Description

China COVID-19 Pandemic Mitigation Products Market – 2020-2024 Report

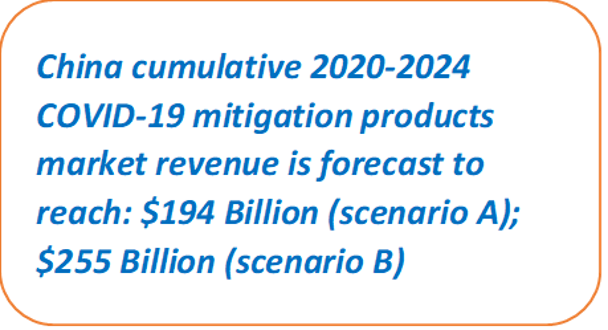

On the backdrop of the need for essential medical products and services, a new market has emerged, the COVID-19 pandemic mitigation products market. The China COVID-19 pandemic mitigation cumulative 2020-2024 market is worth $194-255 billion*.

|

(*) Market size is year and scenario dependent.

To adhere to our high standards of research, as nobody can forecast the future of the pandemic, we include in the report two scenarios:

- Optimistic scenario– assumes (among other things) that mass vaccination will commence by July 2021

- Conservative scenario– assumes (among other things) that no mass vaccination will be available until July 2024

Why trust this report?

- The team which created this report was led by ex-executives of the medical industry and bio-security experts, who wrote this report with the COVID-19 industry executives in mind

- As the COVID-19 pandemic knowledge changes all the time, we update the report once a month

- The team has published since 2006 36 Pandemic related reports

- Team members imported and maintained medical systems & products to China since 1978

Bottom Line: While other COVID-19 reports are written (at best) by MBAs, this report is published by professionals for experts

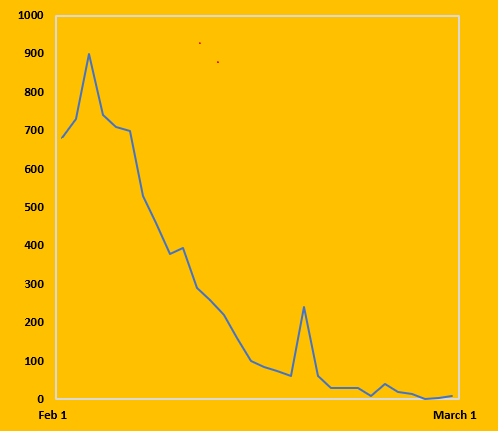

China infections per day (10 days average). Note the effect of the 70 days rigorous lockdown strategy

|

According to the report:

Following a total of 83,462 COVID-19 cases, 4,634 deaths and an extremely long lockdown of 50 million people, China is ahead of the global curve in its recovery from the first wave of the COVID-19 outbreak, with many provinces slowly returning to normal levels of activity. Factories are restarting production and consumers are beginning to spend again. However, the crisis has had a dramatic and prolonged impact on the Chinese economy and healthcare system.

The June outbreak in Beijing has witnessed 260 persons infected with COVID-19 and was a reminder that a every measure should be taken to mitigate future waves.

Many attribute China’s successful suppression of the outbreak to a strategy no democratic country can take. According to the report the concept that no democratic country can mitigate the pandemic curve as the autocratic government of China did, is wrong.

Take for example democratic Taiwan’s success. Taiwan’s Center for Disease Control learned from past epidemics and built the National Health Command Center (NHCC) to aid in disaster management for epidemics following the 2004 SARS outbreak. The NHCC built a network of testing labs, a strategic pandemic stockpile and a medical surge capacity. By January, following information about the Chinese coronavirus outbreak, NHCC was engaged in discrete actions to avoid the proliferation of the disease in Taiwan. It conducted screening of flights from Mainland China and the tracking of individual cases. As a result of its early response, Taiwan (population 24 million) had 455 infected and 7 dead – a better outbreak response than in the PRC.

Bottom line: Democratic Taiwan’s early control actions and follow-up mitigation measures have received international commendation and endorsement.

