Description

Germany COVID-19 Pandemic Mitigation Products Market – 2020-2024 Report

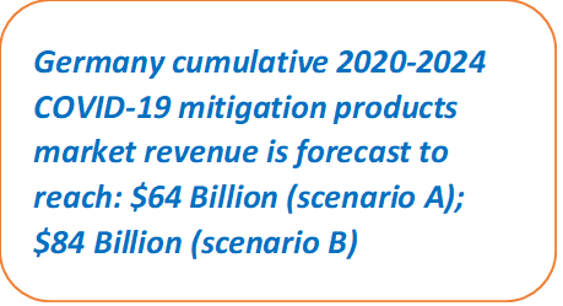

On the backdrop of the need for essential medical products and services, a new market has emerged, the COVID-19 pandemic mitigation products market. This Germany COVID-19 pandemic mitigation cumulative 2020-2024 market is worth $64-84 Billion*.

|

(*) Market size is year and scenario dependent.

To adhere to our high standards of research, as nobody can forecast the future of the pandemic, we include in the report two scenarios:

- Optimistic scenario– assumes (among other things) that mass vaccination will commence by July 2021

- Conservative scenario– assumes (among other things) that no mass vaccination will be available until July 2024

Why trust this report?

- The team which created this report was led by ex-executives of the medical industry and bio-security experts, who wrote this report with the COVID-19 industry executives in mind

- As the COVID-19 pandemic knowledge changes all the time, we update the report once a month

- The team has published since 2006 36 Pandemic related reports

- Team members managed since 1994 a medical systems & instrumentation subsidiary in Germany

Bottom Line: While other COVID-19 reports are written (at best) by MBAs, this report is published by professionals for experts

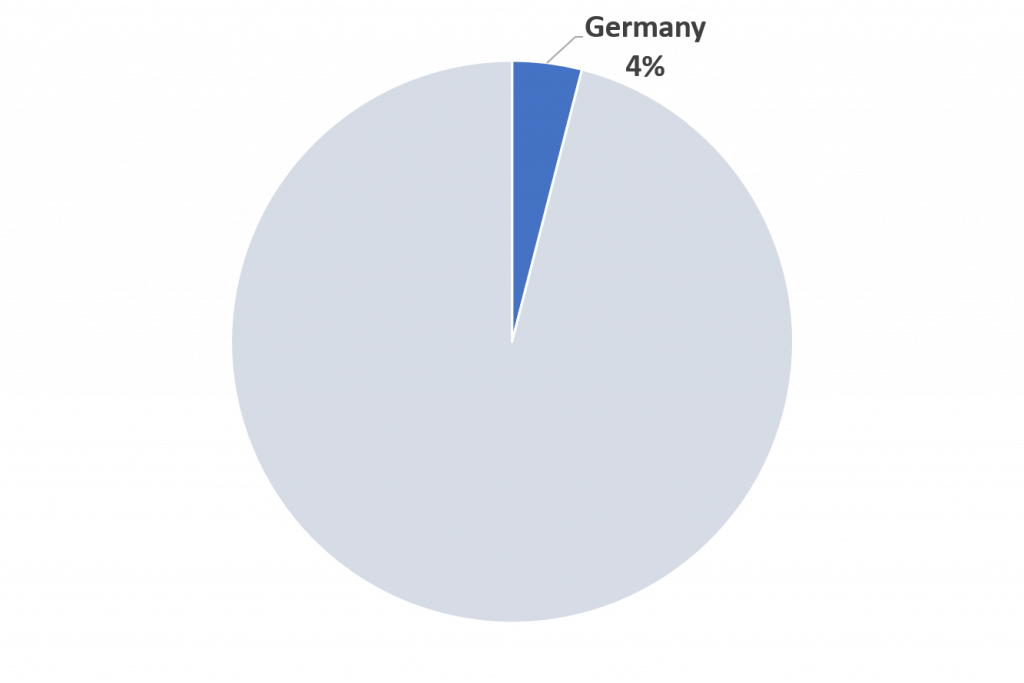

2023 Germany COVID-19 Pandemic Mitigation Market Share (Scenario A)

|

According to the report:

Angela Merkel, the Chancellor, and a scientist (PhD in Quantum Chemistry) is considered by the majority of the Germans to be the ideal leader for the COVID-19 crisis.

If one big democratic country can be considered to have a “decent” COVID-19 disaster management, it is Germany. Fatalities are fewer than in other countries, the government supports suffering firms, politicians & workers are competent.

Germany used its nationwide network of more than 190 testing laboratories that ramped up its testing capability, before the federal government knew a pandemic was around the corner. Germany conducted 350,000 tests a week and can do many more tests.

|

As the federal government hesitated, local governments reacted promptly to close down public places and trace COVID-19 infected contacts. Germany was fortunate, as it got an “early warning” from Italy. Germany used the lead time to knock down the pandemic curve.

Germany Healthcare, ICUs and Vaccines Outlay Statistics (2019)

|

Sources: IMF, WHO, OECD, World Population Prospects (2019 Revision)

German enacted prevention protocols in place facilitated the country’s response to the outbreak. These protocols included early establishment of testing capacities, high levels of testing and an efficient suppression strategy amongst elder population and cost-effective use of Germany’s abundant 660,000 hospital beds.

