The U.S. Projected to Lead The COVID-19 Mitigation Products Market: $55 to $112 Billion per annum, Followed by China

The U.S. Projected to Lead The COVID-19 Mitigation Products Market: $55 to $112 Billion per annum, Followed by China

Homeland Security Research Corp. (HSRC)

WASHINGTON DC, June 29, 2020

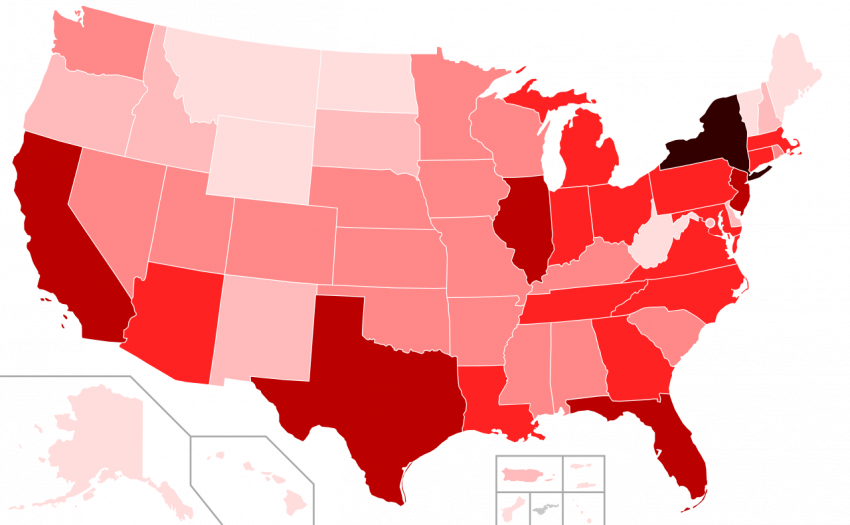

HSRC announces the publication of its research report, “US COVID-19 Pandemic Mitigation Products Market – 2020-2024”. According to this most up-to-update analysis, the U.S. is set to lead the Global market* with an annual market share of 22% to 25% of the cumulative 2020-2024 $1.7–$2.2 Trillion global market.

The U.S. is the leading nation in healthcare spending, resources, medical research, and sophisticated medical care. The U.S. spends $3.3 trillion (IMF, 2019) per year on healthcare, which is more than the combined expenditures of China, Japan, Germany, India, the United Kingdom, Italy, Brazil, Canada, Russia, South Korea, Spain, Australia, Mexico, Indonesia, the Netherlands, Saudi Arabia, Turkey and Switzerland ($3.24 trillion).

When compared directly to China, given the rivalry between the PRC and the USA, it might be important to note that China is very much still a developing country in the field of healthcare infrastructure and spending. China spends 23 times less than the U.S. in terms of per-capita health care expenses ($430 to $10,100) and has 9.6 times (2019 data) fewer intensive care unit hospital beds per hundred thousand people than the U.S. does (34.7 to 3.6). That said, due to the size of China’s population, the PRC has half the overall number of ICU beds that the U.S. has. However, the U.S.’s advantages seemed not to be an impediment to having 29 times more COVID-19 infected cases (2,424,168 to 83,430) and 27 times more COVID related deaths than China (123,473 to 4,634).

Despite the huge spending, the U.S. became the leading COVID sufferer and mitigation market leader. HSRC estimates that there are a number of reasons why this has happened:

- The Pandemic turned into a political issue, not a healthcare one, which should have been led by the CDC which was established 77 years ago with one mission: to mitigate the spread of diseases.

- The White House was late to take counter-pandemic measures, including, but not limited to: stopping international travel (especially from China).

- The Trump administration has no consistent mitigation strategy.

- CDC challenges – during February, the CDC used erroneous PCR testing reagents and up to now they are not doing enough testing nation-wide.

- The federal government does not have a national lockdown authority. This authority is in the hands of the 50 states.

- Millions of infected low-income individuals and others, who are not covered by a medical insurance, refrained from seeking medical care when needed.

The USA is and will continue to be the largest COVID-19 mitigation products market because at this point that’s the only option it has, and it has the resources to invest whatever it takes to mitigate the pandemic.

