Description

Industry 4.0 is here to stay, there is no doubt about that. Many of the individual advances in technology that form the foundations of Industry 4.0 revolution are already used in manufacturing, but with Industry 4.0 merged platform, they will transform production: isolated, optimized cells will come together as a fully integrated, automated, and optimized production flow, leading to greater efficiency and changing traditional production relationships among suppliers, producers, and customers as well as between human and machine.

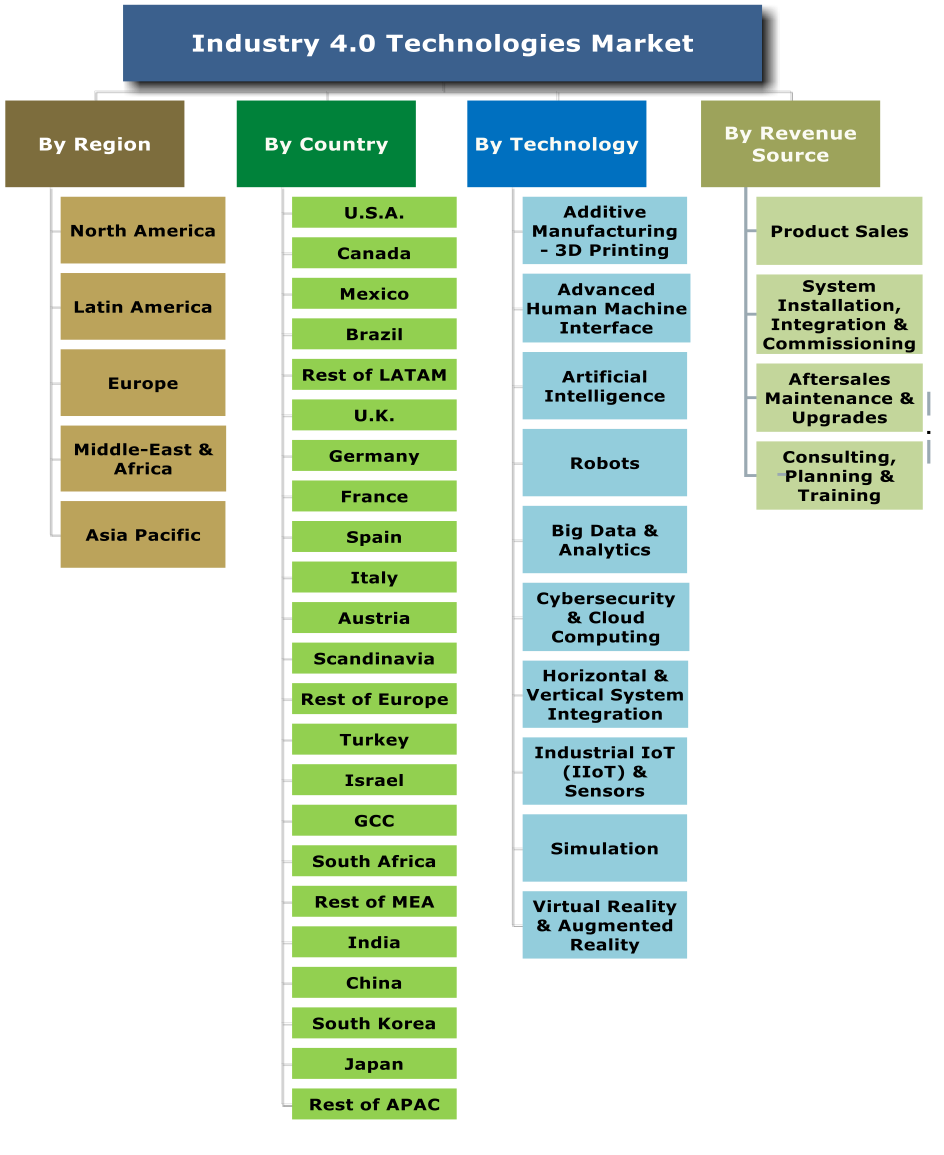

Figure 1 – Industry 4.0 Core Technologies

The 4.0 Industry technology revolution is not only about using data during production, or even integrating data from a wide variety of manufacturing systems throughout the supply chain. It is about analyzing and integrating total product and process life cycle, so that product and customer communicate directly with manufacturing systems and personnel to ensure that the product accommodates the needs of individual customers.

The “Industry 4.0 Technologies Market (Industrial Robotics, 3D Printing, AI, Big Data, Cybersecurity, Cloud Computing, H&V System Integration, Industrial IoT, Sensors, Simulation, VR, AR) 2018-2023” report forecasts that the global Industry 4.0 market* will reach $214B by 2023.

Why buy this report?

1] We provide a Money-Back Guarantee**

2] This report is based on thousands of sources

The report’s research team:

- Reviewed and analyzed over 600 Industry 4.0 reports, papers, vendors and governmental information sources.

- Participated in 16 round table Industry 4.0 focus groups,

- Conducted 75 of face-to-face interviews with industry executives,

- Conducted a meta research including more than 4000 industry executives of over 2,700 companies in 29 countries across 5 continents.

- The report analyzes each dollar spent in the Industry 4.0 market via 4 bottom-up research vectors (see figure 3), thus providing a must-have report for decision-makers in the Industry 4.0 market.

According to a HSRC meta research***, 63% of responders to HSRC, BCG, PwC, The Economist Intelligence Unit, Roland Berger, Rittal and Siemens stated that their business future depends on Industry 4.0 transformation. Manufacturing executives from all industries have squarely identified and, in many cases, begun addressing the need for industrial transformation. The responders that have implemented Industry 4.0 conversion have already seen improvements and expect more progress in the near future.

Some of the world technology giants (see Figure 2) recognized the huge business opportunities of the Industry 4.0, invested in R&D, commercialization of Industry 4.0 technologies and acquired smaller technology companies especially in the AI sector.

Figure 2 – Leading Industry 4.0 Technologies Vendors

In the next decades, businesses will establish global networks that incorporate their machinery, warehousing systems and production facilities in the shape of Cyber-Physical Systems (CPS). In the manufacturing environment, the Cyber-Physical Systems comprise smart machines, storage systems and production facilities capable of autonomously exchanging information, triggering actions and controlling each other independently. These changes add to the traditional business pressure on manufacturers, but also offer unprecedented opportunities to optimize production processes.

