Description

|

|

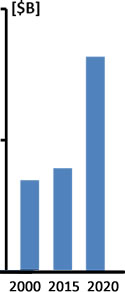

France Homeland Security & Public Safety Market 2000, 2015 & 2020

|

Checkout our updated Global Homeland Security & Public Safety 2019-2024 report.

France Homeland Security Market is in transition. The November 13, 2015 Paris well-planned terror attack demonstrated that the present French security and intelligence apparatus does not have the resources to address future ISIS terror challenges. A major overhaul of France’s internal security infrastructure and funding is already underway. Based on 6 months of intensive market research, interviews and analysis we forecast that the 2015-2020 France Homeland Security market will grow at a CAGR of 15.6%, a dramatic growth from the 3.7% CAGR during 2000-2015.

As stated by the French president, the government is fully aware of the fact that France is facing problems with a far greater reach than its economic ones. ISIS terror threats coupled with the surge in arrival of millions of migrants to Europe are alarming facts that show no signs of declining. Apart from declaring a 6-month state of emergency, the president guided the government to fund whatever is necessary to combat terrorism.

The two-volume * + one “France Homeland Security & Public Safety Market – 2016-2022” report is the most comprehensive review of France’s internal security market available today. It provides a detailed and reasoned roadmap of this growing counter terrorism market.

Counter Terror & Public Safety Market is boosted by the following drivers that will transform and drive France’s security market over the 2016-2022 period:

- The Friday, November 13 Paris terror carnage shook France unlike any other recent terror attack, since they were complex and well-planned.

- The transformation of France’s security infrastructure is best expressed in the words of President, Francois Hollande: “France is at war […]. They (security measures) will necessarily result in extra spending, but under these circumstances, I believe that the security pact will have precedence over the (economic) stability pact“.

- Up to 1,600 French nationals traveled to fight in Syria and Iraq and approximately 2,000 French citizens are involved in extremist Islamic cells in France.

- Europol estimates that up to 5,000 European jihadists have returned to the continent after obtaining combat experience on the battlefields of the Middle East.

- France is caught between a rock and a hard place – if it remains a country with inadequate counter terror funding and homeland security budget.

- France’s market for security & safety products is sophisticated and well served. Local defense and security companies are well entrenched in the French homeland security market. Even with a preference for locally manufactured products, foreign security products can usually strongly compete on the basis of price and innovation. They do not encounter any direct trade barriers or quotas. Non-tariff, indirect trade barriers may be the approval process of dual-use goods, which include various security market products.

This France Interior Security Market report is a resource for executives with interests in the industry. It has been explicitly customized for the security industry and government decision-makers in order to enable them to identify business opportunities, developing technologies, security market trends and risks, as well as to benchmark business plans.

Questions answered in this 475-page two-volume + one* report includes:

- What will the French Homeland Security Market size and trends be during 2016-2022?

- Which submarkets provide attractive business opportunities?

- Who are the French HLS decision-makers?

- What drives the French Homeland Security & Public Safety managers to purchase solutions and services?

- What are the customers looking for?

- What are the technology & services trends?

- What is the March? de la s?curit? int?rieure SWOT (Strengths, Weaknesses, Opportunities & Threats)?

- What are the challenges to market penetration & growth?

|

France Homeland Security & Public Safety Market Report Core Submarkets |

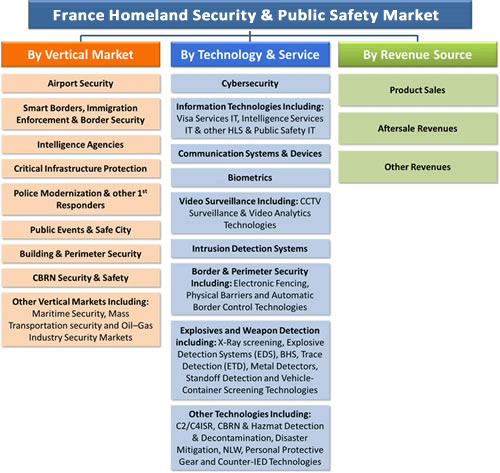

With 475 Pages, 66 Tables and 151 Figures, this 2-volume + one* report covers 9 Vertical, 9 Technology and 3 Revenue Source Submarkets, offering for each of them 2015 data and assessments, and 2016-2022 forecasts and analyses.

* The “Global Homeland Security & Public Safety Industry – 2016 Edition” report is a free of charge Bonus for multi-reader license customers and is offered at half price to single-reader customers.

Why Buy this Report?