Exploiting its early accomplishment in segregating the infected, Germany moved to the second phase of the coronavirus pandemic mitigation, tracking each chain of the virus. It established a capacity of more than 4 million tests a week and contact tracing by thousands of “containment scouts” at Germany’s public-health organizations.

To protect workers’ income, Germany has ramped up Kurzarbeitergeld (Salary for temporary work), an instituted system under which the government covers up to 86% of the missed earnings of workers. While the German vehicle industry ceased production for a while, other industry segments like pharma and petrochemicals kept working.

The IMF forecasts a 7% contraction by 2020, graver than the 2008-2009 crisis. Germany’s accomplishments in coping with the coronavirus are indisputable.

Germany COVID-19 Market Segmentation Vectors

6 End User and 4 Revenue Source Markets:

|

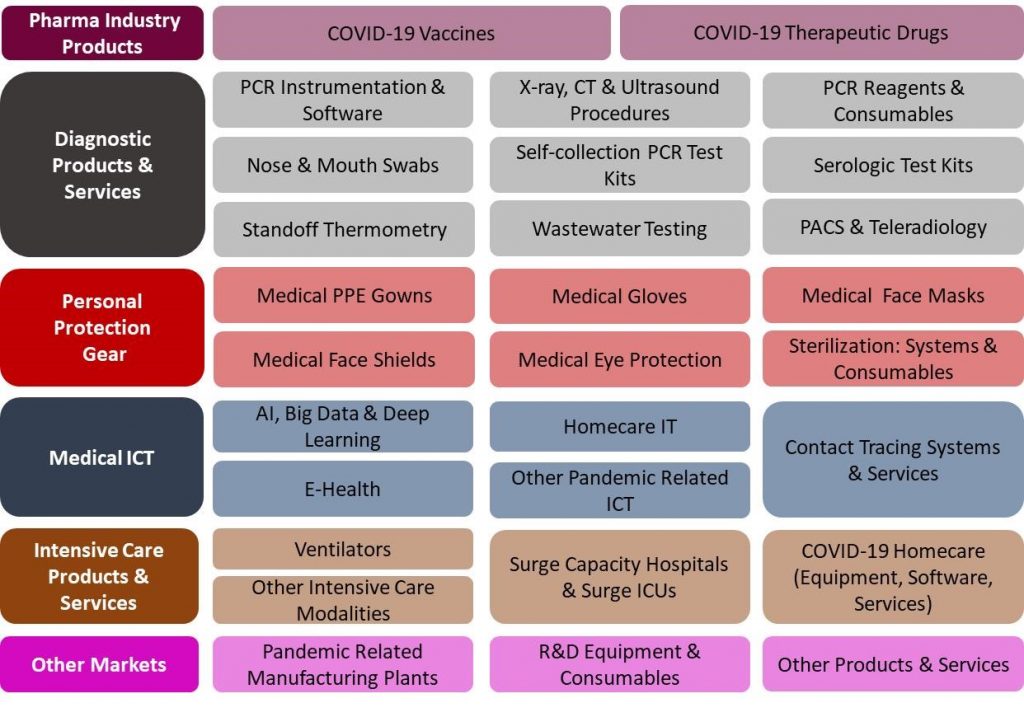

29 Products and Services Markets:

|

Germany’s COVID-19 pandemic mitigation products market is driven by the demand for the following:

- On the backdrop of the first on-going outbreak in the country, and the removal of the lockdown, the country healthcare establishment invests billions to mitigate the next wave of the pandemic

- PCR Tests

- Serologic Tests

- COVID-19 Vaccines

- Ventilators

- Electronic Contact Tracing

- Surge Hospitals

- PPE

- Invasive Ventilators

- New ICU Units

- COVID-19 Medications

- COVID-19 Informatics

- COVID-19 Medical Imaging Services

- Training of ICU and ER Personnel

- Strategic National Stockpile

- Pandemic Related Turnkey Manufacturing Plants

and the following factors:

- The growing size of coronavirus related information and mounting complications of datasets, and the need save financial resources

- Advanced AI and machine learning ha a high demand among general practitioners and others who are not coronavirus ICUs experts

- The country Pharma and Biotech companies research and development of coronavirus vaccines and medications

This 420 -page market report is the most comprehensive review of the German COVID-19 market available today. The objective of this report is to provide today’s strategic decision-makers with an expert 360-degree, time-sensitive, detailed view of this interconnected market.

The Germany COVID-19 Pandemic Mitigation Products Market – 2020-2024 report presents a thorough market analysis of 29 products & services, 6 end user, 4 revenue source markets. Furthermore, the report provides updated extensive data of 37 key vendors.

Why Buy this Germany COVID-19 Pandemic Mitigation Products Market Report?

A. Questions answered in this report include:

- What is the German COVID-19 Market size and what are the forecast trends during 2020-2024?

- What are the most attractive business opportunities?

