Description

Industry 4.0 is here to stay, there is no doubt about that. The “Industry 4.0 Market & Technologies. Focus on Asia-Pacific 2018-2023” report forecasts that the 2016-2023 Asia-Pacific Industry 4.0 market is the fastest growing regional market, which will rise at a CAGR of 23.7%. China is projected to invest hundreds of billions to retain its #1 position as the world’s leading manufacturing economy.

Why Buy This Report?

- No Risk. We Provide a Money-Back Guarantee* – With our money-back guarantee, you’ll be able to find out for yourself how valuable the report is for your business an unprecedented offer in the market research industry.

- This report is based on thousands of sources. – The report research team:

- reviewed and analyzed over 600 Industry 4.0 reports, papers, vendors and governmental information sources.

- participated in 31 round table Industry 4.0 focus groups

- conducted 75 face-to-face interviews with industry executives

- conducted a meta-research including more than 4000 industry executives from over 2,700 companies in 29 countries

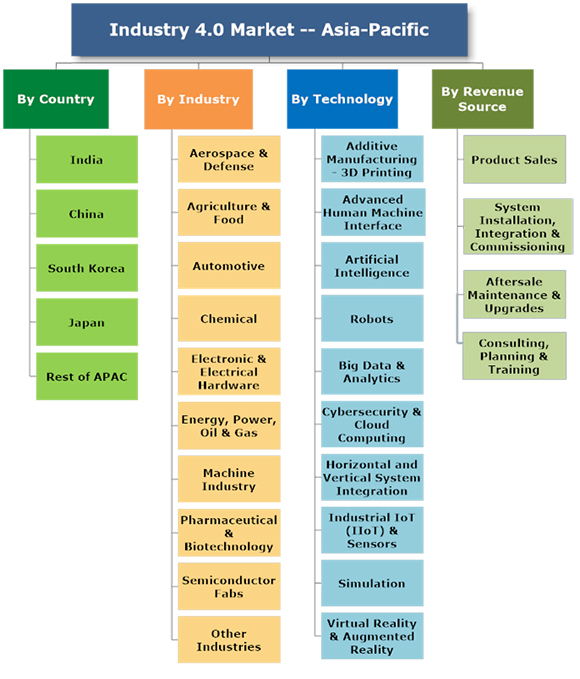

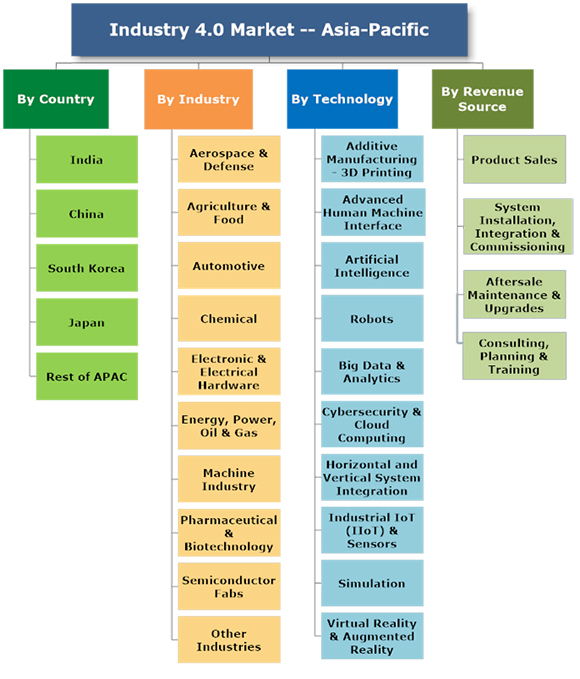

- The report analyzes each dollar spent in Asia Pacific Industry 4.0 market via 4 bottom-up research vectors, providing a valuable report for all decision makers in the Industry 4.0 market.

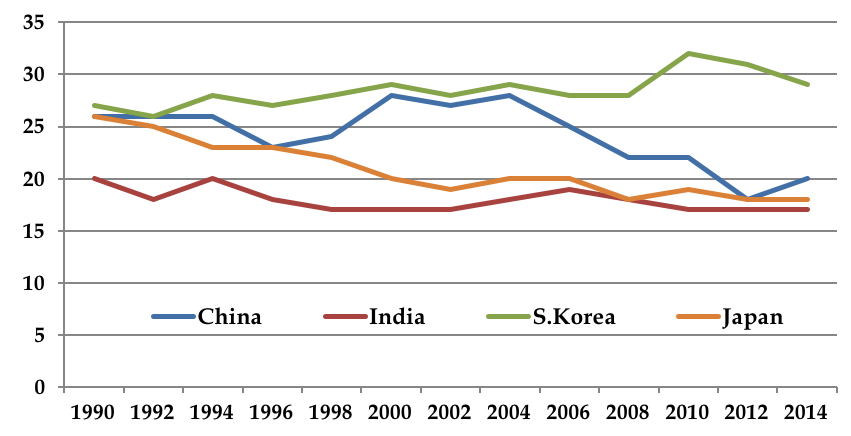

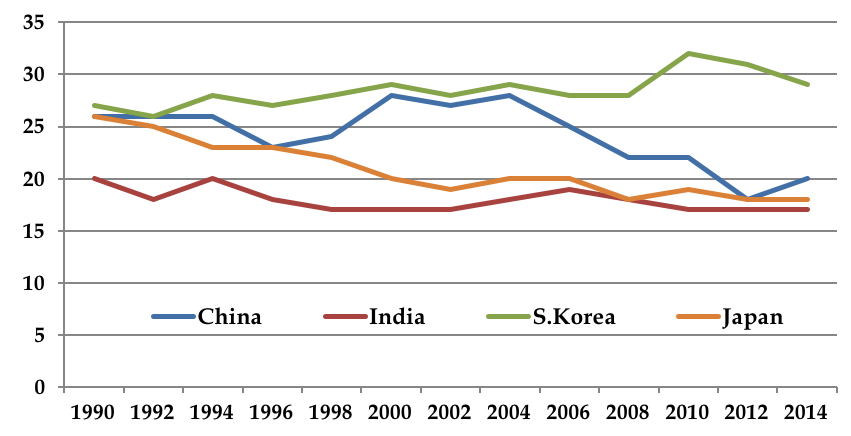

During four decades, APAC led by China, has proved to be the global factory , driven by low labor costs and globalization. With the Industry 4.0 revolution, which depends more on employees’ skills rather than cheap labor and western economies Industry 4.0 investments the tide is reversing. In order to mitigate this threat, APAC emerging economies, South Korea, Japan and China invest heavily in the 4th industrial revolution to compete with western economies Industry 4.0 ramifications. They provide government funding for Industry 4.0 projects, R&D, subsidies and tax incentives to Industry 4.0 investors.