A. Market data is analyzed via 3 orthogonal perspectives:

With a highly fragmented HLS & Public Safety market we address the “money trail” – each dollar spent – via the following 3 viewpoints:

- By 9 Vertical Markets including:

- France Airport Security

- France Smart Borders, Immigration Enforcement & Border Security

- France Intelligence Agencies

- France Critical Infrastructure Protection

- France Police Modernization & Other 1st Responders

- France Public Events & Safe City

- France Building & Perimeter Security

- France CBRN Security & Safety

- Other Vertical Markets (including Maritime Security, Mass transportation Security and Oil-Gas Industry Security)

- By 3 Revenue Sources including:

- Products Sales

- Maintenance & Service, Upgrades, Refurbishment

- Planning, Training and Consulting

- By 9 Technology Markets including:

- France Cybersecurity

- France Counter Terror & Crime IT

- France Communication Systems & Devices

- France Biometrics

- France Video Surveillance Technologies

- France Intrusion Detection Systems

- France Border & Perimeter Security Technologies

- France Explosives & Weapons Detection Technologies

- Other Technologies (including: C2/C4ISR Systems, NLW, Counter IED, Personal Protective Gear and more

B. Detailed market analysis frameworks for each of the market sectors, including:

- Market drivers & inhibitors

- Business opportunities

- SWOT analysis

- Competitive analysis

- Business environment

- The 2015-2020 market segmented by 51 submarkets

C. This is the only report that addresses the HLS & Public Safety dual-use markets in France:

76% of the French market revenues derives from dual-use products. For example, cybersecurity systems are used to address both cyber-crime and cyber-terror. Decision-makers forming their strategy need a complete view of this overlapping market both independently and in their intersections.

D. The France HLS Market report includes the following 5 appendices:

- Appendix A: French Counter Terror & Public Safety Agencies

- Appendix B: European Security Related Product Standards

- Appendix C: The European Union Challenges and Outlook

- Appendix D: The European Migration Crisis

- Appendix E: Abbreviations

E. The March? de la s?curit? int?rieure report addresses over 90 technologies including:

- Access Control Systems

- Automated Border Control (ABC) Gates

- Backscatter X-Ray Container-Vehicle Screening Systems

- Bio-Agents & Infectious Disease Detection

- Biometrics

- Biosecurity and Biosafety Devices & Systems

- Bio-Terror & Infectious Disease Early Alert System Devices & Systems

- Boarding Gate Explosives Scanners

- Border & Perimeter Barriers

- C2/C4ISR Systems

- Capacitance Sensors Fence

- CBRN and Hazmat Personal Protective Gear

- Cell Broadcast Mass Emergency Notification

- Chemical Agent Detection

- Chemical, HAZMAT & Nuclear Detection

- Coherent Scatter 2D X-Ray Systems

- Communication Systems & Devices

- Cybersecurity

- Decontamination of CBRN & HAZMAT Incidents

- Desktop ETD Devices

- Dual Energy LINAC X-Ray Container-Vehicle Screening Systems

- Dual-View LINAC X-Ray Container-Vehicle Screening Systems

- Dumb Fences

- Electronic Fencing

- Emergency Management IT Systems

- Emergency Medical Services (EMS) Devices & Systems

- E-Passports

- Fiber Optic Fence

- Gamma Ray Systems Container-Vehicle Screening Systems

- Hand Held Metal Detectors

- Handheld ETD Devices

- Homeland Security & Public Safety IT Systems

- Human Portable Radiation Detection Systems (HPRDS)

- Hybrid Tomographic EDS & 2D X-Ray Screening

- IED Placement Detection

- Infrastructure as a Service (IaaS) IT

- Intelligence Community Big Data IT

- Intelligence Community Cloud Infrastructure IT

- Intelligence Community Software as a Service (SaaS)

- Intelligence Services IT

- Inter-operable Communication Systems

- Intrusion Detection Systems

- Ion Mobility Spectroscopy (IMS)

- Liquid Explosives Detection Devices

- Luggage, Baggage & Mail Screening Systems

- Maritime Awareness Global Network (MAGNET)

- Mass Emergency Notification Devices & Systems

- Metal detection Portals

- Multimodal Biometric Systems

- Narcotics Trace Detection Devices

- Natural & Manmade Disaster Early Warning systems

- Non-Lethal Weapons(NLW)

- Nuclear/Radiological Detection Devices & Systems

- Other Security Technologies

- People Screening MMWave (AIT) Portals

- People Screening X-Ray Backscatter (AIT) Portals

- Perimeter Security Technologies

- Personal (Ballistic & CBRNE) Protective Gear

- Personal Body Armor

- Platform as a Service (PaaS)

- Police Modernization Systems and Devices

- Ported Coax Buried Line Fence

- Rescue & Recovery Equipment

- Respiratory Protective Equipment

- Satellite Based Maritime Tracking

- Shoe Scanners

- Siren Systems

- SkyBitz Global Locating System

- Standoff Explosives & Weapon Detection Systems

- Standoff Suicide Bombers Detection

- Strain Sensitive Cables Fence

- Suicide Bombers Borne IED (PBIED) Detectors

- Suicide Bombers Detonation Neutralization

- Taut Wire Fence

- Text Alert Systems

- The Advanced Spectroscopic Portals (ASP)