- What drives the customers to purchase solutions and services?

- What are the German COVID-19 Market trends?

- What are the challenges to market penetration & growth?

B. German COVID-19 market size data is analyzed via 5 independent key perspectives. With a highly fragmented market we address the “money trail” – each dollar spent in the German COVID-19 market is analyzed and crosschecked via 3 orthogonal viewpoints:

- By 29 Products and Services:

|

|

- By 6 End User Markets:

|

- By 4 Revenue Source Markets:

|

C. Detailed market analysis frameworks for each of the market sectors are provided, including:

|

D. The report provides an updated extensive data of the leading 37 companies (including companies’ profile, recent annual revenues, COVID-19 mitigation activities & products and contact information).

E. The report includes over 2300 links to the COVID-19 pandemic mitigation community information sources

F. The report mentions > 450 Vendors including the following:

Moderna, IBM, 3M Company, Philips NV, Johnson & Johnson, Roche, Nvidia Corporation, Thermo Fisher Scientific, Siemens, Toshiba, Google, Samsung Electronics Co, GE Healthcare, Medtronic, MedWhat, MedyMatch, Merck, Metabiota, Micron Technology, Infermedica, Infervision, Inovio Pharmaceuticals, Microsoft Corporation, Mindshare Medical, Morpheo, Pfizer, Philips NV, Maxim Biotech, Honeywell Safety Products, Philips Healthcare, Siemens, Recursion Pharmaceuticals, Fujifilm Holdings Corporation, 3Scan, Abbott , AbCellera, Advenio Technosys, Agfa Healthcare, Agilent Technologies, AiCure, Aindra, Allscripts Healthcare Solutions, Amara Health Analytics, Amazon , analyticsMD, Apixio, Apple, Arterys Inc., Atlas Wearables, Atomwise, Avalon Nutrition VITL, Babylon Health, Bay Labs, Behold.ai, benevolent.ai, BIOBEATS, BlueDot, Bollé Safety, Bullard, Buoy Health, Care Angel Wearables QorQL, Careskore, Clinithink, Cloud Pharmaceuticals, CloudMedx, CureMetrix Mental health Ginger.io, Cyrcadia, Deep 6 AI, Deep Genomics, Dell Technologies Inc., Delta Plus Group, Desktop Genetics Virtual mate Ada Health, DreaMed Diabetes, Dupont, EaglEyeMed, Eli Lilly, Encon Safety Products, Enlitic, EnsoData, Entopsis, Envisagenics Research iCarbonX, ERB Industries Inc., Ergodyne, Essilor of America, Flashback Technologies, Flow Health, Ford, Freenome, Frequency Therapeutics Inc., Gateway Safety Inc., General Motors, General Vision, Gentex Corporation, Gibco, Gilead Sciences, Globavir Biosciences, Healint, Health Fidelity, HealthNextGen, HexArmor, Hindsait, Imagen Technologies, Imagia Cybernetics, Inside DNA, InSilico Medicine, Intel Corporation, Intendu, Invitrogen, Ion Torrent, Ironwear, Jvion, Kapa Biosystems, Keen Eye Technologies, Kimberly-Clark Professional, Lexmark International Inc., LifeGraph, Lucina Health, Lumiata, Lunit, Lytics, Magnea, Maxwell MRI, McKesson Corporation, MCR Safety, Medal, Medalogix, Medasense, MedAware, Niramai Health Analytix, Novarad Corporation, NuMedii, Numerate, Nuritas Pharma Turbine, Oncora Medical, Ovuline, PeerWell, PhysIQ, Precision Health Intelligence, Predible Health, Profility, Proscia, pulseData, Pyramex Safety, Qualaris Healthcare Solutions, Qualcomm Incorporated, Qualcomm Incorporated, Qure.Ai, Radians Inc., Roam Analytics, RxPREDICT, Safety Optical Service Ltd, Sanofi, Saykara, Sellstrom Manufacturing Company (SureWerx), Sense.ly, Sensory Inc., Sigma-Aldrich Corp., Skymind Inc., Vir Biotechnology Inc., VisionAid Inc., WuXi Biologics, Xilinx Inc. and more.

G. Germany COVID-19 market report includes 5 appendices:

- Appendix 1: Differences & Similarities between Common Flu and Coronavirus

- Appendix 2: COVID-19 Tests

- Appendix 3: Abbreviations

- Appendix 4: Glossary

- Appendix 5: Bibliography

COVID-19 pandemic mitigation market research team

The team which composed this report brings 43 years of hands on record in the development and commercialization of healthcare products including: antibody antigen identification, E-health, decontamination and biosecurity, PACS, teleradiology, PPE, computerized tomography, ultrasound, electron microscopy, medical devices and more. Our team members bring long term relations with the U.S. FDA and CDC as well as the EU CE and other national medical regulatory agencies.

As early as January 20, 2020 we recruited all our analysts to research the COVID-19 pandemic mitigation related products purchases. We interviewed hundreds of experts, participated in more than 95 conferences and webinars, reviewed more than 1,500 publications and interviewed executives of more than 65 pandemic related companies.