Figure 1 – Manufacturing Sector Share [%] of GDP by Key APAC Countries

Most of the world technology giants (see Figure 2) that recognize the huge business opportunities of the Industry 4.0, invested in R&D, commercialization of Industry 4.0 technologies and acquired smaller technology companies especially in the AI and big data sector.

Figure 2 – Leading Industry 4.0 Technology Corporations

The Industry 4.0 competition is not only about technology or offering the best products, but also, about the companies that collect appropriate data and combine it to offer premium digital services. Those who know what the customer wants and can forecast consumer demand, will provide the information to develop an unfair competitive advantage.

According to the report, China is unique in the breadth and size of its Industry 4.0 strategy and funding; the PRC government commenced in 2015 the Made in China 2025 scheme, specifying ten industries including semiconductors, aerospace, agricultural equipment, quantum computing and other sectors, which are the core of government planning.

The PRC Made in China plan, an industrial-policy program is derived in part from Germany’s Industry 4.0 model, which focuses on creating a helpful environment through training and policy support but leaves business decisions to companies. China’s version is much more hands-on. The plan includes 1,013 state-guided funds , endowed with $807B, much of it for Made in China industries.

The program includes a manufacturing-subsidy program, spread across 62 distinct initiatives. According to the report, China will dominate 42% of the APAC Industry 4.0 market by 2023.

In India, the world’s fastest growing economy, it is estimated that the industrial sector will embrace Industry 4.0, and transform the Indian manufacturing economy.

Japan is a highly robotized country and the world´s predominant industrial robot manufacturer with a market share of 52%. To address its 21st century economic, social and industrial challenges Japan launched its Society 5.0 program. The Society 5.0 program includes (but is not limited to) Japan’s Industry 4.0 program.

In the next decades, Asia Pacific businesses will establish global networks that incorporate their machinery, warehousing systems and production facilities in the shape of cyber-physical systems. In the manufacturing environment, these cyber-physical systems comprise smart machines, storage systems and production facilities capable of autonomously exchanging information, triggering actions and controlling each other independently. These changes add to the traditional business pressure on manufacturers, but also offer unprecedented opportunities to optimize production processes.

The Asia Pacific Industry 4.0 transformation will change long-held dynamics in the balance of economic power between the Far East, the U.S. and Europe.

The report analyzes each dollar spent in the APAC Industry 4.0 market via 4 bottom-up research vectors (see Figure 3).

Figure 3 – Asia Pacific Industry 4.0 Report Submarkets Granulation Vectors

The Asia Pacific Industry 4.0 evolution holds immense potential for the region economy. Smart factories allow individual customer requirements to be met, meaning that even one-off items can be manufactured profitably. In Industry 4.0, dynamic business and engineering processes enable last-minute changes to production and deliver the ability to respond flexibly to disruptions and failures on behalf of suppliers.

End-to-end transparency is provided over the manufacturing process, facilitating optimized decision-making. Industry 4.0 will also result in new ways of creating value and novel business models. It will provide start-ups and SMEs with the opportunity to develop and provide downstream services.

The major winners might be those that control Industry 4.0 Platforms , software layers that syndicate various devices, information and services, on top of which other firms can build their own offerings.

The transformation of the economy being brought about by Industry 4.0 means that business processes such as supply, manufacturing, maintenance, delivery and customer service will all be connected via the Industrial IoT systems. These extremely flexible value networks will require new forms of collaboration between companies, both nationally and globally.

In 2018-2023, the market will undergo a major transformation through the following drivers:

- The APAC, U.S. and Europe competition in the manufacturing sector is becoming fiercer and fiercer

- China invests hundreds of billions to retain its #1 position as the world’s leading manufacturing economy

- China, Singapore, India, Japan, Cambodia, Vietnam and other Asia Pacific countries earmarked more than $1 trillion funding to their Industry 4.0 programs.

- APAC economies of low labor manufacturing costs invest in Industry 4.0 to maintain their industrial base taken by high labor cost countries Industry 4.0 investments

- Unprecedented opportunities to optimize production processes

The “Industry 4.0 Market & Technologies. Focus on Asia-Pacific 2018-2023” report is the most comprehensive review of this emerging market available today. It provides a detailed and reasoned roadmap of this rapidly growing market.

The report analyzes each dollar spent in the Industry 4.0 market via 4 bottom-up research vectors (see Figure 3), thus providing a valuable report for all decision-makers in the Industry 4.0 market.

The report is aimed at:

- Industry 4.0 Products Vendors

- Industry 4.0 Systems Integrators

- Government Industry Agencies

- Manufacturing Companies, SME included

The report has been explicitly customized for the industry and government decision-makers to enable them to identify business opportunities, emerging technologies, market trends and risks, as well as to benchmark business plans.

Questions answered in this 640-page 4-volume market report include:

- What was the Asia Pacific 40 submarkets size and what were the trends during 2016 & 2017?

- What is the 2018-2023 forecast for each of the Asia Pacific submarkets?

- Which industries and technologies provide attractive business opportunities?

- What drives the Asia Pacific Industry 4.0 managers to purchase solutions and services?

- What are the Asia Pacific technology & services trends?

- What are the market SWOT (Strengths, Weaknesses, Opportunities and Threats)?