- Tomographic Explosive Detection Systems (EDS)

- Transportable X-Ray Screening Checkpoints

- VBIED Detonation Neutralization

- Vehicle & Container Screening Systems

- Vehicle Borne IED (VBIED) Detectors

- Vehicle Screening ETD Systems

- Vibration Sensors Mounted on Fence

- Video Analytics

- Video Surveillance

- Visa & Passport related IT

- Voice Alert Systems

- Wide Area Communications and Tracking Technology

- X-Ray Container-Vehicle Screening Systems

- X-ray Screening systems

F. The market report addresses over 300 European Homeland Security and Public Safety standards (including links)

G. The market report provides the number of passengers and number of screened cabin & checked-in baggage and luggage at each of the major airports by 2016 & 2020

H. The supplementary* “Global Homeland Security and Public Safety Industry – 2016 Edition” report (updated in May 2016) provides the following insights and analysis of the industry including:

- The Global Industry 2016 status

- Effects of Emerging Technologies on the Industry

- The Market Trends

- Vendor – Government Relationship

- Geopolitical Outlook 2016-2022

- The Industry Business Models & Strategies

- Market Entry Challenges

- The Industry: Supply-Side & Demand-Side Analysis

- Market Entry Strategies

- Price Elasticity

- Past Mergers & Acquisitions (M&A) Events

I. The supplementary* “Global Homeland Security and Public Safety Industry – 2016 Edition” report provides an updated (May 2016) and extensive information (including Company Profile, Recent Annual Revenues, Key Executives, Homeland Security and Public Safety Products, and Contact Info.) on the 119 leading security Vendors in the industry, namely:

- 3M

- 3i-MIND

- 3VR

- 3xLOGIC

- ABB

- Accenture

- ACTi Corporation

- ADT Security Services

- AeroVironment Inc.

- Agent Video Intelligence

- Airbus Defence and Space

- Alcatel-Lucent (Nokia Group)

- ALPHAOPEN

- American Science & Engineering Inc.

- Anixter

- Aralia Systems

- AT&T Inc.

- Augusta Systems

- Austal

- Avigilon Corporation

- Aware

- Axis

- AxxonSoft

- Ayonix

- BAE Systems

- BioEnable Technologies Pvt Ltd

- BioLink Solutions

- Boeing

- Bollinger Shipyards, Inc

- Bosch Security Systems

- Bruker Corporation

- BT

- Camero

- Cassidian

- CelPlan

- China Security & Surveillance, Inc.

- Cisco Systems

- Citilog

- Cognitec Systems GmbH

- Computer Network Limited (CNL)

- Computer Sciences Corporation

- CrossMatch

- Diebold

- DRS Technologies Inc.

- DVTel

- Elbit Systems Ltd.

- Elsag Datamat

- Emerson Electric

- Ericsson

- ESRI

- FaceFirst

- Finmeccanica SpA

- Firetide

- Fulcrum Biometrics LLC

- G4S

- General Atomics Aeronautical Systems Inc.

- General Dynamics Corporation

- Getac Technology Corporation

- Hanwha Techwin

- Harris Corporation

- Hewlett Packard Enterprise

- Hexagon AB

- Honeywell International Inc.

- Huawei Technologies Co., Ltd

- IBM

- IndigoVision

- Intel Security

- IntuVision Inc

- iOmniscient

- IPConfigure

- IPS Intelligent Video Analytics

- Iris ID Systems, Inc.

- IriTech Inc.

- Israel Aerospace Industries Ltd.

- ISS

- L-3 Security & Detection Systems

- Leidos, Inc.

- Lockheed Martin Corporation

- MACROSCOP

- MDS

- Mer group

- Milestone Systems A/S

- Mirasys

- Motorola Solutions, Inc.

- National Instruments

- NEC Corporation

- NICE Systems

- Northrop Grumman Corporation

- Nuance Communications, Inc.

- ObjectVideo

- Panasonic Corporation

- Pelco

- Pivot3

- Proximex

- QinetiQ Limited

- Rapiscan Systems, Inc.

- Raytheon

- Rockwell Collins, Inc.

- Safran S.A.

- Salient Sciences

- Schneider Electric

- SeeTec

- Siemens

- Smart China (Holdings) Limited

- Smiths Detection Inc.

- Sony Corp.

- Speech Technology Center

- Suprema Inc.

- Synectics Plc

- Tandu Technologies & Security Systems Ltd

- Texas Instruments

- Textron Inc.

- Thales Group

- Total Recall

- Unisys Corporation

- Verint

- Vialogy LLC

- Vigilant Technology

- Zhejiang Dahua Technology