Figure 3 – Industry 4.0 Technologies Report Submarkets Granulation Vectors

Industry 4.0 technologies hold immense potential. Smart factories allow individual customer requirements to be met and mean that even one-off items can be manufactured profitably. In Industry 4.0, dynamic business and engineering processes enable last-minute changes to production and deliver the ability to respond flexibly to disruptions and failures on behalf of suppliers.

End-to-end transparency is provided over the manufacturing process, facilitating optimized decision-making. Industry 4.0 Technologies will also result in new ways of creating value and novel business models. It will provide start-ups and SMEs with the opportunity to develop and provide downstream services.

The major winners might be those that control Industry 4.0 Technology Platforms , software layers that syndicate various devices, information and services, on top of which other firms can build their own offerings.

Figure 4 – Manufacturing Sector Share [%] of GDP by Key Countries

Governments and the private sector of countries with high labor costs (e.g., EU countries and the U.S.A.) invest in Industry 4.0 Technologies to increase their industrial base which has been taken over by low labor cost countries (see figure above). Low labor costs industries and their governments (e.g., China, India and Cambodia) are reacting to this trend by investing in Industry 4.0 Technologies as well. To maintain their industrial base, governments across the globe, fund Industry 4.0 projects, R&D, and provide subsidies and tax incentives to Industry 4.0 Technologies investors.

In a global manufacturing industry that is changing faster than ever, Industry 4.0 trend analysis is critical for all companies to drive sustainable growth. As competition increases and innovative ideas continue to disrupt entire industries, harnessing mega trend analysis allows businesses to remain relevant and succeed in the market place of the future.

The market will undergo a major transformation in 2018-2023 through the following drivers:

- Global competition in the manufacturing sector is becoming fiercer and fiercer

- Unprecedented opportunities to optimize production processes

- Governments and the private sector of high labor costs economies invest in Industry 4.0 Technologies to increase their industrial base taken by low labor cost countries

- Governments of low labor costs economies invest in Industry 4.0 Technologies to maintain their industrial base taken by high labor cost countries Industry 4.0 Technologies investments

- Government funded Industry 4.0 projects, R&D, subsidies and tax incentives

- “Industry 4.0 Technologies” offers start-ups and SMEs the opportunity to develop and provide downstream services

- Industry 4.0 dynamic business and engineering processes enable last-minute changes to production and deliver the ability to respond flexibly to disruptions

- “Industry 4.0 Technologies” provides the link to the consumer, and can forecast consumer demand

The 3-volume “Industry 4.0 Technologies Market (Industrial Robotics, 3D Printing, AI, Big Data, Cybersecurity, Cloud Computing, H&V System Integration, Industrial IoT, Sensors, Simulation, VR, AR) 2018-2023” report is the most comprehensive review of this emerging market available today. It provides a detailed and reasoned roadmap of this rapidly growing market.

The report is aimed at:

- Industry 4.0 Technologies Vendors

- Industry 4.0 Systems Integrators

- Government Industry Agencies

- Manufacturing Companies, SME included

The report has been explicitly customized for the industry and government decision-makers to enable them to identify business opportunities, emerging technologies, market trends and risks, as well as to benchmark business plans.

Questions answered in this 531-page market report include:

- What was the 138 submarkets size and what were the trends during 2016 & 2017?

- What is the 2018-2023 forecast for each of the 138 submarkets?

- Which technologies provide attractive business opportunities?

- What drives the Industry 4.0 managers to purchase solutions and services?

- What are the technology & services trends?

- What is the market SWOT (Strengths, Weaknesses, Opportunities and Threats)?