With 460 pages, 167 tables and figures, this 4-volume report covers 10 technologies, 10 industries, 4 revenue sources, and Asia Pacific national markets, offering for each of them 2016-2017 estimates and 2018-2023 forecasts and analyses..

Why Buy This Report?

A. This is the most comprehensive information source of the Asia Pacific Industry 4.0 market and technologies available today

B. Market data is analyzed via 4 key perspectives:

With a highly fragmented Industry 4.0 market we address the money trail via the following 4 bottom-up market size vectors:

- Aerospace I4.0

- Defense I4.0

- Agriculture I4.0

- Food I4.0

- Automotive I4.0

- Chemical I4.0

- Electronic Hardware I4.0

- Electrical Hardware I4.0

|

- Energy, Power I4.0

- Oil & Gas I4.0

- Machine Industry I4.0

- Pharmaceutical I4.0

- Biotechnology I4.0

- Semiconductors I4.0

- Other I4.0 Industries

|

- By Industry 4.0 Technologies:

- Additive Manufacturing- 3D Printing

- Advanced Human Machine Interface

- Artificial Intelligence

- Industrial Robots

- Big Data & Analytics

- Cybersecurity & Cloud Computing

|

- Horizontal and Vertical System Integration

- Industrial IoT (IIoT)

- Sensors

- Simulation

- Virtual Reality

- Augmented Reality

- Predictive Maintenance

|

- By 4 Revenue Sources:

- Product Sales

- System Installation, Integration & Commissioning

- Aftersale Maintenance, Upgrades & Spare Parts

- Consulting, Planning & Training

- India

- China

- Japan

- South Korea

- Rest of APAC

|

C. Detailed market analysis framework is provided as follows:

- Market drivers & inhibitors

- Business opportunities

- SWOT analysis

- Barriers to new entry, supplier power, buyer power and competitive rivalry

- Business environment

- The 2016-2023 market segmented by 188 submarkets

- More than 1000 references and links to Industry 4.0 data sources & publications

D. The report includes the following appendices:

- Appendix A: Industry 4.0 Smart Maintenance

- Appendix B: How to Convert an Industry 2.0 or Industry 3.0 Business to Industry 4.0

- Appendix C: Abbreviations

- Appendix D: Terminology

- Appendix E: Research Sources & Bibliography

E. The report presents extensive information on 49 leading companies (including companies profile, Industry 4.0 activities & products, and recent events), namely:

3D Systems

ABB Ltd.

Advantech

Aibrain

Alphabet

Arcadia Data

Arm Ltd.

Beijer Electronics

Bosch

Cisco

CyberX

Dassault Syst?mes

DENSO

EOS

ExOne

General Electric

Honeywell |

Hewlett Packard

Huawei

IBM

Intel

Intelligent Automation

Interset Software

Kuka

Magic Leap

Microsoft

Mitsubishi Electric

NEC

NGRAIN

Oculus VR

Oracle

QUALCOMM

Rethink Robotics

Rockwell Automation |

Samsung

SAP

Sensory

Siemens

SIGFOX

Splunk

Sri International

Stratasys

Texas Instruments

TRUMPF

u-blox

Wittenstein

Worldsensing SL

Xerafy

Xjet |

NOTES:

(*) Industry 4.0 Report “Money-Back Guarantee” Program: Terms & Conditions

- To qualify for the money-back guarantee program send an email with your contact information to: sales@homelandsecurityresearch.com

- HSRC will inform the customer of his/her eligibility for the program ASAP.

- Qualified customers are required to pay the full list price of the report, and a copy of the report will be dispatched to them ASAP.

- Customers wishing to implement the money-back-guarantee policy, must notify HSRC via e-mail (sales@homelandsecurityresearch.com), within 48 hours of receipt of the report that they request a refund. The customer will have to erase and destroy any copy of the report and inform sales@homelandsecurityresearch.com that it has been done.

- The customer has 48 hours of receipt of the report to fully comply with Clause (4).

- HSRC would appreciate receiving customer’s honest review of the report and the reason(s) it didn’t meet his/her needs/expectations.

- Upon receipt of the e-mail as detailed in Clause (4), HSRC will issue within 3 working days refund instructions (minus $300 for shipping and handling).

- HSRC reserves the right to decide that a company doesn’t qualify for this promotion at HSRC’s own discretion

(**) “Market” Definition. Industry 4.0 turnkey systems sale, aftersales maintenance & upgrades and outsourced services such as consulting, planning & training

(***) The Meta-Research is based on the statistics of 11 Industry 4.0 surveys conducted by HSRC, BCG, PwC, Deloitte, Roland Berger, Rittal, Siemens and The Economist Intelligence Unit, totaling >4000 responders.