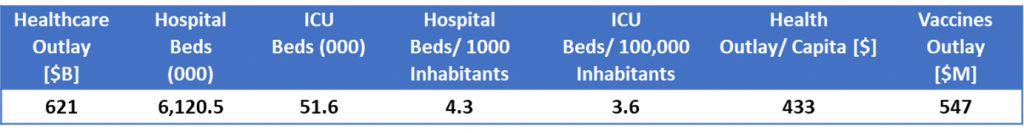

China Healthcare, ICUs and Vaccines Outlay Statistics (2019)

|

Sources: IMF, WHO, OECD, World Population Prospects (2019 Revision)

As for China, only two out of seven elements which contributed to the effective containment of the COVID-19 in China are due to its autocratic regime:

- Lessons learned from past outbreaks

- China PPE and Medical Devices industry

- Draconian lockdown of 50 million people

- The “health code” surveillance (an advanced contact tracing system) infrastructure

- China’s Safe City infrastructure

- “We will invest whatever it takes to contain the outbreak” policy

- Last and not least, the Face Masks culture

Lessons learned from past viral outbreaks

Due to the 2003 SARS outbreak, the Chinese government has been worried about the potential return of the deadly virus. It restructured the country’s healthcare system to handle the next outbreak. China extended the laboratory networks to handle the pathogens of infectious diseases; moreover, it founded a new laboratory in Wuhan and another laboratory to study pneumonia with uncertain origins.

It is believed that a quicker publication of the epidemic information was a lesson that China learned from the SARS outbreak as the lack of information release worsened the outbreak.

With the improved public health system, China managed to handle several public health emergencies. In coping with the 2009 H1N1 flu outbreak, China developed and distributed vaccines to 100 million people within months as an active prevention. During the 2013 H7N9 outbreak in East China, the country’s health system identified the pathogen five days after the outbreak. Test kits were designed and distributed to all mainland provinces three days after the identification. Within months, effective vaccines were developed. Besides, the Chinese academic community was the first to reveal the virus’s transmission methods, molecular mechanisms and effective treatment.

Chinese PPE and Medical Devices industry

China manufactures the majority of the globe’s PPE. In Q-1 2020, as the coronavirus tore through China, forcing it into lockdown, Chinese PPE factories ramped up production. Then China tried to jump-start the economy. With the pandemic spreading throughout the rest of the world, demand for personal protective equipment soared to the point that factory owners in the industry began boasting that they owned money printing machines. As orders of consumer goods shrunk, anxious manufacturers who had the clean rooms and know-how needed to make PPE switched their lines over to make face masks, gloves and PPE gowns.

With demand exploding, full payment up front became the norm. Fraud and counterfeit products proliferated. In April, the PRC government rolled out actions intended to clamp down on counterfeit PPE, and it became even trickier to ship products out of China.

The Smartphone based “health code” (contact tracing) system

The Chinese government which invested already billions on advanced people surveillance infrastructure based on 230 million video camera backed by face recognition systems extended this infrastructure to mitigate the pandemic. The extension is called the “health code” service.

The “health code” service is run on the ubiquitous smart phone’s platforms Alipay and WeChat. It was developed for the government to give users color-coded labels based on their health condition and travel record, and a QR code that can be scanned by government authorities.

As millions of people in China emerge from a long period of lockdown, their freedom of movement is largely dependent on the “health code” apps.

The apps users with a green code are allowed to travel relatively freely. A yellow code indicates that the holder should be in home isolation, and a red one indicates a verified COVID-19 patient who should be in quarantine.

The apps have become an integral part of Chinese authorities’ supervision of individuals and their movements in and out of affected areas.

The “health code” service app draws on medical information including: COVID-19 related symptoms (e.g., fever, cough), medical treatment, isolated surveillance, contact information, travel record of the pandemic area, user’s travel history including the mode of travel and what seat they sat in, and details on the vehicle and its driver.

