the customers looking for?

- What are the technology & services trends?

- What is the market SWOT (Strengths, Weaknesses, Opportunities and Threats)?

- What are the challenges to market penetration & growth?

With 467 pages, 64 tables and 154 figures, this two-volume + one* report covers 9 vertical, 9 technologic and 3 revenue source submarkets, offering for each of them 2015 data and assessments, and 2016-2022 forecasts and analyses.

* Customers who purchase a multi-readers license of the report will get the “Global Homeland Security & Public Safety Industry – 2016 Edition” report free of charge. Single-reader license customers will get a 50% discount for the Industry report.

Why Buy this Report?

A. Market data is analyzed via 3 orthogonal perspectives:

With a highly fragmented Homeland Security & Public Safety market we address the “money trail” – each dollar spent – via the following 3 viewpoints:

- By 9 Vertical Markets including:

- Airport Security

- Smart Borders, Immigration Enforcement & Border Security

- Intelligence Agencies

- Critical Infrastructure Protection

- Police Modernization & Other 1st Responders

- Public Events & Safe City

- Building & Perimeter Security

- CBRN Security & Safety

- Other Vertical Markets (including: Maritime Security, Mass Transportation Security and Oil-Gas Industry Security)

- By 3 Revenue Sources including:

- Products Sales

- Maintenance & Service, Upgrades, Refurbishment

- Planning, Training and Consulting

- By 9 Technology Markets including:

- Cybersecurity

- Counter Terror & Crime IT

- Communication Systems & Devices

- Biometrics

- Video Surveillance Technologies

- Intrusion Detection Systems

- Border & Perimeter Security Technologies

- Explosives & Weapons Detection Technologies

- Other Technologies (including: C2/C4ISR Systems, NLW, Counter IED, Personal Protective Gear and more)

B. Detailed market analysis frameworks for each of the market sectors, including:

- Market drivers & inhibitors

- Business opportunities

- SWOT analysis

- Competitive analysis

- Business environment

- The 2015-2022 market segmented by 51 submarkets

C. This report addresses the Homeland Security & Public Safety dual-use products markets:

76% of the Belgium market revenues derive from dual-use products. For example, cybersecurity systems are used to address both cyber-crime and cyber-terror. Decision-makers forming their strategy need a complete view of this overlapping market both independently and in their intersections.

D. The report includes the following 5 appendices:

- Appendix A: Belgium Counter Terror & Public Safety Agencies

- Appendix B: European Security Related Product Standards

- Appendix C: The European Union Challenges and Outlook

- Appendix D: The European Migration Crisis

- Appendix E: Abbreviations

E. The report addresses over 300 European Homeland Security and Public Safety standards (including links)

F. The report provides the number of passengers and number of screened cabin & checked-in baggage and luggage at each of the major airports by 2016 & 2020

G. The report discusses directly and indirectly the following 90 technologies:

- Access Control Systems

- Automated Border Control (ABC) Gates

- Backscatter X-Ray Container-Vehicle Screening Systems

- Bio-Agents & Infectious Disease Detection

- Biometrics

- Biosecurity and Biosafety Devices & Systems

- Bio-Terror & Infectious Disease Early Alert System Devices & Systems

- Boarding Gate Explosives Scanners

- Border & Perimeter Barriers

- C2/C4ISR Systems

- Capacitance Sensors Fence

- CBRN and Hazmat Personal Protective Gear

- Cell Broadcast Mass Emergency Notification

- Chemical Agent Detection

- Chemical, HAZMAT & Nuclear Detection

- Coherent Scatter 2D X-Ray Systems

- Communication Systems & Devices

- Cybersecurity

- Decontamination of CBRN & HAZMAT Incidents

- Desktop ETD Devices

- Dual Energy LINAC X-Ray Container-Vehicle Screening Systems

- Dual-View LINAC X-Ray Container-Vehicle Screening Systems

- Dumb Fences

- Electronic Fencing

- Emergency Management IT Systems

- Emergency Medical Services (EMS) Devices & Systems

- E-Passports

- Fiber Optic Fence

- Gamma Ray Systems Container-Vehicle Screening Systems

- Hand Held Metal Detectors

- Handheld ETD Devices

- Homeland Security & Public Safety IT Systems

- Human Portable Radiation Detection Systems (HPRDS)

- Hybrid Tomographic EDS & 2D X-Ray Screening

- IED Placement Detection

- Infrastructure as a Service (IaaS) IT

- Intelligence Community Big Data IT

- Intelligence Community Cloud Infrastructure IT

- Intelligence Community Software as a Service (SaaS)

- Intelligence Services IT

- Interoperable Communication Systems

- Intrusion Detection Systems

- Ion Mobility Spectroscopy (IMS)

- Liquid Explosives Detection Devices

- Luggage, Baggage & Mail Screening Systems

- Maritime Awareness Global Network (MAGNET)

- Mass Emergency Notification Devices & Systems

- Metal detection Portals

- Multimodal Biometric Systems

- Narcotics Trace Detection Devices

- Natural & Manmade Disaster Early Warning systems

- Non-Lethal Weapons(NLW)

