Description

Japan COVID-19 Pandemic Mitigation Products Market – 2020-2024 Report

On the backdrop of the need for essential medical products and services, a new market has emerged, the COVID-19 pandemic mitigation products market. This Japan COVID-19 pandemic mitigation cumulative 2020-2024 market is worth $40-53 Billion*.

|

(*) Market size is year and scenario dependent.

To adhere to our high standards of research, as nobody can forecast the future of the pandemic, we include in the report two scenarios:

- Optimistic scenario– assumes (among other things) that mass vaccination will commence by July 2021

- Conservative scenario– assumes (among other things) that no mass vaccination will be available until July 2024

Why trust this report?

- The team which created this report was led by ex-executives of the medical industry and bio-security experts, who wrote this report with the COVID-19 industry executives in mind

- As the COVID-19 pandemic knowledge changes all the time, we update the report once a month

- The team has published since 2006 36 Pandemic related reports

- Team members imported (via Fuji Medical) medical systems & instrumentation to Japan ) since 1996

Bottom Line: While other COVID-19 reports are written (at best) by MBAs, this report is published by professionals for experts

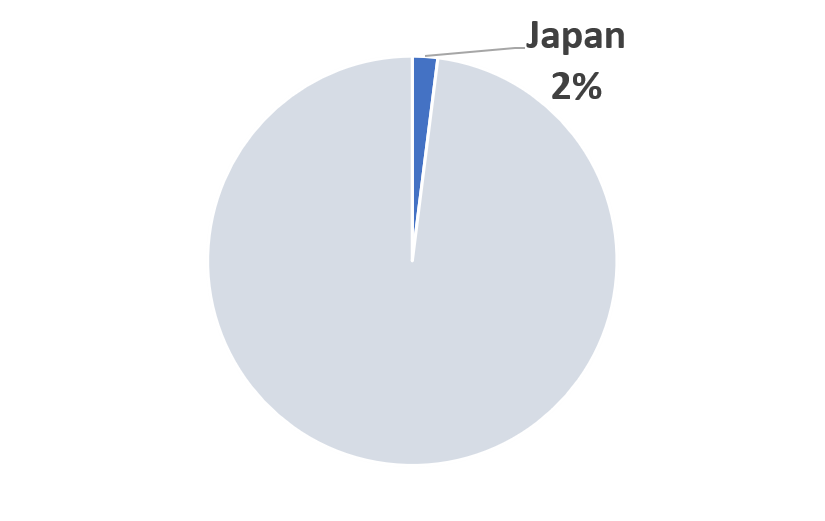

2023 Japan COVID-19 Pandemic Mitigation Market Share (Scenario A)

|

(*) Market size is year and scenario dependent.

|

According to the report:

The virus was first verified to have spread to Japan in January 2020. Confirmed cases have been recorded in each of the 47 prefectures except for Iwate.

The Japanese government confirmed its first outbreak of the coronavirus disease 2019 (COVID-19) in the country. This was followed by a second outbreak that was introduced by travelling passengers and returnees from Europe and the United States between 11 March and 23 March. According to the Japanese National Institute of Infectious Diseases, the majority of viruses spreading in Japan derive from the European type while those of the Wuhan type have been disappearing since March.

During the January-July period Japan had fewer COVID-19 fatalities than the global average. This is exceptionally stunning because Japan has many of the circumstances that make it susceptible to the coronavirus, Japan didn’t embrace the vigorous methods to mitigate the coronavirus that some Asia Pacific countries did.

At the February Wuhan outbreak peak, Japan kept borders open. As the coronavirus spread, it became obvious that COVID-19 is a disease that primarily kills the elderly and is massively amplified by crowds or prolonged close contact. Japan has the highest elderly population per capita in the world. Japan’s inhabitants are also densely crowded in mega cities.

Then there is Japan’s refusal to conduct massive testing. By now (July 18), total PCR tests stand at approximately 0.3% of the population. Japan didn’t impose a mass lockdown on the extent of Europe’s. The stay-at-home request was voluntary. Non-vital businesses were requested to close.

Now, five months after the first COVID-19 case was reported in Japan, Japan has fewer than 20,000 infected and less than 1,000 fatalities. The state of emergency has been lifted, and life is rapidly returning to normal.

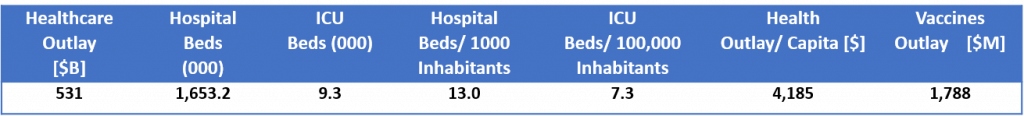

Japan Healthcare, ICUs and Vaccines Outlay Statistics (2019)

|

Sources: IMF, WHO, OECD, World Population Prospects (2019 Revision)

The telecom titan Softbank conducted 40,000 workers serologic antibody tests, which demonstrated that 0.24% had been exposed to the coronavirus. Double blinded research which tested 8,000 persons resulted in smaller levels of exposure.