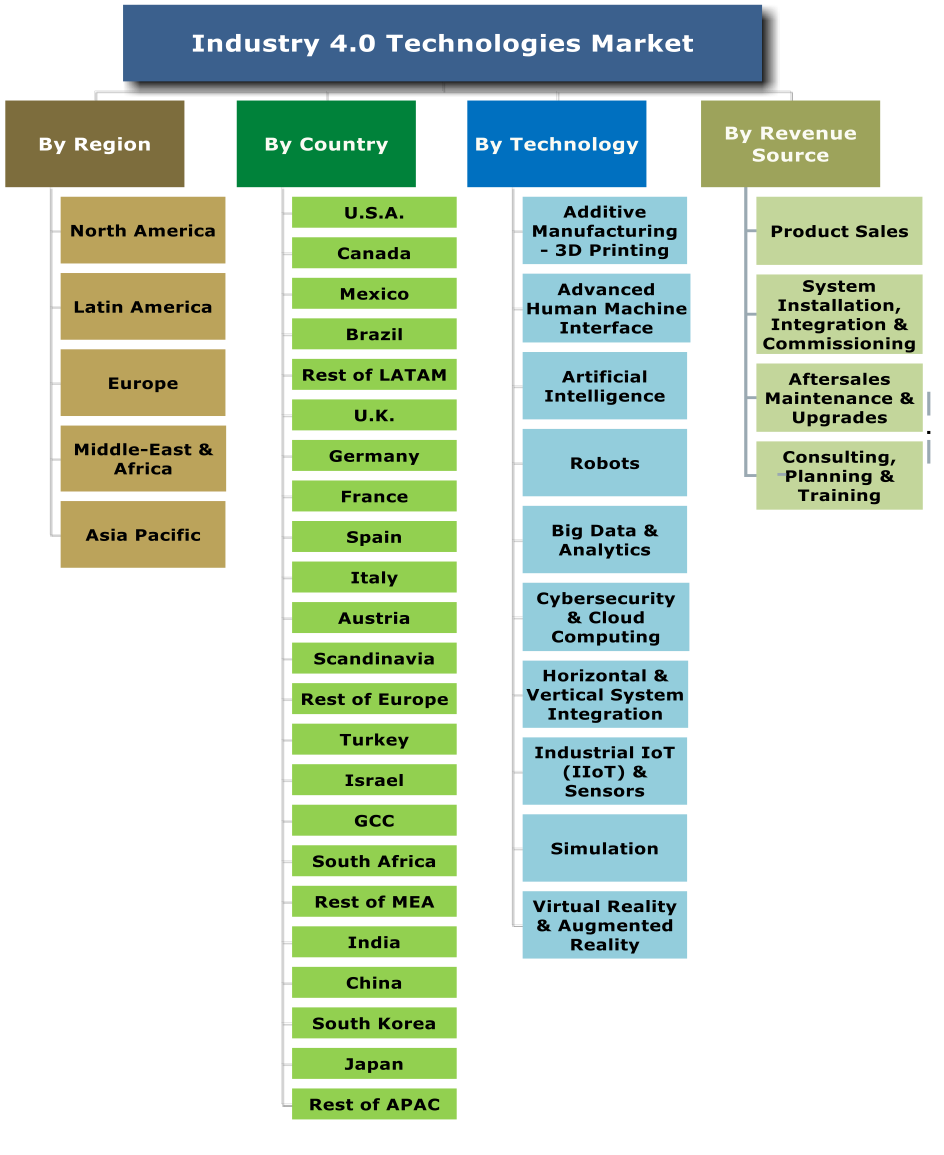

With 531 pages, 84 tables and 110 figures, this 3-volume report covers 10 leading technologies, 4 revenue sources, 5 regional and 22 national markets, offering for each of them 2016-2017 estimates and 2018-2023 forecasts and analyses.

Why Buy This Report?

A. This is the most comprehensive information source of the global Industry 4.0 market and technologies.

B. Market data is analyzed via 4 key perspectives:

With a highly fragmented Industry 4.0 market we address the money trail via the following 4 bottom-up market size vectors:

- By Industry 4.0 Technologies:

- Additive Manufacturing- 3D Printing

- Advanced Human Machine Interface

- Artificial Intelligence

- Industrial Robots

- Big Data & Analytics

- Cybersecurity & Cloud Computing

|

- Horizontal & Vertical System Integration

- Industrial IoT (IIoT)

- Sensors

- Simulation

- Virtual Reality & Augmented Reality

- Predictive Maintenance

|

- By 4 Revenue Sources:

- Product Sales

- System Installation, Integration & Commissioning

- Aftersale Maintenance, Upgrades & Spare Parts

- Consulting, Planning & Training

-

- North America

- Latin America

- Europe

- Middle East and Africa

- Asia-Pacific

- U.S.

- Canada

- Mexico

- Brazil

- Rest of LATAM

- UK

- Germany

- France

- Italy

- Spain

- Scandinavia

|

- Rest of Europe

- Turkey

- Israel

- GCC

- South Africa

- Rest of MEA

- India

- China

- Japan

- South Korea

- Rest of APAC

|

C. Detailed market analysis framework is provided:

- Market drivers & inhibitors

- Business opportunities

- SWOT analysis

- Barriers to new entry, supplier power, buyer power and competitive rivalry

- Business environment

- The 2016-2023 market segmented by 212 submarkets

- More than 1000 references and links to Industry 4.0 data sources & publications

D. The report includes the following appendices:

- Appendix A: Industry 4.0 Smart Maintenance

- Appendix B: How to Convert an Industry 2.0 or Industry 3.0 Business to Industry 4.0

- Appendix C: Abbreviations

- Appendix D: Terminology

- Appendix E: Research Sources & Bibliography

E. Industry 4.0 market report addresses 12 technologies:

- Additive Manufacturing- 3D Printing

- Advanced Human Machine Interface

- Artificial Intelligence

- Industrial Robots

- Big Data & Analytics

- Cybersecurity & Cloud Computing

- Horizontal and Vertical System Integration

- Industrial IoT (IIoT)

- Sensors

- Simulation

- Virtual Reality

- Augmented Reality

F. The report presents extensive information on 49 leading companies (including companies profile, Industry 4.0 activities & products, and recent events), namely:

3D Systems

ABB Ltd.

Advantech

Aibrain

Alphabet

Arcadia Data

Arm Ltd.

Beijer Electronics

Bosch

Cisco

CyberX

Dassault Syst?mes

DENSO

EOS

ExOne

General Electric

Honeywell |

Hewlett Packard

Huawei

IBM

Intel

Intelligent Automation

Interset Software

Kuka

Magic Leap

Microsoft

Mitsubishi Electric

NEC

NGRAIN

Oculus VR

Oracle

QUALCOMM

Rethink Robotics

Rockwell Automation |

Samsung

SAP

Sensory

Siemens

SIGFOX

Splunk

Sri International

Stratasys

Texas Instruments

TRUMPF

u-blox

Wittenstein

Worldsensing SL

Xerafy

Xjet |

NOTES:

(*) “Market” Definition. Industry 4.0 turnkey systems sale, aftersales maintenance & upgrades and outsourced services such as consulting, planning & training

(**) Industry 4.0 Report “Money-Back Guarantee” Program: Terms & Conditions

- To qualify for the money-back guarantee program send an email with your contact information to: sales@homelandsecurityresearch.com

- HSRC will inform the customer of his/her eligibility for the program ASAP.

- Qualified customers are required to pay the full list price of the report, and a copy of the report will be dispatched to them ASAP.

- Customers wishing to implement the money-back-guarantee policy must notify HSRC via e-mail (sales@homelandsecurityresearch.com), within 48 hours of receipt of the report that they request a refund. The customer will have to erase and destroy any copy of the report and inform sales@homelandsecurityresearch.com that it has been done.

- The customer has 48 hours of receipt of the report to fully comply with Clause (4).

- HSRC would appreciate receiving customer’s honest review of the report and the reason(s) it didn’t meet his/her needs/expectations.

- Upon receipt of the e-mail as detailed in Clause (4), HSRC will issue, within 3 working days, a refund instruction (minus $300 for shipping and handling).

- HSRC reserves the right to decide that a company doesn’t qualify for this promotion, at HSRC’s own discretion

(***) The Meta-Research is based on the statistics of 11 Industry 4.0 surveys conducted by HSRC, BCG, PwC, Deloitte, Roland Berger, Rittal, Siemens and The Economist Intelligence Unit, totaling >4000 responders.