Table of Contents

Download TOC as PDF

3 Volumes:

Industry 4.0 Market & Technologies. Focus on Asia-Pacific 2018-2023 – Volume 1

Industry 4.0 Market & Technologies. Focus on Asia-Pacific 2018-2023 – Volume 2

Industry 4.0 Market & Technologies. Focus on Asia-Pacific 2018-2023 – Volume 3

Industry 4.0 Market & Technologies. Focus on Asia-Pacific 2018-2023 – Volume 4

Industry 4.0 Market & Technologies. Focus on Asia-Pacific 2018-2023 – Volume 1

| 1 |

Executive Summary |

| 1.1 |

Industry 4.0 Definition |

| 1.2 |

Fourth Industrial Revolution – Industry 4.0 Evolution |

| 1.3 |

Key Findings |

| 1.4 |

Key Market Drivers |

| 1.5 |

Industry 4.0 Key Challenges |

| 1.6 |

Major Conclusions |

| 1.7 |

Industry 4.0 Eco-System |

| 1.8 |

Industry 4.0 Client CEO Takeaway |

| 1.9 |

Recommendations for Industry 4.0 Vendors |

| 1.1 |

Industry 4.0 Market Research Vectors |

| 1.11 |

Asia-Pacific Industry 4.0 Market Size – 2016-2023 |

| 1.11.1 |

Asia-Pacific Industry 4.0 Market Size by Industry – 2016-2023 |

| 1.11.2 |

Asia-Pacific Industry 4.0 Market Size by Technology – 2016-2023 |

| 1.11.3 |

Asia-Pacific Industry 4.0 Market Size by Revenue Source -2016-2023 |

| 1.11.4 |

Industry 4.0 Market Size by Country – 2016-2023 |

| 2 |

Industry 4.0 Market Background |

| 2.1 |

Industry 4.0 Market: Introduction |

| 2.2 |

Industry 3.0 Factory Vs. Industry 4.0 Factory |

| 2.3 |

Industry 4.0 Ecosystem and Outlook |

| 2.4 |

Industry 4.0 Design Principles |

| 2.5 |

Industry 4.0 Technologies, Architecture and Supply Chain Intra-Relationship |

| 2.6 |

Manufacturers Industry 4.0 Introduction Strategies |

| 2.7 |

Cobots |

| 2.8 |

In-memory Computing |

| 2.9 |

Edge Computing |

| 2.1 |

Industry Cyber-Physical Systems (CPS) |

| 2.11 |

Industry 4.0 Mega Trends |

| 2.12 |

Predictive Maintenance 4.0 |

| 2.13 |

Smart Factories |

| 2.14 |

Society 4.0 |

| 2.15 |

Customized Manufacturing 4.0 |

| 2.16 |

Industry 4.0: Value Chain |

| 2.17 |

Logistics 4.0 & Smart Supply Chain 4.0 Management |

| 2.18 |

Value of Industry 4.0 Partnerships |

| 2.19 |

Industry 4.0 & Smart Manufacturing: Operational-Technology & Information Technology Convergence |

| 2.2 |

Industry 4.0 Lifecycle Management |

| 2.21 |

Industry 4.0 Vertical Integration |

| 2.22 |

Industry 4.0: Effects on the Private Sector |

| 2.23 |

Industry 4.0: Effects on Governments |

| 2.24 |

How to Introduce Industry 4.0: The Fourth Industrial Revolution Intelligence Concept (4IRI) |