As stated above, Japan’s death rate per capita from coronavirus is one of the lowest in the developed world, more than 70 times lower than the UK and 40 times lower than the USA. Scientists have asked themselves what it is about Japan’s response to the coronavirus that has enabled such a low death rate. The government response, a milder strain of the virus, social effect caused by community immunity, cultural habits such as bowing etiquette or wearing face masks, hand washing with sanitizing equipment, a protective genetic trait, and a relative immunity conferred by the mandatory BCG tuberculosis vaccine have all been proposed as possible explanations.

Japan COVID-19 Market Segmentation Vectors

6 End User and 4 Revenue Source Markets:

|

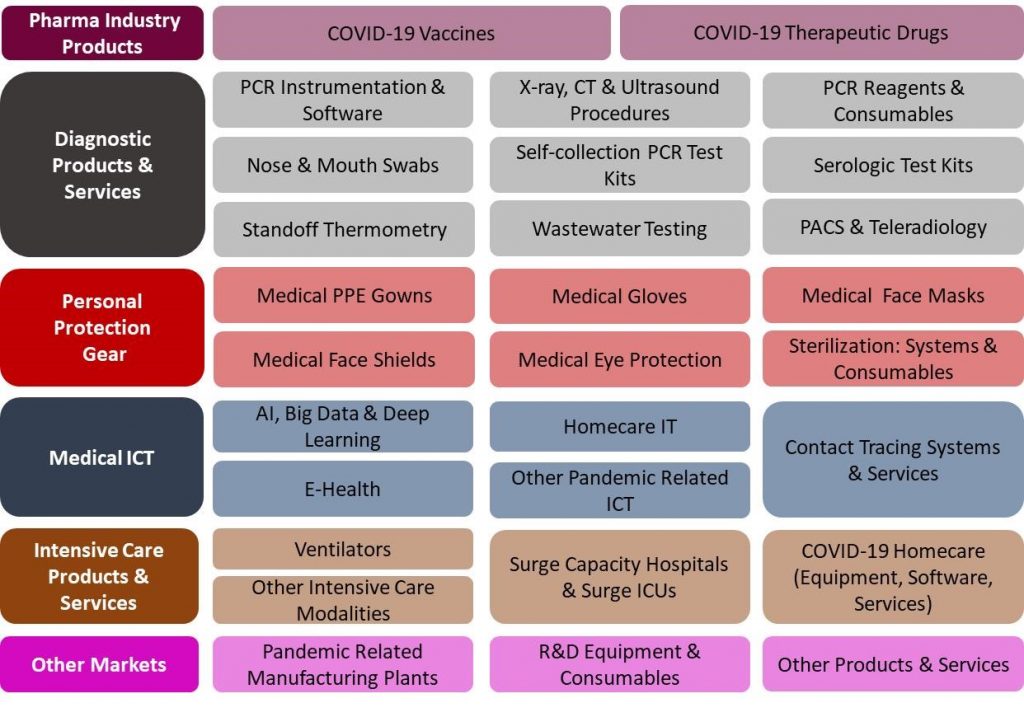

29 Products and Services Markets:

|

Japan’s COVID-19 pandemic mitigation products market is driven by the demand for the following:

- In between the first and second surge of the pandemic by early 2020, and the removal of the lockdown, the country’s healthcare establishment invested billions to mitigate the next wave of the pandemic

- The growing size of coronavirus related information and mounting complications of datasets, and the need saved by financial resources

- Advanced AI and machine learning have a high demand among general practitioners and others who are not coronavirus ICU experts

- Japanese pharma and biotech companies research and development of coronavirus vaccines and medications

- Japan invests heavily on PCR and serologic tests. Having said that, national health authorities in Japan do not provide regional data for test-confirmed cases of the virus

and demand for:

- COVID-19 Vaccines

- Ventilators

- Electronic Contact Tracing

- Surge Hospitals

- PPE

- Invasive ventilators

- New ICU units

- COVID-19 medications

- COVID-19 Informatics

- COVID-19 medical imaging services

- New ICU beds

- COVID-19 medications

- COVID-19 Informatics

- Training of ICU and ER personnel

- Strategic National Stockpile

- Pandemic related turnkey manufacturing plants

This 420 -page market report is the most comprehensive review of the Japanese COVID-19 market available today. The objective of this report is to provide today’s strategic decision-makers with an expert 360-degree, time-sensitive, detailed view of this interconnected market.

The Japan COVID-19 Pandemic Mitigation Products Market – 2020-2024 report presents a thorough market analysis of 29 products & services, 6 end user, 4 revenue source markets. Furthermore, the report provides updated extensive data of 37 key vendors.

Why Buy this Japan COVID-19 Pandemic Mitigation Products Market Report?

A. Questions answered in this report include:

- What is the Japanese COVID-19 Market size and what are the forecast trends during 2020-2024?

- What are the most attractive business opportunities?

- What drives the customers to purchase solutions and services?

- What are the Japanese COVID-19 Market trends?