Table of Contents

Download TOC as PDF

Volumes:

Industry 4.0 Technology Markets – 2018-2023 – Volume 1

Industry 4.0 Technology Markets – 2018-2023 – Volume 2

Industry 4.0 Technology Markets – 2018-2023 – Volume 3

Industry 4.0 Technology Markets – 2018-2023 – Volume 1

| 1 |

Executive Summary |

| 1.1 |

Industry 4.0 Definition |

| 1.2 |

Fourth Industrial Revolution – Industry 4.0 Evolution |

| 1.3 |

Key Findings |

| 1.4 |

Key Market Drivers |

| 1.5 |

Industry 4.0 Key Challenges |

| 1.6 |

Major Conclusions |

| 1.7 |

Industry 4.0 Eco-System |

| 1.8 |

Industry 4.0 Client CEO Takeaway |

| 1.9 |

Recommendations for Industry 4.0 Vendors |

| 1.1 |

Industry 4.0 Market Research Vectors |

| 1.11 |

Global Industry 4.0 Market Size – 2016-2023 |

| 1.11.1 |

Global Industry 4.0 Market Size by Technology – 2016-2023 |

| 1.11.2 |

Global Industry 4.0 Market Size by Revenue Source -2016-2023 |

| 1.11.3 |

Industry 4.0 Market Size by Region – 2016-2023 |

| 1.11.4 |

Industry 4.0 Market Size by Country – 2016-2023 |

| 2 |

Industry 4.0 Market Background |

| 2.1 |

Industry 4.0 Market: Introduction |

| 2.2 |

Industry 3.0 Factory Vs. Industry 4.0 Factory |

| 2.3 |

Industry 4.0 Ecosystem and Outlook |

| 2.4 |

Industry 4.0 Design Principles |

| 2.5 |

Industry 4.0 Technologies, Architecture and Supply Chain Intra-Relationship |

| 2.6 |

Manufacturers Industry 4.0 Introduction Strategies |

| 2.7 |

Cobots |

| 2.8 |

In-memory Computing |

| 2.9 |

Edge Computing |

| 2.1 |

Industry Cyber-Physical Systems (CPS) |

| 2.11 |

Industry 4.0 Mega Trends |

| 2.12 |

Predictive Maintenance 4.0 |

| 2.13 |

Smart Factories |

| 2.14 |

Society 4.0 |

| 2.15 |

Customized Manufacturing 4.0 |

| 2.16 |

Industry 4.0: Value Chain |

| 2.17 |

Logistics 4.0 & Smart Supply Chain 4.0 Management |

| 2.18 |

Value of Industry 4.0 Partnerships |

| 2.19 |

Industry 4.0 & Smart Manufacturing: Operational-Technology & Information Technology Convergence |

| 2.2 |

Industry 4.0 Lifecycle Management |

| 2.21 |

Industry 4.0 Vertical Integration |

| 2.22 |

Industry 4.0: Effects on the Private Sector |

| 2.23 |

Industry 4.0: Effects on Governments |

| 2.24 |

How to Introduce Industry 4.0: The Fourth Industrial Revolution Intelligence Concept (4IRI) |