This should be contrasted to China’s successful response, which, it is important to point out, was not solely, as many believe, due to its authoritarian government. There are six elements which dominated the effective mitigation of China’s COVID-19 outbreak:

- Lessons learned from past outbreaks. The 2003 SARS, 2009 H1N1 flu and the 2013 H7N9 outbreaks demonstrated the effects of outbreaks. This resulted in funding a restructured healthcare system and the establishment of a pandemic related laboratory network across the country.

- A draconic lockdown of 50 million people.

- China’s Safe City Infrastructure The government invested during 2014-2018 billions of USD on a 650 cities’ “Safe City” infrastructure. The core of the “Safe City” system is a people surveillance platform based on 230 million video cameras, backed by face recognition biometrics.

- The “health code” surveillance infrastructure The Chinese augmented the safe city infrastructure by a so called “health code” service. The “health code” service, running on ubiquitous smart phone’s platforms, was developed for the Chinese government to give users color-coded labels based on their health condition and travel record, and a code that can be scanned by government authorities and millions of establishments. As millions of people in China emerge from a long period of lockdown, their freedom of movement is largely dependent on the “health code” apps. The apps users with a green code are allowed to travel relatively freely. A yellow code indicates that the holder should be in home isolation, and a red one indicates a verified COVID-19 patient who should be in quarantine.

- Chinese citizens (like many in Asia-Pacific countries) culture is to wear face masks when needed.

- “We will invest whatever it takes to contain the outbreak” government policy.

The global COVID-19 Pandemic Mitigation Products Market – 2020-2024 report presents a thorough market analysis of 57 products & services sub-reports, 6 vertical, 4 revenue source, 5 regional and 13 national markets providing in-depth analysis of this newly formed market.

This 1020-page 5-volume market mega report is the first and most comprehensive review of the new global COVID-19 Pandemic Mitigation Products & Services market available today. As countries start to re-open, and you do your best to recover your business, the report brings to your attention multi-billion business opportunities that may assist your struggle to retain business continuity and growth. This newly formed market is not limited to the healthcare supplier’s industry; many business opportunities are being created for industries from contract tracing to blockchain, from AI, big data & deep learning to nonwoven fabrics.

Browse through 5 volumes market data, 1020 pages, 728 tables & Figures, 212 submarkets and view a comprehensive Table of Content here: ToC

To adhere to our high standards of research, as nobody can truly forecast the future of this on-going pandemic, we include in the report two scenarios:

- Optimistic scenario – assumes (among other things) that mass vaccination will commence by July 2021

- Conservative scenario – assumes (among other things) that no mass vaccination will be available until 2024

The objective of this report is to provide today’s strategic decision-makers with an expert 360-degree, time-sensitive, detailed view of this interconnected market and provides answers to questions such as:

- What is the COVID-19 Pandemic Mitigation Products & Services market size and what are the forecasted trends during 2020-2024?

- What are the most attractive business opportunities?

- What drives the customers to purchase solutions and services?

- What are the COVID-19 Mitigation technology & services trends?

- What is the 212 sub-markets size over the 2020-2024 period?

- What are the challenges to market penetration & growth?

With a highly fragmented market we address the “money trail” – each dollar spent in the global COVID-19 Pandemic Mitigation market is analyzed and crosschecked via 5 orthogonal viewpoints:

- 54 products and services:

|

1. COVID -19 Vaccines |

2. Medical Eye Protection |

|

3. COVID -19 Therapeutic Drugs |

4. PPE Sterilization: Systems & Consumables |

|

5. Other COVID-19 Pharma Industry Products |

6. Hand & Surface Sanitizers |

|

7. PCR Instrumentation & Software |

8. COVID-19 Sterilization |

|

9. Robotic PCR Systems & Software |

10. Other COVID-19 Personal Protection Gear |

|

11. COVID -19 PCR Reagents & Consumables |

12. COVID-19 AI, Big Data & Deep Learning |

|

13. Nose & Mouth Swabs |

14. COVID-19 related Homecare IT |

|

15. COVID-19 Self-collection PCR Test Kits |

16. Pandemic Contact Tracing |

|

17. COVID-19 Serologic Test Kits |

18. E-Health |

|

19. Standoff Thermometry |

20. COVID-19 Related Blockchain Technologies |

|

21. COVID-19 X-Ray Procedures |

22. Other COVID-19 ICT |

|

23. COVID-19 CT Procedures |

24. Noninvasive Ventilators |

|

25. COVID-19 Ultrasound Procedures |

26. Invasive Mechanical Ventilators |

|

27. COVID-19 Wastewater testing |

28. Next Generation Ventilators |

|

29. COVID-19 FDG-PET/CT Procedures |

30. COVID-19 Homecare |

|

31. PACS 32. Teleradiology |

33. Portable Ventilators |

|

34. Medical PPE Gowns |

35. Surge Capacity Hospitals 36. COVID-19 ICUs |

|

37. Medical Gloves |

38. COVID-19 related Kidney Dialysis |

|

39. Medical Face Masks |

40. COVID-19 related Extracorporeal Membrane Oxygenation Procedures |

|

41. Medical Face Shields |

42. Other COVID-19 related Intensive Care Modalities |

|

43. PPE Gowns Manufacturing Plants |

44. PCR Systems Manufacturing Plants |

|

45. Gloves Manufacturing Plants |

46. Nose & Mouth Swabs Manufacturing Plants |

|

47. Face Masks Manufacturing Plants |

48. Medical Glass Manufacturing Plants |

|

49. Face Shields Manufacturing Plants |

50. COVID-19 related R&D Equipment & Consumables |

|

51. Self-Collected PCR Test Kits Manufacturing. Plants |

52. COVID-19 Vaccine Manufacturing Plants |

|

53. Melt-Blown PPE Fabric Manufacturing Plants |

54. Ventilators Manufacturing Plants |

- 6 vertical markets

- Hospitals & Surge Hospitals

- Clinical Labs

- Clinics

- Emergency Medical Services (EMS)

- Homecare & Nursing Homes

- Research Bodies

- 13 National Markets:

- USA

- Canada

- UK

- Germany

- France

- Italy

- Rest of Europe

- India

- China

- South Korea

- Japan

- Rest of Asia Pacific

- ROW

- 5 Regional Markets:

- North America

- Latin America

- Europe

- Middle East & Africa

- Asia Pacific

- 4 Revenue Source Markets:

- Product Sales

- Training Services

- Planning & Consulting

- Maintenance & Upgrades

(*) Market size is scenario dependent.

For more information, or to purchase a copy, please visit us here.

About the analysts that composed this report:

The team which composed this report brings 43 years of hands on record in the development and commercialization of healthcare products including: antibody antigen detection, E-health, Bio-decontamination and biosecurity, PACS, teleradiology, PPE, computerized tomography, medical devices, and brings long term cooperation with the FDA and CDC as well as the EU CE and other national medical legislation agencies.

As early as January 20, 2020 we recruited all our analysts to research the COVID-19 pandemic mitigation related products & services purchases. We interviewed hundreds of experts, participated in more than 95 conferences and webinars, reviewed more than 1,500 publications and interviewed executives of more than 65 pandemic related companies.

Given the geographical reach of the coronavirus, its significant personal effect, and the serious economic disturbance it has affected, there is not a specific HSRC activity that has not been touched by it. In spite of the pandemic’s challenges, HSRC continues to support our customers and execute our quest to develop the mitigation of COVID-19. During this era and despite difficulties, HSRC operations have continued to publish COVID-19 related market research reports.

It has been exciting to see how developing tecno-clinical methods and technologies perform a key role in the response to COVID-19. Companies, big and small, turned to enroll in the war against the deadly virus and to accelerate efforts to help others to create and improve COVID-19 mitigation products and services.

About Homeland Security Research Corp. (HSRC)

Homeland Security Research Corp. (HSRC) is an international market and technology research firm specializing in the Public Safety Industry. HSRC provides premium off-the-shelf and customized market reports on present and emerging technologies and industry expertise, enabling global clients to gain time-critical insight into business opportunities. HSRC’s clients include the U.S. Congress, DHS, U.S. Army, U.S. Navy, DOD, DOT, GAO, NATO, and EU, among others, as well as government agencies in Japan, Korea, Taiwan, Israel, Canada, UK, Germany, Australia, Sweden, Finland, Singapore. With over 950 private sector clients (76% returning), including major defense and security contractors and Fortune 2000 companies, HSRC earned the reputation as the industry’s Gold Standard for public safety market reports.

Washington D.C. 20004, 601 Pennsylvania Ave., NW Suite 900,

Tel: 202-455-0966, info@homelandsecurityresearch.com, https://hsrc.biz