U.S. HLS-HLD Markets – 2011-2014

See also the latest version of this report

This report is the most comprehensive review of the U.S. Homeland Security & Homeland Defense market available today.

With more than 890 pages, 420 tables, 460 figures, the report covers more than 450 sub-markets. It offers for each sub-market: 2009-2010 data, funding and market size, as well as 2011-2014 forecasts and analysis. This report provides essential intelligence on approximately 40% of the global HLS-HLD market.

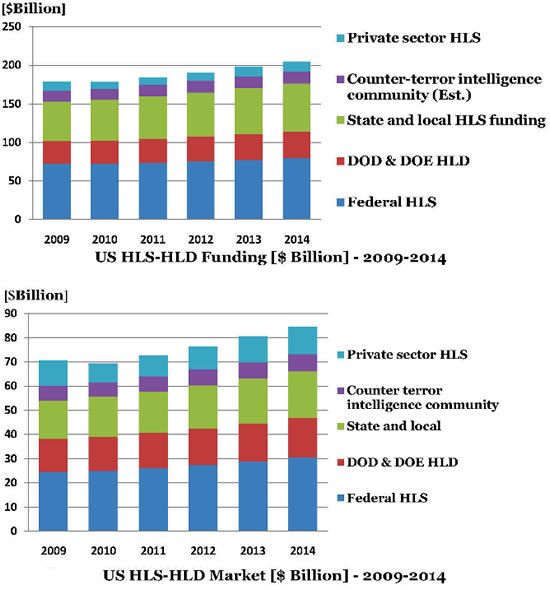

Over the next four years: the U.S. HLS-HLD (i.e. federal, state and local governments, and the private sector) funding will grow from $184 billion in 2011 to $205 billion by 2014. The market will grow from $73 billion in 2011 to $86 billion by 2014.

The markets are presented from two vantage points:

- “Supply-side”: presents the markets of 16 industry sectors (e.g. Information technology, Maritime Security, 1st responders, Radio communication, Aviation security, Biometrics, Standoff explosives detection, Perimeter security)

- “Demand-side” (customers): offers granular analysis of more than 450 sub-markets by procurement authority (e.g. private sector industries, TSA, CBP, 27 key states and hundreds of federal programs)

The report reveals that:

- While the DHS plays a key role in homeland security, it does not dominate the market. The combined FY 2010 state and local markets, which employ more than 2.2 million first responders, totaled $16.5 billion, whereas the DHS HLS market totaled $13 billion.

- The aviation security sector enjoys much greater importance in the public image than in actual dollars and cents. While certainly important, it represents only 4.7% of the market, is much smaller than some other industry sectors (i.e. the 23% market share of the information technology sector).

- The HLS sector’s $49.1 billion (FY 2010) market dominates 72% of the HLS-HLD markets, followed by the HLD sector’s $14.1 billion and the intelligence community counter-terror’s $6.1 billion