| 2.25 |

Industry 4.0 Challenges |

| 2.26 |

Industry 4.0 Risks |

| 3 |

Industry 4.0 Market Drivers |

| 4 |

Industry 4.0 Market Inhibitors |

| 5 |

Industry 4.0 SWOT Analysis |

| 5.1 |

Strengths |

| 5.2 |

Weaknesses |

| 5.3 |

Opportunities |

| 5.4 |

Threats |

| 6 |

Barriers to New Entry, Supplier Power, Buyer Power and Competitive Rivalry |

| 7 |

Business Opportunities |

| 7.1 |

Industrie 4.0 is Both Good and Bad News For Suppliers |

| 7.2 |

Industry 4.0 Business Opportunities |

| 7.2.1 |

Platforms |

| 7.2.2 |

Licensed IP: |

| 7.2.3 |

Pay-By-Use and Subscription Based Services: |

| |

|

| |

INDUSTRY 4.0 MARKET |

| 8 |

Asia-Pacific Industry 4.0 Market by Industry – 2016-2023 |

| 8.1 |

Asia-Pacific Industry 4.0 Market Size 2016-2023 |

| 8.2 |

Asia-Pacific Industry 4.0 Market Breakdown 2016-2023 |

| 9 |

Aerospace & Defense 4.0 Market – 2016-2023 |

| 9.1 |

Defense Industry 4.0 Market Background |

| 9.2 |

U.S. Defense Scenario |

| 9.3 |

Aerospace Industry 4.0 Market Background |

| 9.4 |

Asia-Pacific Aerospace & Defense Industry 4.0 Market Size 2016-2023 |

| 9.4.1 |

Industry 4.0 Aerospace & Defense Market Size 2016-2023 |

| 9.4.2 |

Aerospace & Defense Industry 4.0: Market Dynamics 2016-2023 |

| 9.4.3 |

Aerospace & Defense Industry 4.0: Market Breakdown 2016-2023 |

| 10 |

Agriculture & Food Industries 4.0 Market – 2016-2023 |

| 10.1 |

Agriculture 4.0 Market Background |

| 10.1.1 |

Introduction |

| 10.1.2 |

Agriculture 4.0 Scope |

| 10.1.3 |

Agriculture 4.0 Farm Machinery |

| 10.1.4 |

The Added Value for Customers & Farmers |

| 10.1.5 |

Agriculture 4.0 Conclusions |

| 10.2 |

Asia-Pacific Agriculture & Food Industry 4.0 Market 2016-2023 |

| 10.2.1 |

Industry 4.0 Agriculture & Food Market Size 2016-2023 |

| 10.2.2 |

Agriculture & Food Industry 4.0: Market Dynamics 2016-2023 |

| 10.2.3 |

Agriculture & Food Industry 4.0: Market Breakdown 2016-2023 |

| 11 |

Automotive Industry Market – 2016-2023 |

| 11.1 |

Industry 4.0 Automotive Industry Market Background |

| 11.2 |

Industry 4.0 on the Automotive Industry: Major Trends |

| 11.2.1 |

Automotive Industry Cloud Computing |

| 11.2.2 |

Automotive Industry Cybersecurity |

| 11.2.3 |

Automotive Industry Big Data Analytics |

| 11.2.4 |

Automotive Industry Internet of Cars |

| 11.2.5 |

Automotive Industry: Opportunities |

| 11.3 |

Automotive Industry 4.0 Market Drivers |

| 11.4 |

Automotive Industry 4.0 Market: Key Challenges |

| 11.5 |

Autonomous Cars 4.0 |

| 11.6 |

Automotive Industry 4.0: Internet of Things |

| 11.7 |

Automotive Industry 4.0: Machine-Learning |

| 11.8 |

Automotive Industry 4.0: Cloud-based Intelligence |

| 11.9 |

Customized Car Manufacturing 4.0 |

| 11.1 |

Automotive Industry 4.0 Example: BMW |

| 11.11 |

Asia-Pacific Automotive Industry 4.0 Market 2016-2023 |

| 11.11.1 |

Industry 4.0 Automotive Market Size 2016-2023 |

| 11.11.2 |

Automotive Industry 4.0: Market Dynamics 2016-2023 |

| 12 |

Chemical Industry 4.0 Market – 2016-2023 |

| 12.1 |

Chemical Industry 4.0 Market Background |

| 12.1.1 |

The Asia-Pacific Chemical Industry |

| 12.1.2 |

Chemical Industry 4.0 Market |

| 12.1.3 |

Industry 4.0 Transformations in the Chemical Industry |

| 12.2 |

Asia-Pacific Chemical Industry 4.0 Market 2016-2023 |

| 12.2.1 |

Industry 4.0 Chemical Market Size 2016-2023 |

| 12.2.2 |

Chemical Industry 4.0: Market Dynamics 2016-2023 |

| 13 |

Electronic & Electrical Hardware Industries 4.0 Market – 2016-2023 |

| 13.1 |

Electronic & Electrical Hardware: Industry 4.0 Market Background |

| 13.2 |

Asia-Pacific Electronic & Electrical Hardware Industry 4.0 Market 2016-2023 |

| 13.2.1 |

Industry 4.0 Electronic & Electrical Hardware Market Size 2016-2023 |

| 13.2.2 |

Electronic & Electrical Hardware Industry 4.0: Market Dynamics 2016-2023 |

| 14 |

Energy, Power, Oil & Gas 4.0 Market – 2016-2023 |

| 14.1 |

Industry 4.0 Energy, Power, Oil & Gas Market Background |

| 14.1.1 |

Energy, Power, Oil & Gas Industry Trends |

| 14.1.2 |

The Oil & Gas Industry |

| 14.1.3 |

Industry 4.0 Oil & Gas Sector Environmental Perspective |

| 14.1.4 |

Industry 4.0 Undersea Oil & Gas Challenge |

| 14.1.5 |

Oil & Gas Big Data |

| 14.1.6 |

Oil & Gas Industry 4.0 Outlook |

| 14.1.7 |

Industry 4.0 Energy and Power Market Background |

| 14.2 |

Industry 4.0 & Industrial IoT Energy Productivity |

| 14.2.1 |

Introduction |

| 14.2.2 |

Energy and Power Industry 4.0 Remote Monitoring |

| 14.2.3 |

Predictive Maintenance |

| 14.2.4 |

Energy and Power Industry 4.0 Advanced Control |

| 14.3 |

Asia-Pacific Energy, Power, Oil & Gas Industry 4.0 Market 2016-2023 |

| 14.3.1 |

Industry 4.0 Energy, Power, Oil & Gas Market Size 2016-2023 |

| 14.3.2 |

Energy, Power, Oil & Gas Industry 4.0: Market Dynamics 2016-2023 |

| 15 |

Machine Manufacturing 4.0 Market – 2016-2023 |

| 15.1 |

Machine Manufacturing Industry 4.0 Market Background |

| 15.1.1 |

The Machine Manufacturing Industry |

| 15.1.2 |

Machine Manufacturing Industry 4.0 Market |

| 15.2 |

Asia-Pacific Machine Manufacturing Industry 4.0 Market 2016-2023 |

| 15.2.1 |

Industry 4.0 Machine Market Size 2016-2023 |

| 15.2.2 |

Machine Industry 4.0: Market Dynamics 2016-2023 |

| 16 |

Pharmaceutical & Biotechnology 4.0 Market – 2016-2023 |

| 16.1 |

Pharmaceutical & Biotechnology Industry 4.0 Market Background |

| 16.2 |

Asia-Pacific Pharmaceutical & Biotechnology Industry 4.0 Market 2016-2023 |

| 16.2.1 |

Industry 4.0 Pharmaceutical & Biotechnology Market Size 2016-2023 |

| 16.2.2 |

Pharmaceutical & Biotechnology Industry 4.0: Market Dynamics 2016-2023 |

| 17 |

Semiconductors 4.0 Market – 2016-2023 |

| 17.1 |

Semiconductor Market Background |

| 17.1.1 |

Industry 4.0 Semiconductors |

| 17.1.2 |

Semiconductor Manufacturing Horizontal Integration |

| 17.1.3 |

Semiconductor Industry 4.0: Customization Considerations |

| 17.1.4 |

Industry 4.0 Semiconductor Manufacturing Market |

| 17.1.5 |

Conclusions |

| 17.2 |

Asia-Pacific Industry 4.0 Semiconductors Market 2016-2023 |

| 17.2.1 |

Industry 4.0 Semiconductors Market Size 2016-2023 |

| 17.2.2 |

Semiconductors Industry 4.0: Market Dynamics 2016-2023 |

| 18 |

Asia-Pacific Other Industry 4.0 Markets – 2016-2023 |

| 18.1 |

Other 4.0 Industry Markets Size 2016-2023 |

| 18.2 |

Other Industries 4.0: Market Dynamics 2016-2023 |

[Back to top]