- What are the challenges to market penetration & growth?

B. Japan COVID-19 market size data is analyzed via 5 independent key perspectives. With a highly fragmented market we address the “money trail” – each dollar spent in the Japanese COVID-19 market is analyzed and crosschecked via 3 orthogonal viewpoints:

- By 29 Products and Services:

|

|

- By 6 End User Markets:

|

- By 4 Revenue Source Markets:

|

C. Detailed market analysis frameworks for each of the market sectors are provided, including:

|

D. The report provides an updated extensive data of the leading 37 companies (including companies’ profile, recent annual revenues, COVID-19 mitigation activities & products and contact information).

E. The report includes over 2300 links to the COVID-19 pandemic mitigation community information sources

F. The report mentions > 450 Vendors including the following:

Moderna, IBM, 3M Company, Philips NV, Johnson & Johnson, Roche, Nvidia Corporation, Thermo Fisher Scientific, Siemens, Toshiba, Google, Samsung Electronics Co, GE Healthcare, Medtronic, MedWhat, MedyMatch, Merck, Metabiota, Micron Technology, Infermedica, Infervision, Inovio Pharmaceuticals, Microsoft Corporation, Mindshare Medical, Morpheo, Pfizer, Philips NV, Maxim Biotech, Honeywell Safety Products, Philips Healthcare, Siemens, Recursion Pharmaceuticals, Fujifilm Holdings Corporation, 3Scan, Abbott , AbCellera, Advenio Technosys, Agfa Healthcare, Agilent Technologies, AiCure, Aindra, Allscripts Healthcare Solutions, Amara Health Analytics, Amazon , analyticsMD, Apixio, Apple, Arterys Inc., Atlas Wearables, Atomwise, Avalon Nutrition VITL, Babylon Health, Bay Labs, Behold.ai, benevolent.ai, BIOBEATS, BlueDot, Bollé Safety, Bullard, Buoy Health, Care Angel Wearables QorQL, Careskore, Clinithink, Cloud Pharmaceuticals, CloudMedx, CureMetrix Mental health Ginger.io, Cyrcadia, Deep 6 AI, Deep Genomics, Dell Technologies Inc., Delta Plus Group, Desktop Genetics Virtual mate Ada Health, DreaMed Diabetes, Dupont, EaglEyeMed, Eli Lilly, Encon Safety Products, Enlitic, EnsoData, Entopsis, Envisagenics Research iCarbonX, ERB Industries Inc., Ergodyne, Essilor of America, Flashback Technologies, Flow Health, Ford, Freenome, Frequency Therapeutics Inc., Gateway Safety Inc., General Motors, General Vision, Gentex Corporation, Gibco, Gilead Sciences, Globavir Biosciences, Healint, Health Fidelity, HealthNextGen, HexArmor, Hindsait, Imagen Technologies, Imagia Cybernetics, Inside DNA, InSilico Medicine, Intel Corporation, Intendu, Invitrogen, Ion Torrent, Ironwear, Jvion, Kapa Biosystems, Keen Eye Technologies, Kimberly-Clark Professional, Lexmark International Inc., LifeGraph, Lucina Health, Lumiata, Lunit, Lytics, Magnea, Maxwell MRI, McKesson Corporation, MCR Safety, Medal, Medalogix, Medasense, MedAware, Niramai Health Analytix, Novarad Corporation, NuMedii, Numerate, Nuritas Pharma Turbine, Oncora Medical, Ovuline, PeerWell, PhysIQ, Precision Health Intelligence, Predible Health, Profility, Proscia, pulseData, Pyramex Safety, Qualaris Healthcare Solutions, Qualcomm Incorporated, Qualcomm Incorporated, Qure.Ai, Radians Inc., Roam Analytics, RxPREDICT, Safety Optical Service Ltd, Sanofi, Saykara, Sellstrom Manufacturing Company (SureWerx), Sense.ly, Sensory Inc., Sigma-Aldrich Corp., Skymind Inc., Vir Biotechnology Inc., VisionAid Inc., WuXi Biologics, Xilinx Inc. and more.

G. Japan COVID-19 market report includes 5 appendices:

- Appendix 1: Differences & Similarities between Common Flu and Coronavirus

- Appendix 2: COVID-19 Tests

- Appendix 3: Abbreviations

- Appendix 4: Glossary

- Appendix 5: Bibliography

COVID-19 pandemic mitigation market research team

The team which composed this report brings 43 years of hands on record in the development and commercialization of healthcare products including: antibody antigen identification, E-health, decontamination and biosecurity, PACS, teleradiology, PPE, computerized tomography, ultrasound, electron microscopy, medical devices and more. Our team members bring long term relations with the U.S. FDA and CDC as well as the EU CE and other national medical regulatory agencies.

As early as January 20, 2020 we recruited all our analysts to research the COVID-19 pandemic mitigation related products purchases. We interviewed hundreds of experts, participated in more than 95 conferences and webinars, reviewed more than 1,500 publications and interviewed executives of more than 65 pandemic related companies.