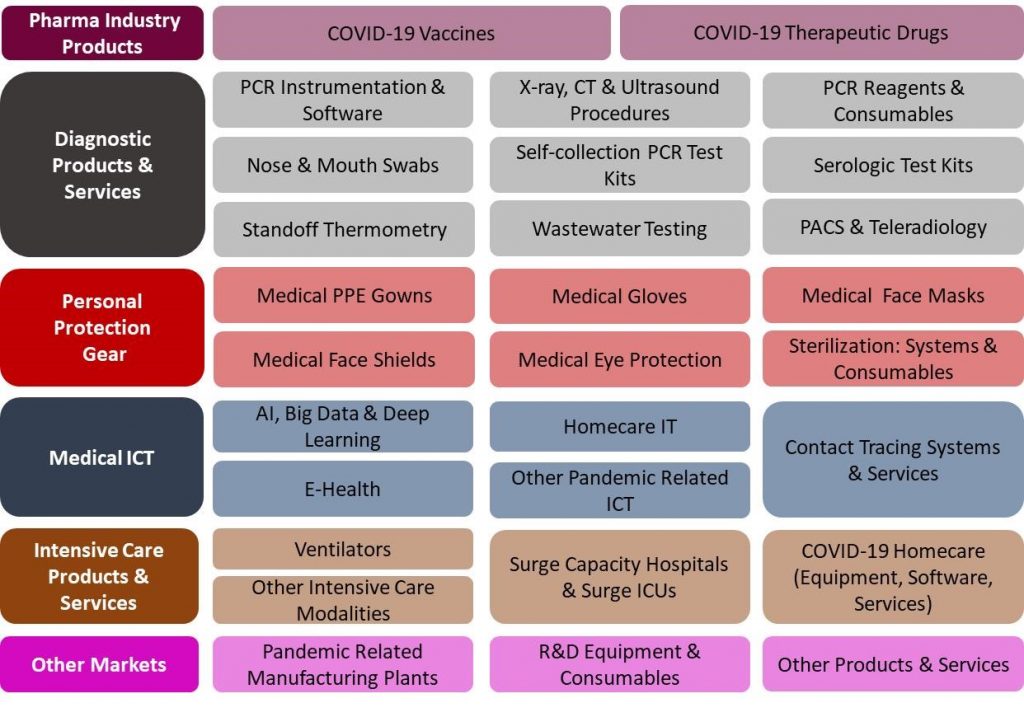

China COVID-19 Market Segmentation Vectors

6 End User and 4 Revenue Source Markets:

|

29 Products and Services Markets:

|

China’s COVID-19 pandemic mitigation products market is driven by the demand for the following:

- PCR Tests

- Serologic Tests

- COVID-19 Vaccines

- Ventilators

- Electronic Contact Tracing

- Surge Hospitals

- PPE

- Invasive Ventilators

- New ICU Units

- COVID-19 Medications

- COVID-19 Informatics

- COVID-19 Medical Imaging Services

- Training of ICU and ER Personnel

- Strategic National Stockpile

- Pandemic Related Turnkey Manufacturing Plants

and such factors as:

- The growing size of coronavirus related information and mounting complications of datasets, and the need saved by financial resources

- Advanced AI and machine learning has a high demand among general practitioners and others who are not coronavirus ICU experts

- The country pharma and biotech companies research and development of coronavirus vaccines and medications

This 450 -page market report is the most comprehensive review of the Chinese COVID-19 market available today. The objective of this report is to provide today’s strategic decision-makers with an expert 360-degree, time-sensitive, detailed view of this interconnected market.

The China COVID-19 Pandemic Mitigation Products Market – 2020-2024 report presents a thorough market analysis of 29 products & services, 6 end users, and 4 revenue source markets. Furthermore, the report provides updated extensive data of 37 key vendors.

Why Buy this China COVID-19 Pandemic Mitigation Products Market Report?

A. Questions answered in this report include:

- What is the US COVID-19 Market size and what are the forecast trends during 2020-2024?

- What are the most attractive business opportunities?

- What drives the customers to purchase solutions and services?

- What are the US COVID-19 Market trends?

- What is the 10 sub-markets size over the 2020-2024 period?

- What are the challenges to market penetration & growth?

B. Chinese COVID-19 market size data is analyzed via 5 independent key perspectives. With a highly fragmented market we address the “money trail” – each dollar spent in the Chinese COVID-19 market is analyzed and crosschecked via 3 orthogonal viewpoints:

- By 29 Products and Services:

|

|

- By 6 End User Markets:

|

- By 4 Revenue Source Markets:

|

C. Detailed market analysis frameworks for each of the market sectors are provided, including:

|

D. The report provides an updated extensive data of the leading 37 companies (including companies’ profile, recent annual revenues, COVID-19 mitigation activities & products and contact information).