Industry 4.0 Market & Technologies. Focus on Asia-Pacific 2018-2023 – Volume 2

| |

TECHNOLOGY MARKETS |

| 1 |

Industry 4.0 Technology Markets |

| 1.1 |

Background |

| 1.2 |

The Forth Industrial Revolution Technologies |

| 1.3 |

Industry 4.0 Manufacturing Technologies |

| 1.4 |

Cyber Physical Infrastructure (CPS) |

| 1.5 |

Industry 4.0 Big Data and Cloud Computing |

| 1.6 |

Augmented Reality, Simulation & Visualization |

| 1.7 |

Industry 4.0 ICT |

| 1.7.1 |

Industry 4.0 Enterprise Resource Planning (ERP) |

| 1.7.2 |

ERP 4.0 |

| 1.7.3 |

Quality Management ERP 4.0 |

| 1.7.4 |

Supervisory Control and Data Acquisition (SCADA) |

| 1.8 |

On-Demand Industry 4.0 |

| 1.8.1 |

Programmable Logic Controller (PLC) |

| 1.8.2 |

Distributed Control System (DCS) |

| 1.8.3 |

Embedded ICT Conclusions |

| 1.9 |

Industry 4.0 Standardization Languages |

| 1.1 |

Visual Intelligence |

| 1.11 |

Industry 4.0 Technologies: Conclusions |

| 1.12 |

Asia-Pacific Consolidated Industry 4.0 Market, by Technology 2016-2023 |

| 2 |

Additive Manufacturing 3D Printing 4.0 Market – 2016-2023 |

| 2.1 |

Industry 4.0 Additive Manufacturing – 3D Printing Market Background |

| 2.1.1 |

Additive Manufacturing- 3D Printing: Introduction |

| 2.1.2 |

Additive Manufacturing – 3D Printing Technologies |

| 2.1.3 |

3D Printer: 27 Manufacturers |

| 2.1.4 |

Categories of Additive Materials |

| 2.2 |

Asia-Pacific Industry 4.0 Additive Manufacturing-3D Printing Market 2016-2023 |

| 2.2.1 |

Industry 4.0 Additive Manufacturing – 3D Printing Market Size 2016-2023 |

| 2.2.2 |

Additive Manufacturing – 3D Printing Industry 4.0 Market Dynamics 2016-2023 |

| 3 |

Advanced Human Machine Interface 4.0 Market – 2016-2023 |

| 3.1 |

Industry 4.0 Advanced Human Machine Interface Market Background |

| 3.2 |

Asia-Pacific Industry 4.0 Advanced Human Machine Interface Market 2016-2023 |

| 3.2.1 |

Industry 4.0 Advanced Human Machine Interface Market Size 2016-2023 |

| 3.2.2 |

Advanced Human Machine Interface Industry 4.0 Market Dynamics 2016-2023 |

| 4 |

Artificial Intelligence 4.0 Market – 2016-2023 |

| 4.1 |

Industry 4.0 Artificial Intelligence Market Background |

| 4.2 |

Industry 4.0 Artificial Intelligence |

| 4.2.1 |

Industry 4.0 AI Automated Planning and Scheduling |

| 4.2.2 |

Industry 4.0 AI Based Machine Learning |

| 4.2.3 |

Industry 4.0 AI in Robotics |

| 4.2.4 |

Artificial Neural Network and Connectionism |

| 4.2.5 |

Deep Learning |

| 4.2.6 |

Automotive AI |

| 4.2.7 |

The AI Partnership |

| 4.3 |

Asia-Pacific Industry 4.0 Artificial Intelligence Market 2016-2023 |

| 4.3.1 |

Industry 4.0 Artificial Intelligence Market Size 2016-2023 |

| 4.3.2 |

Artificial Intelligence Industry 4.0 Market Dynamics 2016-2023 |

| 5 |

Industrial Robots 4.0 Market – 2016-2023 |

| 5.1 |

Industry 4.0 Industrial Robots Market Background |

| 5.1.1 |

Industry 4.0 Industrial Robots |

| 5.1.2 |

Integration of Robots in Industry 4.0 |

| 5.1.3 |

Robots Role in Industry 4.0 |

| 5.1.4 |

4.0 Autonomous Robots Market: Conclusions |

| 5.1.5 |

Industry 4.0 Autonomous Robots Market Outlook |

| 5.2 |

Industrial Robots: Facts and Figures |

| 5.2.1 |

Industry 4.0 Delta Robots Market Background |

| 5.2.2 |

Industry 4.0 Parallel Robots Market Background |

| 5.2.3 |

Industry 4.0 Articulated Robots Market Background |

| 5.2.4 |

Industry 4.0 Cartesian & Gantry Robots Market Background |

| 5.2.5 |

Industry 4.0 SCARA Robots Market Background |

| 5.2.6 |

Industry 4.0 Collaborative Industry Robots Market Background |

| 5.2.7 |

Industry 4.0 Cylindrical Robots Market Background |

| 5.3 |

Key Vendors |

| 5.4 |

Asia-Pacific Industry 4.0 Robots Market 2016-2023 |

| 5.4.1 |

Industry 4.0 Robots Market Size 2016-2023 |

| 5.4.2 |

Robots Industry 4.0 Market Dynamics 2016-2023 |

| 6 |

Big Data & Analytics 4.0 Market – 2016-2023 |

| 6.1 |

Industry 4.0 Big Data & Analytics Market Background |

| 6.1.1 |

Big Data Analytics |

| 6.1.2 |

Industry 4.0 Big Data & Analytics Market Outlook |

| 6.2 |

Asia-Pacific Industry 4.0 Big Data & Analytics Market 2016-2023 |

| 6.2.1 |

Industry 4.0 Big Data & Analytics Market Size 2016-2023 |

| 6.2.2 |

Big Data & Analytics Industry 4.0 Market Dynamics 2016-2023 |

| 7 |

Cybersecurity & Cloud Computing 4.0 Market – 2016-2023 |

| 7.1 |

Industry 4.0 Cloud Computing |

| 7.1.1 |

Summary |

| 7.1.2 |

Introduction to Cloud Computing |

| 7.1.3 |

Cloud Computing Impact on Industry 4.0 |

| 7.1.4 |

Industry 4.0 Cloud Computing Market Background |

| 7.1.5 |

Cloud Manufacturing Market Background |

| 7.2 |

Industry 4.0 Cybersecurity Market Background |

| 7.3 |

Asia-Pacific Industry 4.0 Cybersecurity & Cloud Computing Market 2016-2023 |

| 7.3.1 |

Industry 4.0 Cybersecurity & Cloud Computing Market Size 2016-2023 |

| 7.3.2 |

Cybersecurity & Cloud Computing Industry 4.0 Market Dynamics 2016-2023 |

| 8 |

Horizontal and Vertical System Integration 4.0 Market – 2016-2023 |

| 8.1 |

Industry 4.0 Horizontal and Vertical System Integration Market Background |

| 8.2 |

Asia-Pacific Industry 4.0 Horizontal and Vertical System Integration Market 2016-2023 |

