Description

|

| Standoff Laser-Induced Breakdown Spectroscopy Explosive Detection System |

See also the latest version of this report

Improvised Explosive Devices (IED), People Borne Improvised Explosive Devices (PBIED) and Vehicle-Borne Explosives (VBIED), used by homegrown suicide bombers (especially the ISIS trained terrorists), pose a major threat to Europe. Their mitigation is a major challenge for both European Internal Security agencies and NATO. European armies that returned from Iraq and Afghanistan must be prepared for the next GWOT tasks overseas.

According to the report, a growing number of European security and defense forces develop and acquire cutting-edge standoff IED, PBIED & VBIED detection equipment.

The purpose of standoff PBIED, VBIED and weapon detection technologies is to determine at a safe distance if a human subject or a vehicle are carrying explosives or weapons. Concealed explosives detection is perceived as one of the greatest challenges facing the counter-terror and military communities. The threat posed by suicide bombers is the key to the emergence of transformational counter-terror technologies and tactics. The maturity and deployment of advanced standoff detection technologies, capable of detecting suicide bombers and other terrorists at a safe distance, will change the landscape of homeland security and asymmetric warfare.

According to the “Standoff IED, Person-Borne & Vehicle-Borne Explosives and Weapon Detection Technologies: European Market – 2015-2020″ report, the 2015-2020 revenues CAGR will stand at 7.5%.

The report examines each dollar spent in the market via 2 orthogonal money trails:

1. By 6 Technology Markets:

- Walk-By Explosives & Weapon Sensing Systems

- Pass-through Threat Detection Corridors

- Standoff PBIED Detection

- Standoff VBIED Detection

- Standoff IED Detection

- Other Technologies

2. By 4 Revenue Sources:

- Government Funded R&D

- Government Funded Testing & Evaluation

- New Systems Sales

- Aftersale Revenues

This Standoff IED, Person-Borne & Vehicle-Borne Explosives and Weapon Detection Technologies: European Market – 2015-202 report is a resource for executives with interests in the industry. It has been explicitly customized for decision-makers to identify business opportunities, developing technologies, market trends and risks, as well as to benchmark business plans.

Questions answered in this 215-page report include:

- What will the regional market size be in 2015-2020?

- What are the main Standoff IED, Person-Borne & Vehicle-Borne Explosives & Weapon Detection technology trends?

- Where and what are the market opportunities?

- What are the market drivers and inhibitors?

- Who are the key vendors?

- What are the business and technological challenges?

The Standoff IED, Person-Borne & Vehicle-Borne Explosives and Weapon Detection Technologies: European Market – 2015-2020 report presents in 215 pages, 20 tables and 97 figures, analysis of current and pipeline technologies and 18 leading vendors. The report, granulated into 10 submarkets, provides for each submarket 2013-2014 data & analyses, and projects the 2015-2020 market and technologies from several perspectives, including:

- Business opportunities and challenges

- SWOT analysis

- Market analysis (e.g., market dynamics, market drivers and inhibitors)

The report presents:

- Current and pipeline technologies:

- Standoff Walk-by & Pass-through Threat Detection Corridors:

Walk-through Corridors – Active Electromagnetic Weapons Detection, Passive Electro Magnetic Signature Corridor, Standoff Passive MMWave Doorways, Focal Plane Array Passive MMWave, Walk-through Corridors – Fourier Transform Infrared (FTIR) Spectroscopy Systems, Covert Walk-through Biometric Identification Corridors, Fused Standoff PBIED Detection &Video-based Biometrics, Walk-by Active Centimeter Range (Ku band) Microwave System - Open Space Standoff Explosives & Weapon Detection:

Bi-Modal Standoff Open Space IED, PBIED, VBIED – Explosives & Weapon Detection Systems - Standoff Vehicle-Borne Explosives Detection:

Standoff Raman Spectroscopy Based VBIED Detection - UGV Standoff IED, Person-Borne & Vehicle-Borne Explosives & Weapon Detection:

UGV detection Expectation Management systems, UGV Management software, UGV Mobility technology, Pipeline UGV IED, PBIED & VBIED Detection technologies, Cobham Antenna Technology, IAI CIMS Systems, Standoff MMWave IED Detection robots. - Multi-Modal Fused Standoff IED, Person-Borne & Vehicle-Borne Explosives & Weapon Detection:

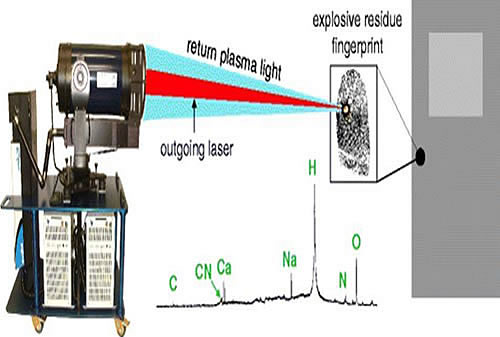

The CounterBomber Technology Standoff Active MMWave, Standoff Passive MMWave Imaging, Standoff MMWave PBIED Gait signatures Detection technologies, Infra-red Standoff Detection, Standoff Terahertz, Laser-Based Explosives Detection technologies, Standoff Raman Spectroscopy, Standoff Non-linear Wave Mixing Detection Technology, Standoff Light Detection and Ranging (LIDAR) Explosives Detection, Triple Modality Standoff Detection Technology, Differential Phase-Contrast X-ray Imaging, The University of Puerto Rico Advanced standoff Detection Techniques, Rydberg Spectroscopy/Microwave Scattering Based Detection

- Standoff Walk-by & Pass-through Threat Detection Corridors:

- Key Vendors: Alakai Defense Systems, APSTEC Systems, BAE Systems, Boeing, ChemImage Sensor Systems (CISS), Cobham plc, Flir, Fluidmesh Networks, Genia Photonics, GE Security, Honeywell, IAI, Implant Sciences Corporation, Raytheon, SAGO Systems, TeraView, ThruVision Systems, Rafael.

For readers who wish to acquire more information, the report includes 8 in-depth appendices:

-

- R&D Programs and Projects

- The Improvised Explosive Device Defeat Organization (JIEDDO)

- Vehicle Borne Improvised Explosive Devices (VBIED)

- Guided Aerial IEDs

- 2014 IED, PBIED & VBIED Attacks

- Suicide Terrorism

- The U.S. PBIED, VBIED & IED Detection Eco-System

- Short Term Global Geopolitical Outlook