E. The report includes over 2300 links to the COVID-19 pandemic mitigation community information sources

F. The report mentions > 450 Vendors including the following:

Moderna, IBM, 3M Company, Philips NV, Johnson & Johnson, Roche, Nvidia Corporation, Thermo Fisher Scientific, Siemens, Toshiba, Google, Samsung Electronics Co, GE Healthcare, Medtronic, MedWhat, MedyMatch, Merck, Metabiota, Micron Technology, Infermedica, Infervision, Inovio Pharmaceuticals, Microsoft Corporation, Mindshare Medical, Morpheo, Pfizer, Philips NV, Maxim Biotech, Honeywell Safety Products, Philips Healthcare, Siemens, Recursion Pharmaceuticals, Fujifilm Holdings Corporation, 3Scan, Abbott , AbCellera, Advenio Technosys, Agfa Healthcare, Agilent Technologies, AiCure, Aindra, Allscripts Healthcare Solutions, Amara Health Analytics, Amazon , analyticsMD, Apixio, Apple, Arterys Inc., Atlas Wearables, Atomwise, Avalon Nutrition VITL, Babylon Health, Bay Labs, Behold.ai, benevolent.ai, BIOBEATS, BlueDot, Bollé Safety, Bullard, Buoy Health, Care Angel Wearables QorQL, Careskore, Clinithink, Cloud Pharmaceuticals, CloudMedx, CureMetrix Mental health Ginger.io, Cyrcadia, Deep 6 AI, Deep Genomics, Dell Technologies Inc., Delta Plus Group, Desktop Genetics Virtual mate Ada Health, DreaMed Diabetes, Dupont, EaglEyeMed, Eli Lilly, Encon Safety Products, Enlitic, EnsoData, Entopsis, Envisagenics Research iCarbonX, ERB Industries Inc., Ergodyne, Essilor of America, Flashback Technologies, Flow Health, Ford, Freenome, Frequency Therapeutics Inc., Gateway Safety Inc., General Motors, General Vision, Gentex Corporation, Gibco, Gilead Sciences, Globavir Biosciences, Healint, Health Fidelity, HealthNextGen, HexArmor, Hindsait, Imagen Technologies, Imagia Cybernetics, Inside DNA, InSilico Medicine, Intel Corporation, Intendu, Invitrogen, Ion Torrent, Ironwear, Jvion, Kapa Biosystems, Keen Eye Technologies, Kimberly-Clark Professional, Lexmark International Inc., LifeGraph, Lucina Health, Lumiata, Lunit, Lytics, Magnea, Maxwell MRI, McKesson Corporation, MCR Safety, Medal, Medalogix, Medasense, MedAware, Niramai Health Analytix, Novarad Corporation, NuMedii, Numerate, Nuritas Pharma Turbine, Oncora Medical, Ovuline, PeerWell, PhysIQ, Precision Health Intelligence, Predible Health, Profility, Proscia, pulseData, Pyramex Safety, Qualaris Healthcare Solutions, Qualcomm Incorporated, Qualcomm Incorporated, Qure.Ai, Radians Inc., Roam Analytics, RxPREDICT, Safety Optical Service Ltd, Sanofi, Saykara, Sellstrom Manufacturing Company (SureWerx), Sense.ly, Sensory Inc., Sigma-Aldrich Corp., Skymind Inc., Vir Biotechnology Inc., VisionAid Inc., WuXi Biologics, Xilinx Inc. and more.

G. China COVID-19 market report includes 5 appendices:

- Appendix 1: Differences & Similarities between Common Flu and Coronavirus

- Appendix 2: COVID-19 Tests

- Appendix 3: Abbreviations

- Appendix 4: Glossary

- Appendix 5: Bibliography

COVID-19 pandemic mitigation market research team

The team which composed this report brings 43 years of hands on record in the development and commercialization of healthcare products including: antibody antigen identification, E-health, decontamination and biosecurity, PACS, teleradiology, PPE, computerized tomography, ultrasound, electron microscopy, medical devices and more. Our team members bring long term relations with the U.S. FDA and CDC as well as the EU CE and other national medical regulatory agencies.

As early as January 20, 2020 we recruited all our analysts to research the COVID-19 pandemic mitigation related products purchases. We interviewed hundreds of experts, participated in more than 95 conferences and webinars, reviewed more than 1,500 publications and interviewed executives of more than 65 pandemic related companies.