| 8.2.1 |

Industry 4.0 Horizontal and Vertical System Integration Market Size 2016-2023 |

| 8.2.2 |

Horizontal and Vertical System Integration Industry 4.0 Market Dynamics 2016-2023 |

| 9 |

Sensors and Industrial IoT 4.0 Market – 2016-2023 |

| 9.1 |

Industry 4.0 Sensors and Industrial IoT Market Background |

| 9.2 |

Industrial IoT (IIoT): Introduction |

| 9.2.1 |

Industrial IoT Market |

| 9.2.2 |

Industrial IoT Cybersecurity |

| 9.3 |

Industrial Internet of Things Market Outlook |

| 9.4 |

Industry 4.0 Sensors Market Background |

| 9.5 |

Industry 4.0 Sensors Communication Protocols |

| 9.6 |

Asia-Pacific Industry 4.0 Sensors and Industrial IoT Market 2016-2023 |

| 9.6.1 |

Industry 4.0 Sensors & Industrial IoT Market Size 2016-2023 |

| 9.6.2 |

Sensors & Industrial IoT Industry 4.0 Market Dynamics 2016-2023 |

| 10 |

Simulation 4.0 Market – 2016-2023 |

| 10.1 |

Industry 4.0 Simulation Market Background |

| 10.2 |

Asia-Pacific Industry 4.0 Simulation Market 2016-2023 |

| 10.2.1 |

Industry 4.0 Simulation Market Size 2016-2023 |

| 10.2.2 |

Simulation Industry 4.0 Market Dynamics 2016-2023 |

| 11 |

Virtual Reality & Augmented Reality 4.0 Market – 2016-2023 |

| 11.1 |

Industry 4.0 Virtual Reality & Augmented Reality Market Background |

| 11.2 |

Asia-Pacific Industry 4.0 Virtual Reality & Augmented Reality Market 2016-2023 |

| 11.2.1 |

Industry 4.0 Virtual Reality & Augmented Reality Market Size 2016-2023 |

| 11.2.2 |

Virtual Reality & Augmented Reality Industry 4.0 Market Dynamics 2016-2023 |

[Back to top]

Industry 4.0 Market & Technologies. Focus on Asia-Pacific 2018-2023 – Volume 3

| |

NATIONAL MARKETS |

| 1 |

India Industry 4.0 Market 2016-2023 |

| 1.1 |

Facts & Figures |

| 1.2 |

India Economy |

| 1.3 |

India Industry 4.0 Market Background |

| 1.4 |

Industry 4.0 Links |

| 1.5 |

India Industry 4.0 Market |

| 1.5.1 |

India Market Size by Revenue Source 2016-2023 |

| 1.5.2 |

India Industry 4.0 Market Dynamics 2016-2023 |

| 1.5.3 |

India Industry 4.0 Market Breakdown 2016-2023 |

| 2 |

China Industry 4.0 Market 2016-2023 |

| 2.1 |

Facts & Figures |

| 2.2 |

The PRC Economy |

| 2.3 |

China Industry 4.0 Market Background |

| 2.3.1 |

The 13th Five-Year Industrial IT Plan |

| 2.3.2 |

China Manufacturing Sector |

| 2.3.3 |

Industry 4.0 Adoption |

| 2.3.4 |

Chinese Government Industry 4.0 Initiative |

| 2.3.4.1 |

Integration of Industry and IT |

| 2.3.4.2 |

Made in China 2025 |

| 2.3.5 |

Made in China 2025 Opportunities for Foreign Investors |

| 2.3.5.1 |

Chinese Government Industry 4.0 Priorities |

| 2.3.5.2 |

The Internet Plus Plan |

| 2.3.5.3 |

First Unmanned Factory |

| 2.3.5.4 |

Local Production of Robots |

| 2.3.5.5 |

Acquiring Industry 4.0-focused Companies |

| 2.3.5.6 |

Hardware and Software Companies Active in Industry 4.0 |

| 2.3.5.7 |

Interest Shown by Private Equity Firms |

| 2.4 |

China Industrial Robots & Cobots |

| 2.5 |

China’s Booming Machine Manufacturers |

| 2.6 |

Dos & Don’ts for Industry 4.0 Importers to China |

| 2.7 |

Industry 4.0 Links |

| 2.8 |

China Industry 4.0 Market |

| 2.8.1 |

China Market Size by Revenue Source 2016-2023 |

| 2.8.2 |

China Industry 4.0 Market Dynamics 2016-2023 |

| 2.8.3 |

China Industry 4.0 Market Breakdown 2016-2023 |

| 3 |

Japan Industry 4.0 Market 2016-2023 |

| 3.1 |

Facts & Figures |

| 3.2 |

Japan Industry 4.0 Market Background |

| 3.3 |

Dos & Don’ts For Industry 4.0 Vendors |

| 3.4 |

Industry 4.0 Links |

| 3.5 |

Japanese Foreign Direct Investment (FDI) to Malaysia |

| 3.6 |

Japan Industry 4.0 Market |

| 3.6.1 |

Japan Market Size by Revenue Source 2016-2023 |

| 3.6.2 |

Japan Industry 4.0 Market Dynamics 2016-2023 |

| 3.6.3 |

Japan Industry 4.0 Market Breakdown 2016-2023 |

| 4 |

South Korea Industry 4.0 Market 2016-2023 |

| 4.1 |

Facts & Figures |

| 4.2 |

South Korea Industry 4.0 Market Background |

| 4.3 |

South Korea, Industry 4.0 Market: Business Opportunities |

| 4.4 |

South Korea, Industry 4.0: Web Resources |

| 4.4.1 |

Trade Shows |

| 4.4.2 |

Key Contacts |

| 4.5 |

South Korea Industry 4.0 Market |

| 4.5.1 |

South Korea Market Size by Revenue Source 2016-2023 |

| 4.5.2 |

South Korea Industry 4.0 Market Dynamics 2016-2023 |

| 4.5.3 |

South Korea Industry 4.0 Market Breakdown 2016-2023 |

| 5 |

Rest of Asia Pacific Industry 4.0 Market 2016-2023 |

| 5.1 |

Rest of Asia Pacific Market Size by Revenue Source 2016-2023 |

| 5.2 |

Rest of Asia Pacific Industry 4.0 Market Dynamics 2016-2023 |

| 5.3 |

Rest of Asia Pacific Industry 4.0 Market Breakdown 2016-2023 |

[Back to top]