| 2.25 |

Industry 4.0 Challenges |

| 2.26 |

Industry 4.0 Risks |

| 3 |

Industry 4.0 Market Drivers |

| 4 |

Industry 4.0 Market Inhibitors |

| 5 |

Industry 4.0 SWOT Analysis |

| 5.1 |

Strengths |

| 5.2 |

Weaknesses |

| 5.3 |

Opportunities |

| 5.4 |

Threats |

| 6 |

Barriers to New Entry, Supplier Power, Buyer Power and Competitive Rivalry |

| 7 |

Business Opportunities |

| 7.1 |

Industrie 4.0 is Both Good and Bad News For Suppliers |

| 7.2 |

Industry 4.0 Business Opportunities |

| 7.2.1 |

Platforms |

| 7.2.2 |

Licensed IP: |

| 7.2.3 |

Pay-By-Use and Subscription Based Services: |

| |

TECHNOLOGY MARKETS |

| 8 |

Industry 4.0 Technology Markets |

| 8.1 |

Background |

| 8.2 |

The Forth Industrial Revolution Technologies |

| 8.3 |

Industry 4.0 Manufacturing Technologies |

| 8.4 |

Cyber Physical Infrastructure (CPS) |

| 8.5 |

Industry 4.0 Big Data and Cloud Computing |

| 8.6 |

Augmented Reality, Simulation & Visualization |

| 8.7 |

Industry 4.0 ICT |

| 8.7.1 |

Industry 4.0 Enterprise Resource Planning (ERP) |

| 8.7.2 |

ERP 4.0 |

| 8.7.3 |

Quality Management ERP 4.0 |

| 8.7.4 |

Supervisory Control and Data Acquisition (SCADA) |

| 8.8 |

On-Demand Industry 4.0 |

| 8.8.1 |

Programmable Logic Controller (PLC) |

| 8.8.2 |

Distributed Control System (DCS) |

| 8.8.3 |

Embedded ICT Conclusions |

| 8.9 |

Industry 4.0 Standardization Languages |

| 8.1 |

Visual Intelligence |

| 8.11 |

Industry 4.0 Technologies: Conclusions |

| 8.12 |

Consolidated Industry 4.0 Market, by Technology 2016-2023 |

| 9 |

Additive Manufacturing 3D Printing 4.0 Market – 2016-2023 |

| 9.1 |

Industry 4.0 Additive Manufacturing – 3D Printing Market Background |

| 9.1.1 |

Additive Manufacturing- 3D Printing: Introduction |

| 9.1.2 |

Additive Manufacturing – 3D Printing Technologies |

| 9.1.3 |

3D Printer: 27 Manufacturers |

| 9.1.4 |

Categories of Additive Materials |

| 9.2 |

Industry 4.0 Additive Manufacturing-3D Printing Market 2016-2023 |

| 9.2.1 |

Industry 4.0 Additive Manufacturing – 3D Printing Market Size 2016-2023 |

| 9.2.2 |

Additive Manufacturing – 3D Printing Industry 4.0 Market Dynamics 2016-2023 |

| 9.2.3 |

Additive Manufacturing – 3D Printing Industry 4.0 Market Breakdown 2016-2023 |

| 10 |

Advanced Human Machine Interface 4.0 Market – 2016-2023 |

| 10.1 |

Industry 4.0 Advanced Human Machine Interface Market Background |

| 10.2 |

Industry 4.0 Advanced Human Machine Interface Market 2016-2023 |

| 10.2.1 |

Industry 4.0 Advanced Human Machine Interface Market Size 2016-2023 |

| 10.2.2 |

Advanced Human Machine Interface Industry 4.0 Market Dynamics 2016-2023 |

| 10.2.3 |

Advanced Human Machine Interface Industry 4.0 Market Breakdown 2016-2023 |

| 11 |

Artificial Intelligence 4.0 Market – 2016-2023 |

| 11.1 |

Industry 4.0 Artificial Intelligence Market Background |

| 11.2 |

Industry 4.0 Artificial Intelligence |

| 11.2.1 |

Industry 4.0 AI Automated Planning and Scheduling |

| 11.2.2 |

Industry 4.0 AI Based Machine Learning |

| 11.2.3 |

Industry 4.0 AI in Robotics |

| 11.2.4 |

Artificial Neural Network and Connectionism |

| 11.2.5 |

Deep Learning |

| 11.2.6 |

Automotive AI |

| 11.2.7 |

The AI Partnership |

| 11.3 |

Industry 4.0 Artificial Intelligence Market 2016-2023 |

| 11.3.1 |

Industry 4.0 Artificial Intelligence Market Size 2016-2023 |

| 11.3.2 |

Artificial Intelligence Industry 4.0 Market Dynamics 2016-2023 |

| 11.3.3 |

Artificial Intelligence Industry 4.0 Market Breakdown 2016-2023 |

| 12 |

Industrial Robots 4.0 Market – 2016-2023 |

| 12.1 |

Industry 4.0 Industrial Robots Market Background |

| 12.1.1 |

Industry 4.0 Industrial Robots |

| 12.1.2 |

Integration of Robots in Industry 4.0 |

| 12.1.3 |

Robots Role in Industry 4.0 |

| 12.1.4 |

4.0 Autonomous Robots Market: Conclusions |

| 12.1.5 |

Industry 4.0 Autonomous Robots Market Outlook |

| 12.2 |

Industrial Robots: Facts and Figures |

| 12.2.1 |

Industry 4.0 Delta Robots Market Background |

| 12.2.2 |

Industry 4.0 Parallel Robots Market Background |

| 12.2.3 |

Industry 4.0 Articulated Robots Market Background |

| 12.2.4 |

Industry 4.0 Cartesian & Gantry Robots Market Background |

| 12.2.5 |

Industry 4.0 SCARA Robots Market Background |

| 12.2.6 |

Industry 4.0 Collaborative Industry Robots Market Background |

| 12.2.7 |

Industry 4.0 Cylindrical Robots Market Background |

| 12.3 |

Key Vendors |

| 12.4 |

Industry 4.0 Robots Market 2016-2023 |

| 12.4.1 |

Industry 4.0 Robots Market Size 2016-2023 |

| 12.4.2 |

Robots Industry 4.0 Market Dynamics 2016-2023 |

| 12.4.3 |

Robots Industry 4.0 Market Breakdown 2016-2023 |

| 13 |

Big Data & Analytics 4.0 Market – 2016-2023 |

| 13.1 |

Industry 4.0 Big Data & Analytics Market Background |

| 13.1.1 |

Big Data Analytics |

| 13.1.2 |

Industry 4.0 Big Data & Analytics Market Outlook |

| 13.2 |

Industry 4.0 Big Data & Analytics Market 2016-2023 |

| 13.2.1 |

Industry 4.0 Big Data & Analytics Market Size 2016-2023 |

| 13.2.2 |

Big Data & Analytics Industry 4.0 Market Dynamics 2016-2023 |

| 13.2.3 |

Big Data & Analytics Industry 4.0 Market Breakdown 2016-2023 |

| 14 |

Cybersecurity & Cloud Computing 4.0 Market – 2016-2023 |

| 14.1 |

Industry 4.0 Cloud Computing |

| 14.1.1 |

Summary |

| 14.1.2 |

Introduction to Cloud Computing |

| 14.1.3 |

Cloud Computing Impact on Industry 4.0 |

| 14.1.4 |

Industry 4.0 Cloud Computing Market Background |

| 14.1.5 |

Cloud Manufacturing Market Background |

| 14.2 |

Industry 4.0 Cybersecurity Market Background |

| 14.3 |

Industry 4.0 Cybersecurity & Cloud Computing Market 2016-2023 |

| 14.3.1 |

Industry 4.0 Cybersecurity & Cloud Computing Market Size 2016-2023 |

| 14.3.2 |

Cybersecurity & Cloud Computing Industry 4.0 Market Dynamics 2016-2023 |

| 14.3.3 |

Cybersecurity & Cloud Computing Industry 4.0 Market Breakdown 2016-2023 |

| 15 |

Horizontal and Vertical System Integration 4.0 Market – 2016-2023 |

| 15.1 |

Industry 4.0 Horizontal and Vertical System Integration Market Background |

| 15.2 |

Industry 4.0 Horizontal and Vertical System Integration Market 2016-2023 |

| 15.2.1 |

Industry 4.0 Horizontal and Vertical System Integration Market Size 2016-2023 |

| 15.2.2 |

Horizontal and Vertical System Integration Industry 4.0 Market Dynamics 2016-2023 |

| 15.2.3 |

Horizontal and Vertical System Integration Industry 4.0 Market Breakdown 2016-2023 |