- Nuclear/Radiological Detection Devices & Systems

- Other Security Technologies

- People Screening MMWave (AIT) Portals

- People Screening X-Ray Backscatter (AIT) Portals

- Perimeter Security Technologies

- Personal (Ballistic & CBRNE) Protective Gear

- Personal Body Armor

- Platform as a Service (PaaS)

- Police Modernization Systems and Devices

- Ported Coax Buried Line Fence

- Rescue & Recovery Equipment

- Respiratory Protective Equipment

- Satellite Based Maritime Tracking

- Shoe Scanners

- Siren Systems

- SkyBitz Global Locating System

- Standoff Explosives & Weapon Detection Systems

- Standoff Suicide Bombers Detection

- Strain Sensitive Cables Fence

- Suicide Bombers Borne IED (PBIED) Detectors

- Suicide Bombers Detonation Neutralization

- Taut Wire Fence

- Text Alert Systems

- The Advanced Spectroscopic Portals (ASP)

- Tomographic Explosive Detection Systems (EDS)

- Transportable X-Ray Screening Checkpoints

- VBIED Detonation Neutralization

- Vehicle & Container Screening Systems

- Vehicle Borne IED (VBIED) Detectors

- Vehicle Screening ETD Systems

- Vibration Sensors Mounted on Fence

- Video Analytics

- Video Surveillance

- Visa & Passport related IT

- Voice Alert Systems

- Wide Area Communications and Tracking Technology

- X-Ray Container-Vehicle Screening Systems

- X-ray Screening systems

H. The supplementary (*) (**) report: “Global Homeland Security and Public Safety Industry – 2016 Edition” (updated in May 2016) provides the following insights and analysis of the industry including:

- The Global Industry 2016 status

- Effects of Emerging Technologies on the Industry

- The Market Trends

- Vendor – Government Relationship

- Geopolitical Outlook 2016-2022

- The Industry Business Models & Strategies

- Market Entry Challenges

- The Industry: Supply-Side & Demand-Side Analysis

- Market Entry Strategies

- Price Elasticity

- Past Mergers & Acquisitions (M&A) Events

I. The supplementary* “Global Homeland Security and Public Safety Industry 2016 Edition” report provides updated (May 2016) and extensive information (including company profile, recent annual revenues, key executives, homeland security and public safety products, and contact info.) on the 119 leading Homeland Security and Public Safety Vendors in the industry, namely:

- 3M

- 3i-MIND

- 3VR

- 3xLOGIC

- ABB

- Accenture

- ACTi Corporation

- ADT Security Services

- AeroVironment Inc.

- Agent Video Intelligence

- Airbus Defence and Space

- Alcatel-Lucent (Nokia Group)

- ALPHAOPEN

- American Science & Engineering Inc.

- Anixter

- Aralia Systems

- AT&T Inc.

- Augusta Systems

- Austal

- Avigilon Corporation

- Aware

- Axis

- AxxonSoft

- Ayonix

- BAE Systems

- BioEnable Technologies Pvt Ltd

- BioLink Solutions

- Boeing

- Bollinger Shipyards, Inc

- Bosch Security Systems

- Bruker Corporation

- BT

- Camero

- Cassidian

- CelPlan

- China Security & Surveillance, Inc.

- Cisco Systems

- Citilog

- Cognitec Systems GmbH

- Computer Network Limited (CNL)

- Computer Sciences Corporation

- CrossMatch

- Diebold

- DRS Technologies Inc.

- DVTel

- Elbit Systems Ltd.

- Elsag Datamat

- Emerson Electric

- Ericsson

- ESRI

- FaceFirst

- Finmeccanica SpA

- Firetide

- Fulcrum Biometrics LLC

- G4S

- General Atomics Aeronautical Systems Inc.

- General Dynamics Corporation

- Getac Technology Corporation

- Hanwha Techwin

- Harris Corporation

- Hewlett Packard Enterprise

- Hexagon AB

- Honeywell International Inc.

- Huawei Technologies Co., Ltd

- IBM

- IndigoVision

- Intel Security

- IntuVision Inc

- iOmniscient

- IPConfigure

- IPS Intelligent Video Analytics

- Iris ID Systems, Inc.

- IriTech Inc.

- Israel Aerospace Industries Ltd.

- ISS

- L-3 Security & Detection Systems

- Leidos, Inc.

- Lockheed Martin Corporation

- MACROSCOP

- MDS

- Mer group

- Milestone Systems A/S

- Mirasys

- Motorola Solutions, Inc.

- National Instruments

- NEC Corporation

- NICE Systems

- Northrop Grumman Corporation

- Nuance Communications, Inc.

- ObjectVideo

- Panasonic Corporation

- Pelco

- Pivot3

- Proximex

- QinetiQ Limited

- Rapiscan Systems, Inc.

- Raytheon

- Rockwell Collins, Inc.

- Safran S.A.

- Salient Sciences

- Schneider Electric

- SeeTec

- Siemens

- Smart China (Holdings) Limited

- Smiths Detection Inc.

- Sony Corp.

- Speech Technology Center

- Suprema Inc.

- Synectics Plc

- Tandu Technologies & Security Systems Ltd

- Texas Instruments

- Textron Inc.

- Thales Group

- Total Recall

- Unisys Corporation

- Verint

- Vialogy LLC

- Vigilant Technology

- Zhejiang Dahua Technology