Industry 4.0 Market & Technologies. Focus on Asia-Pacific 2018-2023 – Volume 4

| 1 |

Vendors |

| 1.1 |

3D Systems Corporation |

| 1.1.1 |

Key Data |

| 1.1.2 |

Company Profile |

| 1.1.3 |

Industry 4.0 Market: Products & Activities |

| 1.1.4 |

Recent Events |

| 1.2 |

ABB Ltd. |

| 1.2.1 |

Key Data |

| 1.2.2 |

Company Profile |

| 1.2.3 |

Industry 4.0 Market: Products & Activities |

| 1.2.4 |

Recent Events |

| 1.3 |

Advantech Co Ltd |

| 1.3.1 |

Key Data |

| 1.3.2 |

Company Profile |

| 1.3.3 |

Industry 4.0 Market: Products & Activities |

| 1.3.4 |

Recent Events |

| 1.4 |

Aibrain Inc. |

| 1.4.1 |

Key Data |

| 1.4.2 |

Company Profile |

| 1.4.3 |

Industry 4.0 Market: Products & Activities |

| 1.4.4 |

Recent Events |

| 1.5 |

Alphabet Inc. |

| 1.5.1 |

Key Data |

| 1.5.2 |

Company Profile |

| 1.5.3 |

Industry 4.0 Market: Products & Activities |

| 1.5.4 |

Recent Events |

| 1.6 |

Arcadia Data |

| 1.6.1 |

Key Data |

| 1.6.2 |

Company Profile |

| 1.6.3 |

Industry 4.0 Market: Products & Activities |

| 1.6.4 |

Recent Events |

| 1.7 |

Arm Ltd. |

| 1.7.1 |

Key Data |

| 1.7.2 |

Company Profile |

| 1.7.3 |

Industry 4.0 Market: Products & Activities |

| 1.7.4 |

Recent Events |

| 1.8 |

Beijer Electronics AB |

| 1.8.1 |

Key Data |

| 1.8.2 |

Company Profile |

| 1.8.3 |

Industry 4.0 Market: Products & Activities |

| 1.8.4 |

Recent Events |

| 1.9 |

Bosch Software Innovations GmbH |

| 1.9.1 |

Key Data |

| 1.9.2 |

Company Profile |

| 1.9.3 |

Industry 4.0 Market: Products & Activities |

| 1.9.4 |

Recent Events |

| 1.1 |

Cisco Systems Inc. |

| 1.10.1 |

Key Data |

| 1.10.2 |

Company Profile |

| 1.10.3 |

Industry 4.0 Market: Products & Activities |

| 1.10.4 |

Recent Events |

| 1.11 |

CyberX, Inc. |

| 1.11.1 |

Key Data |

| 1.11.2 |

Company Profile |

| 1.11.3 |

Industry 4.0 Market: Products & Activities |

| 1.11.4 |

Recent Events |

| 1.12 |

Dassault Syst?mes |

| 1.12.1 |

Key Data |

| 1.12.2 |

Company Profile |

| 1.12.3 |

Industry 4.0 Market: Products & Activities |

| 1.12.4 |

Recent Events |

| 1.13 |

DENSO Corporation |

| 1.13.1 |

Key Data |

| 1.13.2 |

Company Profile |

| 1.13.3 |

Industry 4.0 Market: Products & Activities |

| 1.13.4 |

Recent Events |

| 1.14 |

EOS GmbH |

| 1.14.1 |

Key Data |

| 1.14.2 |

Company Profile |

| 1.14.3 |

Industry 4.0 Market: Products & Activities |

| 1.14.4 |

Recent Events |

| 1.15 |

ExOne Company |

| 1.15.1 |

Key Data |

| 1.15.2 |

Company Profile |

| 1.15.3 |

Industry 4.0 Market: Products & Activities |

| 1.15.4 |

Recent Events |

| 1.16 |

GE – General Electric Company |

| 1.16.1 |

Key Data |

| 1.16.2 |

Company Profile |

| 1.16.3 |

Industry 4.0 Market: Products & Activities |

| 1.16.4 |

Recent Events |

| 1.17 |

Honeywell International Inc. |

| 1.17.1 |

Key Data |

| 1.17.2 |

Company Profile |

| 1.17.3 |

Industry 4.0 Market: Products & Activities |

| 1.17.4 |

Recent Events |

| 1.18 |

HPE – Hewlett Packard Enterprise |

| 1.18.1 |

Key Data |

| 1.18.2 |

Company Profile |

| 1.18.3 |

Industry 4.0 Market: Products & Activities |

| 1.18.4 |

Recent Events |

| 1.19 |

Huawei Technology Co., Ltd. |

| 1.19.1 |

Key Data |

| 1.19.2 |

Company Profile |

| 1.19.3 |

Industry 4.0 Market: Products & Activities |

| 1.19.4 |

Recent Events |

| 1.2 |

IBM – International Business Machines Corporation |

| 1.20.1 |

Key Data |

| 1.20.2 |

Company Profile |

| 1.20.3 |

Industry 4.0 Market: Products & Activities |

| 1.20.4 |

Recent Events |

| 1.21 |

Intel Corporation |

| 1.21.1 |

Key Data |

| 1.21.2 |

Company Profile |

| 1.21.3 |

Industry 4.0 Market: Products & Activities |

| 1.21.4 |

Recent Events |

| |