| 16 |

Sensors and Industrial IoT 4.0 Market – 2016-2023 |

| 16.1 |

Industry 4.0 Sensors and Industrial IoT Market Background |

| 16.2 |

Industrial IoT (IIoT): Introduction |

| 16.2.1 |

Industrial IoT Market |

| 16.2.2 |

Industrial IoT Cybersecurity |

| 16.3 |

Industrial Internet of Things Market Outlook |

| 16.4 |

Industry 4.0 Sensors Market Background |

| 16.5 |

Industry 4.0 Sensors Communication Protocols |

| 16.6 |

Industry 4.0 Sensors and Industrial IoT Market 2016-2023 |

| 16.6.1 |

Industry 4.0 Sensors & Industrial IoT Market Size 2016-2023 |

| 16.6.2 |

Sensors & Industrial IoT Industry 4.0 Market Dynamics 2016-2023 |

| 16.6.3 |

Sensors & Industrial IoT Industry 4.0 Market Breakdown 2016-2023 |

| 17 |

Simulation 4.0 Market – 2016-2023 |

| 17.1 |

Industry 4.0 Simulation Market Background |

| 17.2 |

Industry 4.0 Simulation Market 2016-2023 |

| 17.2.1 |

Industry 4.0 Simulation Market Size 2016-2023 |

| 17.2.2 |

Simulation Industry 4.0 Market Dynamics 2016-2023 |

| 17.2.3 |

Simulation Industry 4.0 Market Breakdown 2016-2023 |

| 18 |

Virtual Reality & Augmented Reality 4.0 Market – 2016-2023 |

| 18.1 |

Industry 4.0 Virtual Reality & Augmented Reality Market Background |

| 18.2 |

Industry 4.0 Virtual Reality & Augmented Reality Market 2016-2023 |

| 18.2.1 |

Industry 4.0 Virtual Reality & Augmented Reality Market Size 2016-2023 |

| 18.2.2 |

Virtual Reality & Augmented Reality Industry 4.0 Market Dynamics 2016-2023 |

| 18.2.3 |

Virtual Reality & Augmented Reality Industry 4.0 Market Breakdown 2016-2023 |

| |

REGIONAL MARKETS |

| 19 |

North America Industry 4.0 Industry 4.0 Market 2016-2023 |

| 19.1 |

North America Industry 4.0 Market Size 2016-2023 |

| 19.2 |

Industry 4.0 Market Breakdown 2016-2023 |

| 20 |

Latin America Industry 4.0 Industry 4.0 Market 2016-2023 |

| 20.1 |

Latin America Industry 4.0 Market Size 2016-2023 |

| 20.2 |

Industry 4.0 Market Breakdown 2016-2023 |

| 21 |

Europe Industry 4.0 Industry 4.0 Market 2016-2023 |

| 21.1 |

The European Industry 4.0 Market Background |

| 21.1.1 |

The EU Industry 4.0 Strengths |

| 21.1.2 |

EU Funding Sources |

| 21.1.3 |

National Industry 4.0 policies |

| 21.2 |

Europe Industry 4.0 Market Size 2016-2023 |

| 21.3 |

Industry 4.0 Market Breakdown 2016-2023 |

| 22 |

Middle East and Africa Industry 4.0 Industry 4.0 Market 2016-2023 |

| 22.1 |

Middle East and Africa Industry 4.0 Market Size 2016-2023 |

| 22.2 |

Industry 4.0 Market Breakdown 2016-2023 |

| 23 |

Asia-Pacific Industry 4.0 Industry 4.0 Market 2016-2023 |

| 23.1 |

Asia-Pacific Industry 4.0 Market Size 2016-2023 |

| 23.2 |

Industry 4.0 Market Breakdown 2016-2023 |

[Back to top]

Industry 4.0 Technology Markets – 2018-2023 – Volume 2

| |

NATIONAL MARKETS |

| 1 |

United States Industry 4.0 Market 2016-2023 |

| 1.1 |

Facts & Figures |

| 1.2 |

U.S. Industry 4.0 Market Background |

| 1.2.1 |

Manufacturing in the United States |

| 1.2.2 |

Smart Factory 2011-2015 |

| 1.2.3 |

U.S. Smart Factory 2011-2015 Projects |

| 1.2.3.1 |

Smart Manufacturing Projects |

| 1.2.3.2 |

U.S. Automotive Smart Manufacturing Projects |

| 1.2.3.3 |

Traditional Smart Manufacturing Projects |

| 1.2.3.4 |

Smart Service Projects |

| 1.2.4 |

United States Industry 4.0 Initiatives |

| 1.2.4.1 |

Overview |

| 1.2.4.2 |

The U.S. National Network for Manufacturing Innovation (NNMI) |

| 1.2.4.3 |

Other U.S. Industry 4.0 Market Initiatives |

| 1.2.5 |

Manufacturing Extension Partnership (MEP) |

| 1.3 |

United States Industry 4.0 Market |

| 1.3.1 |

U.S. Market Size by Revenue Source 2016-2023 |

| 1.3.2 |

U.S. Industry 4.0 Market Dynamics 2016-2023 |

| 1.3.3 |

U.S. Industry 4.0 Market Breakdown 2016-2023 |

| 2 |

Canada Industry 4.0 Market 2016-2023 |

| 2.1 |

Facts & Figures |

| 2.2 |

Canada Industry 4.0 Market Background |

| 2.3 |

Industry 4.0 Links |

| 2.4 |

Canada Industry 4.0 Market |

| 2.4.1 |

Canada Market Size by Revenue Source 2016-2023 |

| 2.4.2 |

Canada Industry 4.0 Market Dynamics 2016-2023 |

| 2.4.3 |

Canada Industry 4.0 Market Breakdown 2016-2023 |

| 3 |

Mexico Industry 4.0 Market 2016-2023 |

| 3.1 |

Facts & Figures |

| 3.2 |

Mexico Industry 4.0 Market Background |

| 3.3 |

Industry 4.0 Links |

| 3.4 |

Mexico Industry 4.0 Market |

| 3.4.1 |

Mexico Market Size by Revenue Source 2016-2023 |

| 3.4.2 |

Mexico Industry 4.0 Market Dynamics 2016-2023 |

| 3.4.3 |

Mexico Industry 4.0 Market Breakdown 2016-2023 |

| 4 |

Brazil Industry 4.0 Market 2016-2023 |

| 4.1 |

Facts & Figures |

| 4.2 |

Brazil Industry 4.0 Market Background |

| 4.3 |

Industry 4.0 Links |

| 4.4 |

Brazil Industry 4.0 Market |

| 4.4.1 |

Brazil Market Size by Revenue Source 2016-2023 |

| 4.4.2 |

Brazil Industry 4.0 Market Dynamics 2016-2023 |

| 4.4.3 |

Brazil Industry 4.0 Market Breakdown 2016-2023 |

| 5 |

Rest of Latin America Industry 4.0 Market 2016-2023 |

| 5.1 |

Rest of Latin America Market Size by Revenue Source 2016-2023 |

| 5.2 |

Rest of Latin America Industry 4.0 Market Dynamics 2016-2023 |

| 5.3 |

Rest of Latin America Industry 4.0 Market Breakdown 2016-2023 |

| 6 |

UK Industry 4.0 Market 2016-2023 |

| 6.1 |

Facts & Figures |

| 6.2 |

The UK Government Industry 4.0 Policy |

| 6.2.1 |

Introduction |

| 6.2.2 |

Recommendations |

| 6.3 |

UK Industry 4.0 Market Background |

| 6.4 |

Example: UK Industry 4.0 Vehicle Manufacturing Sector |

| 6.5 |

Industry 4.0 Links |

| 6.6 |

UK Industry 4.0 Market |

| 6.6.1 |

UK Market Size by Revenue Source 2016-2023 |

| 6.6.2 |

UK Industry 4.0 Market Dynamics 2016-2023 |

| 6.6.3 |

UK Industry 4.0 Market Breakdown 2016-2023 |

| 7 |

Germany Industry 4.0 Market 2016-2023 |

| 7.1 |

Facts & Figures |

| 7.2 |

Germany Industrie 4.0 Market Background |

| 7.2.1 |

Market Background |

| 7.2.2 |

German Government and Fraunhofer Industrie 4.0 Projects |

| 7.2.3 |

Germany, France and Italy Industry 4.0 Collaboration |

| 7.2.4 |

General Dos & Don’ts for Industry 4.0 Vendors in Germany |

| 7.2.5 |

The German Industrie 4.0 Transformation Strategy |

| 7.3 |

German Industry 4.0 Links |

| 7.4 |

Germany Industrie 4.0 Market |

| 7.4.1 |

Germany Market Size by Revenue Source 2016-2023 |

| 7.4.2 |

Germany Industrie 4.0 Market Dynamics 2016-2023 |

| 7.4.3 |

Germany Industrie 4.0 Market Breakdown 2016-2023 |

| 8 |

France Industry 4.0 Market 2016-2023 |

| 8.1 |

Facts & Figures |

| 8.2 |

France Industry 4.0 Market Background |

| 8.3 |

The Industrie du Futur Alliance |

| 8.4 |

Industry 4.0 Links |

| 8.5 |

France Industry 4.0 Market |

| 8.5.1 |

France Market Size by Revenue Source 2016-2023 |

| 8.5.2 |

France Industry 4.0 Market Dynamics 2016-2023 |

| 8.5.3 |

France Industry 4.0 Market Breakdown 2016-2023 |

| 9 |

Italy Industry 4.0 Market 2016-2023 |

| 9.1 |

Facts & Figures |

| 9.2 |

Italy Industry 4.0 Market Background |

| 9.3 |

Leading Industry 4.0 Sub-Sectors |

| 9.4 |

Italy Industry 4.0: Tax Incentives |

| 9.5 |

Industry 4.0 Market: Business Opportunities |

| 9.6 |

Italy Industry 4.0 Links |

| 9.7 |

Italy Industry 4.0 Market |

| 9.7.1 |

Italy Market Size by Revenue Source 2016-2023 |

| 9.7.2 |

Italy Industry 4.0 Market Dynamics 2016-2023 |

| 9.7.3 |

Italy Industry 4.0 Market Breakdown 2016-2023 |

| 10 |

Spain Industry 4.0 Market 2016-2023 |

| 10.1 |

Facts & Figures |

| 10.2 |

Spain Industry 4.0 Market Background |

| 10.3 |

Joint Action for Industry Digitization |

| 10.4 |

Developing Local Supply of Digital Solutions |

| 10.5 |

Spain Connected Industry 4.0 (CI 4.0) Program Funding |

| 10.6 |

Spain Industry 4.0 Market SWOT Analysis |

| 10.7 |

Industry 4.0 Links |

| 10.8 |

Spain Industry 4.0 Market |

| 10.8.1 |

Spain Market Size by Revenue Source 2016-2023 |

| 10.8.2 |

Spain Industry 4.0 Market Dynamics 2016-2023 |

| 10.8.3 |

Spain Industry 4.0 Market Breakdown 2016-2023 |

| 11 |

Scandinavia Industry 4.0 Market 2016-2023 |

| 11.1 |

Sweden Industry 4.0 Market Background |

| 11.1.1 |

Sweden Manufacturing Sector |

| 11.1.2 |

Sweden Industry 4.0 Market |

| 11.1.3 |

Sweden Industry 4.0 Links |

| 11.2 |

Finland Industry 4.0 Market Background |

| 11.2.1 |

Finland Manufacturing Sector |

| 11.2.2 |

Finland Industry 4.0 Market |

| 11.2.3 |

Finland Industry 4.0 Links |

| 11.3 |

Denmark Industry 4.0 Market Background |

| 11.3.1 |

Denmark Manufacturing Sector |

| 11.3.2 |

Denmark Industry 4.0 Market |

| 11.3.3 |

Denmark Industry 4.0 Market SWOT Analysis |

| 11.3.4 |

Denmark Industry 4.0 Links |

| 11.4 |

Norway Industry 4.0 Market Background |

| 11.4.1 |

Norway Manufacturing Sector |

| 11.4.2 |

Norway Industry 4.0 Market |

| 11.4.3 |

Norway Industry 4.0 Links |

| 11.5 |

Scandinavia Industry 4.0 Market |

| 11.5.1 |

Scandinavia Market Size by Revenue Source 2016-2023 |

| 11.5.2 |

Scandinavia Industry 4.0 Market Dynamics 2016-2023 |

| 11.5.3 |

Scandinavia Industry 4.0 Market Breakdown 2016-2023 |

| 12 |

Rest of Europe Industry 4.0 Market 2016-2023 |

| 12.1 |

Rest of Europe Market Size by Revenue Source 2016-2023 |

| 12.2 |

Rest of Europe Industry 4.0 Market Dynamics 2016-2023 |

| 12.3 |

Rest of Europe Industry 4.0 Market Breakdown 2016-2023 |

| 13 |

Turkey Industry 4.0 Market 2016-2023 |

| 13.1 |

Facts & Figures |

| 13.2 |

Turkey Industry 4.0 Market Background |

| 13.3 |

Awareness and Trends |

| 13.4 |

Turkish Intelligent Manufacturing System Technology Roadmap |

| 13.5 |

Industry 4.0 Links |

| 13.6 |

Turkey Industry 4.0 Market |

| 13.6.1 |

Turkey Market Size by Revenue Source 2016-2023 |

| 13.6.2 |

Turkey Industry 4.0 Market Dynamics 2016-2023 |

| 13.6.3 |

Turkey Industry 4.0 Market Breakdown 2016-2023 |

| 14 |

Israel Industry 4.0 Market 2016-2023 |

| 14.1 |

Facts & Figures |

| 14.2 |

Israel Industry 4.0 Market Background |

| 14.3 |

Industry 4.0 Links |

| 14.4 |

Israel Industry 4.0 Market |

| 14.4.1 |

Israel Market Size by Revenue Source 2016-2023 |

| 14.4.2 |

Israel Industry 4.0 Market Dynamics 2016-2023 |

| 14.4.3 |

Israel Industry 4.0 Market Breakdown 2016-2023 |

| 15 |

GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman) Industry 4.0 Market 2016-2023 |

| 15.1 |

GCC Industry 4.0 Market Background |

| 15.2 |

Industry 4.0 Links |

| 15.3 |

GCC Countries Industry 4.0 Market |

| 15.3.1 |

GCC Countries Market Size by Revenue Source 2016-2023 |

| 15.3.2 |

GCC Countries Industry 4.0 Market Dynamics 2016-2023 |

| 15.3.3 |

GCC Countries Industry 4.0 Market Breakdown 2016-2023 |

| 16 |

South Africa Industry 4.0 Market 2016-2023 |

| 16.1 |

Facts & Figures |

| 16.2 |

South Africa Industry 4.0 Market Background |

| 16.3 |

Smart Technology Adoption at Foundation Stage |

| 16.4 |

Great Potential for New Interaction Models |

| 16.5 |

Infrastructure Opportunities and Challenges |

| 16.6 |

Talent Opportunities and Challenges |

| 16.7 |

Industry 4.0 Links |

| 16.8 |

South Africa Industry 4.0 Market |

| 16.8.1 |

South Africa Market Size by Revenue Source 2016-2023 |

| 16.8.2 |

South Africa Industry 4.0 Market Dynamics 2016-2023 |

| 16.8.3 |

South Africa Industry 4.0 Market Breakdown 2016-2023 |

| 17 |

Rest of MEA Industry 4.0 Market 2016-2023 |

| 17.1 |

Rest of MEA Market Size by Revenue Source 2016-2023 |

| 17.2 |

Rest of MEA Industry 4.0 Market Dynamics 2016-2023 |

| 17.3 |

Rest of MEA Industry 4.0 Market Breakdown 2016-2023 |

| 18 |

India Industry 4.0 Market 2016-2023 |

| 18.1 |

Facts & Figures |

| 18.2 |

India Economy |

| 18.3 |

India Industry 4.0 Market Background |

| 18.4 |

Industry 4.0 Links |

| 18.5 |

India Industry 4.0 Market |

| 18.5.1 |

India Market Size by Revenue Source 2016-2023 |

| 18.5.2 |

India Industry 4.0 Market Dynamics 2016-2023 |

| 18.5.3 |

India Industry 4.0 Market Breakdown 2016-2023 |

| 19 |

China Industry 4.0 Market 2016-2023 |

| 19.1 |

Facts & Figures |

| 19.2 |

The PRC Economy |

| 19.3 |

China Industry 4.0 Market Background |

| 19.3.1 |

The 13th Five-Year Industrial IT Plan |

| 19.3.2 |

China Manufacturing Sector |

| 19.3.3 |

Industry 4.0 Adoption |

| 19.3.4 |

Chinese Government Industry 4.0 Initiative |

| 19.3.4.1 |

Integration of Industry and IT |

| 19.3.4.2 |

Made in China 2025 |

| 19.3.5 |

Made in China 2025 Opportunities for Foreign Investors |

| 19.3.5.1 |

Chinese Government Industry 4.0 Priorities |

| 19.3.5.2 |

The Internet Plus Plan |

| 19.3.5.3 |

First Unmanned Factory |

| 19.3.5.4 |

Local Production of Robots |

| 19.3.5.5 |

Acquiring Industry 4.0-focused Companies |

| 19.3.5.6 |

Hardware and Software Companies Active in Industry 4.0 |

| 19.3.5.7 |

Interest Shown by Private Equity Firms |

| 19.4 |

China Industrial Robots & Cobots |

| 19.5 |

China’s Booming Machine Manufacturers |

| 19.6 |

Dos & Don’ts for Industry 4.0 Importers to China |

| 19.7 |

Industry 4.0 Links |

| 19.8 |

China Industry 4.0 Market |

| 19.8.1 |

China Market Size by Revenue Source 2016-2023 |

| 19.8.2 |

China Industry 4.0 Market Dynamics 2016-2023 |

| 19.8.3 |

China Industry 4.0 Market Breakdown 2016-2023 |

| 20 |

Japan Industry 4.0 Market 2016-2023 |

| 20.1 |

Facts & Figures |

| 20.2 |

Japan Industry 4.0 Market Background |

| 20.3 |

Dos & Don’ts For Industry 4.0 Vendors |

| 20.4 |

Industry 4.0 Links |

| 20.5 |

Japanese Foreign Direct Investment (FDI) to Malaysia |

| 20.6 |

Japan Industry 4.0 Market |

| 20.6.1 |

Japan Market Size by Revenue Source 2016-2023 |

| 20.6.2 |

Japan Industry 4.0 Market Dynamics 2016-2023 |

| 20.6.3 |

Japan Industry 4.0 Market Breakdown 2016-2023 |

| 21 |

South Korea Industry 4.0 Market 2016-2023 |

| 21.1 |

Facts & Figures |

| 21.2 |

South Korea Industry 4.0 Market Background |

| 21.3 |

South Korea, Industry 4.0 Market: Business Opportunities |

| 21.4 |

South Korea, Industry 4.0: Web Resources |

| 21.4.1 |

Trade Shows |

| 21.4.2 |

Key Contacts |

| 21.5 |

South Kor |